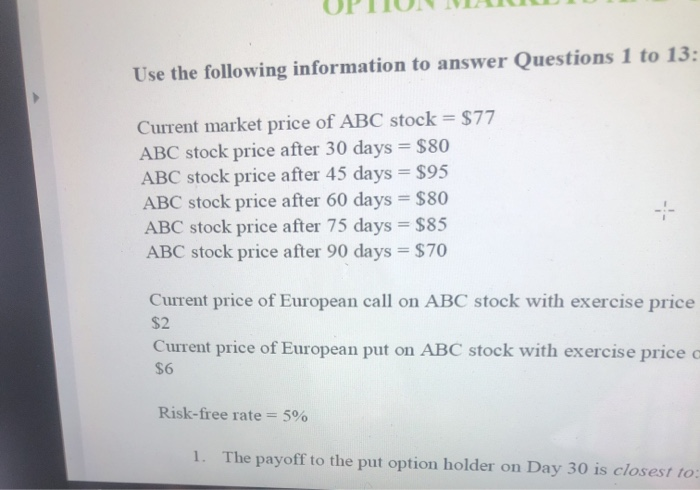

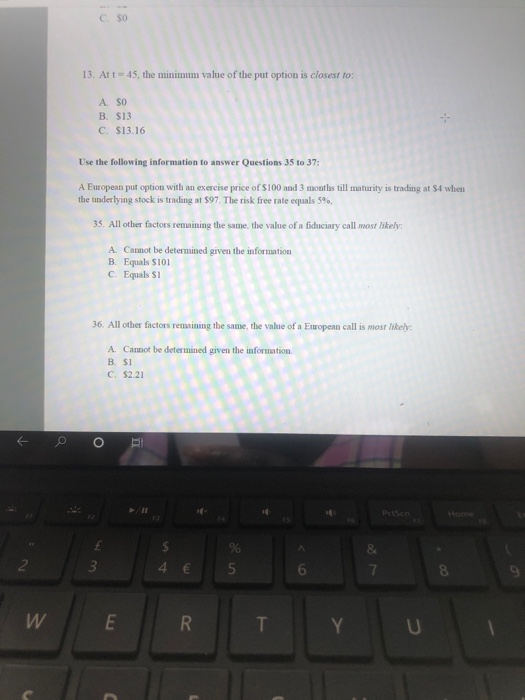

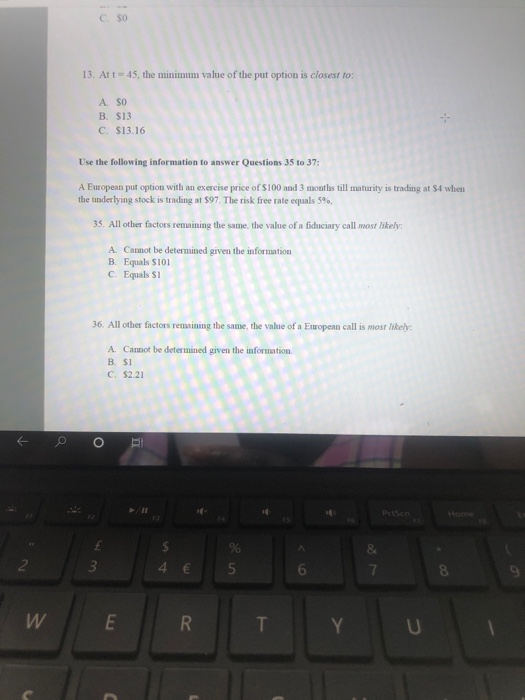

UPTIUNWATU Use the following information to answer Questions 1 to 13: Current market price of ABC stock = $77 ABC stock price after 30 days = $80 ABC stock price after 45 days = $95 ABC stock price after 60 days = $80 ABC stock price after 75 days = $85 ABC stock price after 90 days = $70 Current price of European call on ABC stock with exercise price $2 Current price of European put on ABC stock with exercise price o $6 Risk-free rate = 5% 1. The payoff to the put option holder on Day 30 is closest to: CSO 13. Att = 45, the put option is closest to: A SO B. $13 C. $13.16 Use the following information to answer Questions 35 to 37: A European put option with an exercise price of $100 and 3 months till maturity is trading at $4 when the underlying stock is trading at $97. The risk free rate equals 5% 35. All other factors remaining the same, the value of a fiduciary call most likely A Cammot be determined given the information B. Equals S101 C.Equals si All other factors remaining the same, the value of a European call is most likely A Cannot be determined given the information | 0 0 UPTIUNWATU Use the following information to answer Questions 1 to 13: Current market price of ABC stock = $77 ABC stock price after 30 days = $80 ABC stock price after 45 days = $95 ABC stock price after 60 days = $80 ABC stock price after 75 days = $85 ABC stock price after 90 days = $70 Current price of European call on ABC stock with exercise price $2 Current price of European put on ABC stock with exercise price o $6 Risk-free rate = 5% 1. The payoff to the put option holder on Day 30 is closest to: CSO 13. Att = 45, the put option is closest to: A SO B. $13 C. $13.16 Use the following information to answer Questions 35 to 37: A European put option with an exercise price of $100 and 3 months till maturity is trading at $4 when the underlying stock is trading at $97. The risk free rate equals 5% 35. All other factors remaining the same, the value of a fiduciary call most likely A Cammot be determined given the information B. Equals S101 C.Equals si All other factors remaining the same, the value of a European call is most likely A Cannot be determined given the information | 0 0