Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. January 1: EcoTech Solutions, Inc. conducted an Initial Public Offering (IPO) and raised $10 million in capital, issuing 1 million shares of common

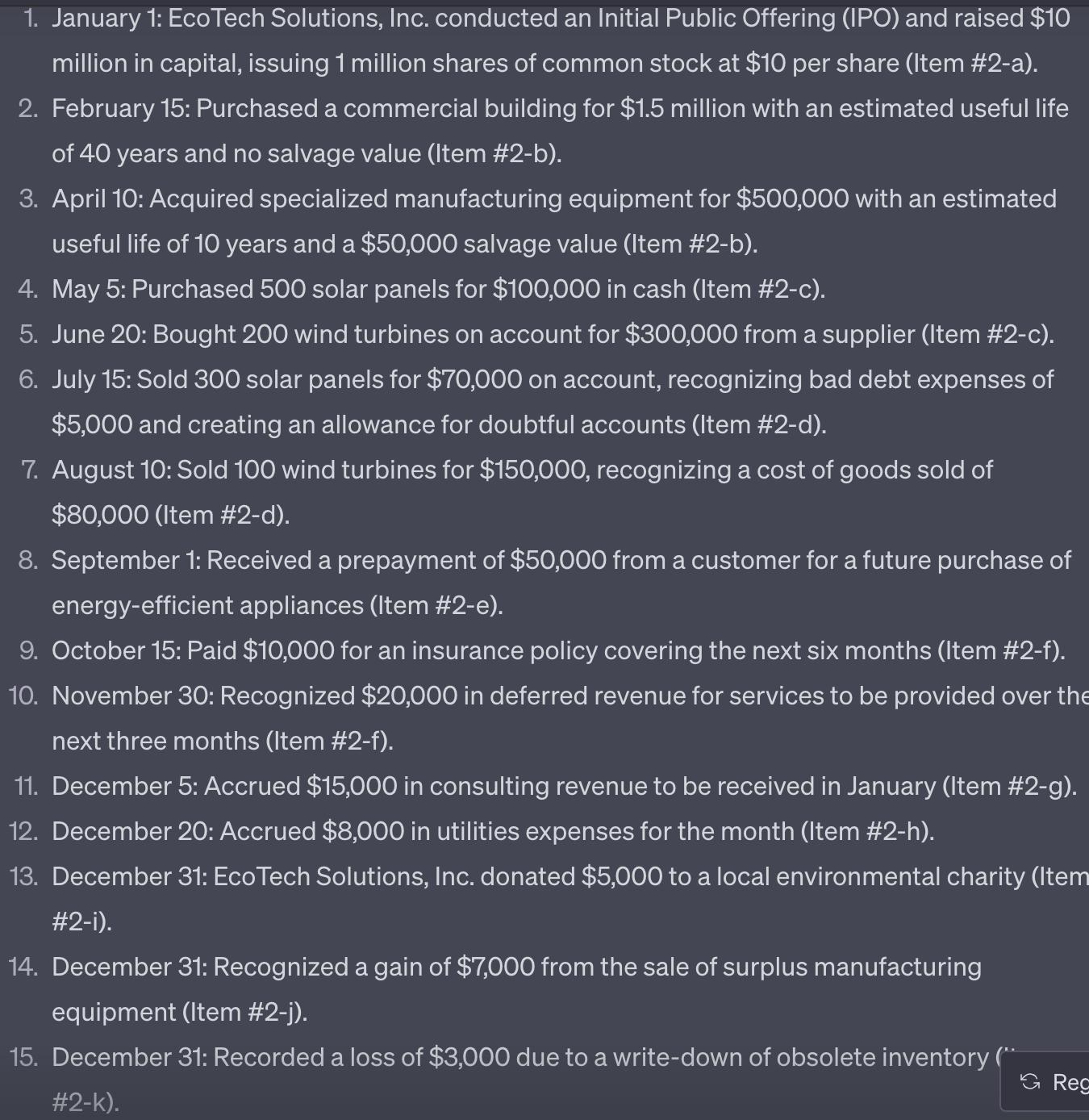

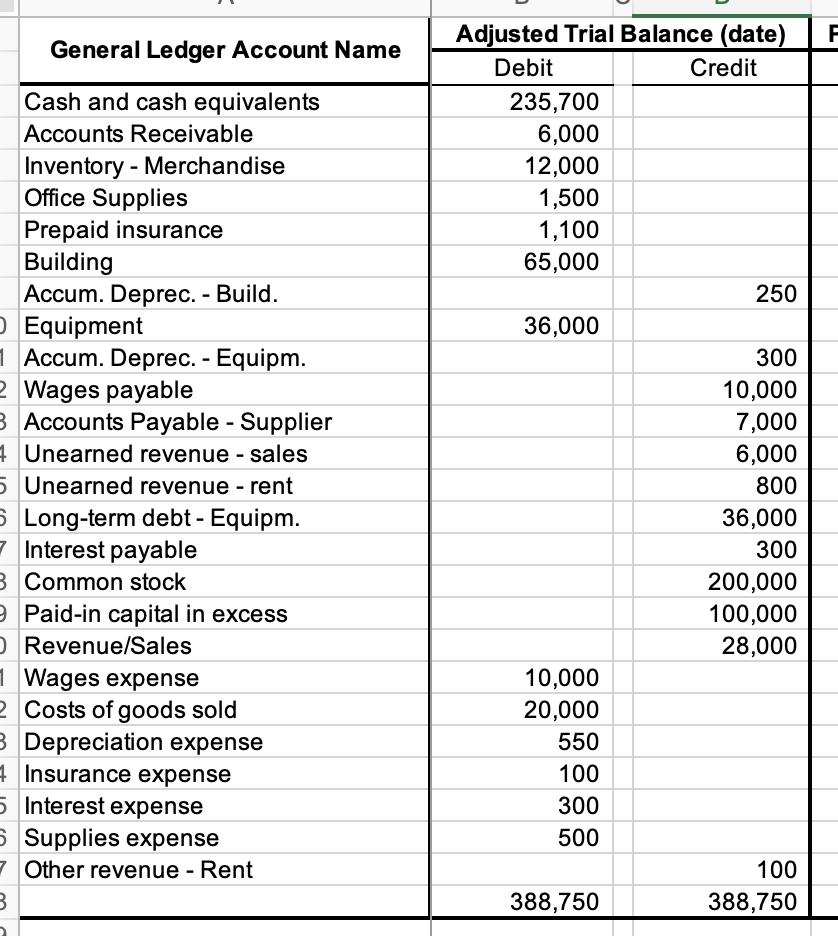

1. January 1: EcoTech Solutions, Inc. conducted an Initial Public Offering (IPO) and raised $10 million in capital, issuing 1 million shares of common stock at $10 per share (Item #2-a). 2. February 15: Purchased a commercial building for $1.5 million with an estimated useful life of 40 years and no salvage value (Item #2-b). 3. April 10: Acquired specialized manufacturing equipment for $500,000 with an estimated useful life of 10 years and a $50,000 salvage value (Item #2-b). 4. May 5: Purchased 500 solar panels for $100,000 in cash (Item #2-c). 5. June 20: Bought 200 wind turbines on account for $300,000 from a supplier (Item #2-c). 6. July 15: Sold 300 solar panels for $70,000 on account, recognizing bad debt expenses of $5,000 and creating an allowance for doubtful accounts (Item #2-d). 7. August 10: Sold 100 wind turbines for $150,000, recognizing a cost of goods sold of $80,000 (Item #2-d). 8. September 1: Received a prepayment of $50,000 from a customer for a future purchase of energy-efficient appliances (Item #2-e). 9. October 15: Paid $10,000 for an insurance policy covering the next six months (Item #2-f). 10. November 30: Recognized $20,000 in deferred revenue for services to be provided over the next three months (Item #2-f). 11. December 5: Accrued $15,000 in consulting revenue to be received in January (Item #2-g). 