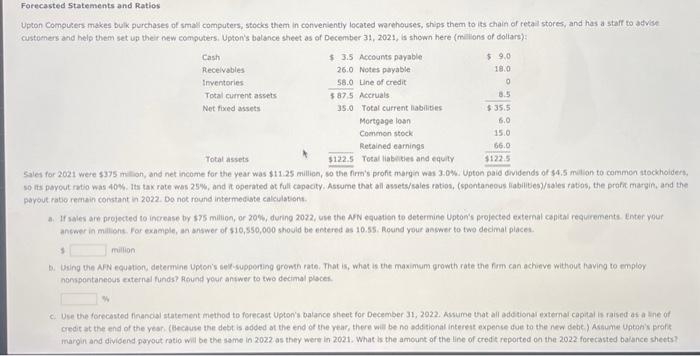

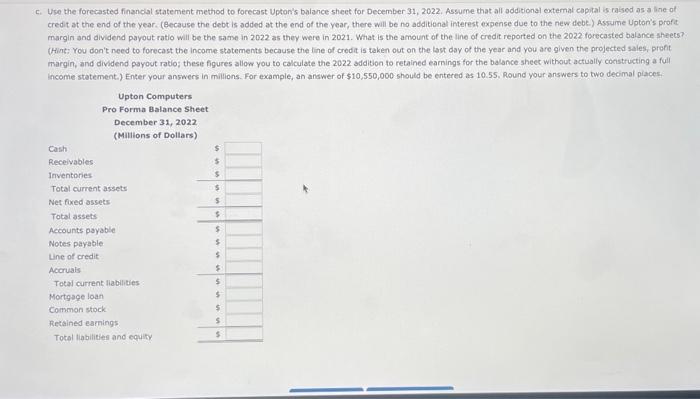

Upton Compusers makes bulk purchases of small computers, stocks them in convenientiy located warehouses, ships them to its chain of retal stores, and has a staif to advise custoeners and help them set up their new computers. Upton's balance sheet as of December 31, 2021, is shown here (milions of doltars): Sales for 2021 were $375 miton, and net income for the year was $11.25 million, wo the firn's profit morgin was 3.0%. Upton paid dividends of $4.5 malian to common stockhoiders so its payout mio was 40%. Its tax rate wos 25%, and operated ot full capocity. Assume that all assets/sales ratios, (spentaneous ilabilites)/soles ratios, the profic margin, and the payout ratio remain constant in 2022 . Do not round intermeciste calculations. a. If sales are projected to increase by $75 milition, or 20%, during 2022 , une the NN equation to setermine Upton's projected external capitai requrements. Enter vour anewer in milions. For example, an answer of $10,550,000 should be entered as 10.55 . Round vour answer to two decimal places. 3 mullion b. Bsing the AFN Equation, determine Uptonis sel-supponing grosth rate. That is, what is the maximum growth rate the fim can achieve without fuving to employ inonspontaneous caternal funds? Reund your aniwer to two decimal places. c. Use the forecasted financial statement method to forecost Uptons batance sheet for December 31, 2022. Assume that all addtional external capital is raised af a ine of credit at the end of the year. (because the debt is added at the end of the year, there will be no additionat interste expence due to the nen debe) Assume Uptoh's profs margin and dividend payout ratio wil be the same in 2022 as they were in 2021 . What is the amount of the line of credic reported on the 2022 forecauted balance sheets? c. Use the forecasted financlal statement method to forecast Upton's balance sheet for December 31, 2022. Assume that all additional extemal capital is raised as a ine of credit at the end of the year. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debe) Assume Uptoris profe margin and dividend payout ratio will be the same in 2022 as they were in 2021 . What is the amount of the line of credit reported on the 2022 forecasted balance sheets? (Hint; You don't need to forecast the income statements because the line of credit is taken out on the last day of the year and you are given the projected sales, profit margin, and dividend payout ratio; these figures allow you to calculate the 2022 addition to retained earnings for the balance sheec without actually constructing a full income statement.) Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55 , Round your answers to two decimal places