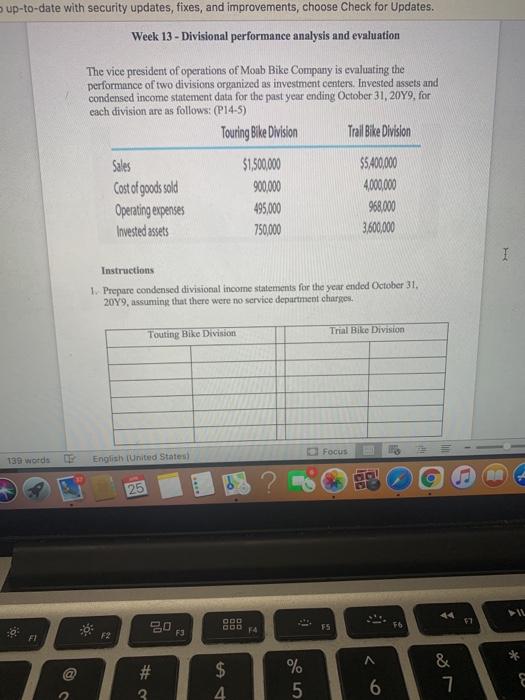

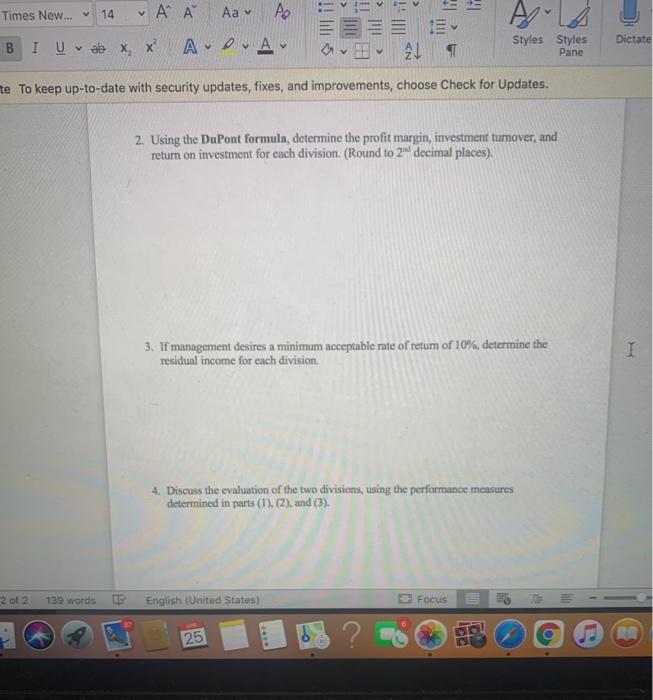

up-to-date with security updates, fixes, and improvements, choose Check for Updates. Week 13 - Divisional performance analysis and evaluation The vice president of operations of Moab Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year ending October 31, 2049, for each division are as follows: (P14-5) Touring Bike Division Trail Bike Division Sales $1,500,000 $5,400,000 Cost of goods sold 900,000 4000,000 Operating expenses 495,000 968,000 Invested assets 750,000 3,600,000 I Instructions 1. Prepare condensed divisional income statements for the year ended October 31, 2019, assuming that there were no service department charges. Trial Bike Division Touting Bike Division Focus 139 words English (United States) 25 ODD GOD F4 8 2. FS F2 F1 F3 A @ # $ 4 % 5 & 7 6 IT Times New... 14 ' Aa v Po Dictate BIUb X X E 21 ADA Styles Styles Pane v te To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. 2. Using the DuPont formula, determine the profit margin, investment tumover, and return on investment for cach division (Round to 2 decimal places), 3. If management desires a minimum acceptable rate of return of 10%, determine the residual income for each division. I 4. Discuss the evaluation of the two divisions, using the performance measures determined in parts (1), (2), and (3). 2 of 2 139 words English (United States) Focus 25 ? up-to-date with security updates, fixes, and improvements, choose Check for Updates. Week 13 - Divisional performance analysis and evaluation The vice president of operations of Moab Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year ending October 31, 2049, for each division are as follows: (P14-5) Touring Bike Division Trail Bike Division Sales $1,500,000 $5,400,000 Cost of goods sold 900,000 4000,000 Operating expenses 495,000 968,000 Invested assets 750,000 3,600,000 I Instructions 1. Prepare condensed divisional income statements for the year ended October 31, 2019, assuming that there were no service department charges. Trial Bike Division Touting Bike Division Focus 139 words English (United States) 25 ODD GOD F4 8 2. FS F2 F1 F3 A @ # $ 4 % 5 & 7 6 IT Times New... 14 ' Aa v Po Dictate BIUb X X E 21 ADA Styles Styles Pane v te To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. 2. Using the DuPont formula, determine the profit margin, investment tumover, and return on investment for cach division (Round to 2 decimal places), 3. If management desires a minimum acceptable rate of return of 10%, determine the residual income for each division. I 4. Discuss the evaluation of the two divisions, using the performance measures determined in parts (1), (2), and (3). 2 of 2 139 words English (United States) Focus 25