12. December 20: Accrued $8,000 in utilities expenses for the month (Item #2-h). 13. December 31: EcoTech Solutions, Inc. donated $5,000 to a local environmental charity (Item #2-i). 14. December 31: Recognized a gain of $7,000 from the sale of surplus manufacturing equipment (Item #2-j). 15. December 31: Recorded a loss of $3,000 due to a write-down of obsolete inventory #2-k). Reg General Ledger Account Name Cash and cash equivalents Accounts Receivable Inventory- Merchandise Office Supplies Prepaid insurance Building Accum. Deprec. - Build. O Equipment 1 Accum. Deprec. - Equipm. 2 Wages payable 3 Accounts Payable - Supplier 4 Unearned revenue - sales 5 Unearned revenue - rent 6 Long-term debt - Equipm. Interest payable 3 Common stock 9 Paid-in capital in excess O Revenue/Sales 1 Wages expense 2 Costs of goods sold 3 Depreciation expense 4 Insurance expense 5 Interest expense 5 Supplies expense 7 Other revenue - Rent B Adjusted Trial Balance (date) Debit Credit 235,700 6,000 12,000 1,500 1,100 65,000 36,000 10,000 20,000 550 100 300 500 388,750 250 300 10,000 7,000 6,000 800 36,000 300 200,000 100,000 28,000 100 388,750 F I 2 3 1 5 6 B 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 A General Ledger Account Name B D Adjusted Trial Balance (date) Debit Credit D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Cash and Cash Equivalents Initial balance 0 Add Proceeds from IPO 10000000 Result 10000000 Accounts Receivable Initial balance 6000 given No adjustments Result 6000 Inventory Merchandise Initial balan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started