Answered step by step

Verified Expert Solution

Question

1 Approved Answer

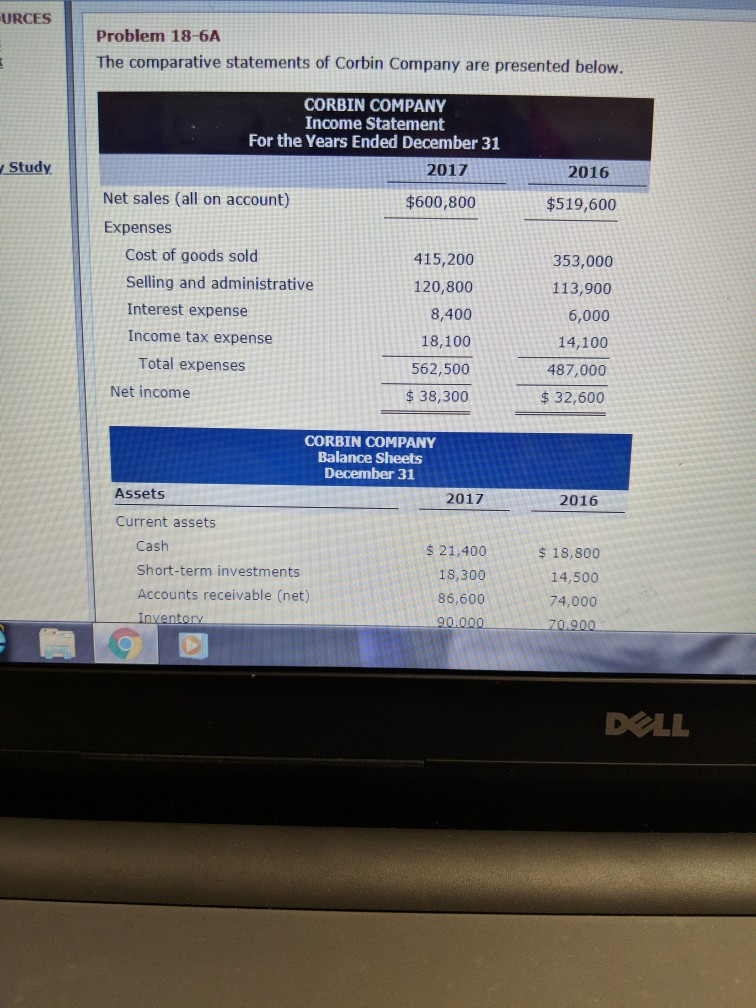

URCES Problem 18-6A The comparative statements of Corbin Company are presented below. CORBIN COMPANY Income Statement For the Years Ended December 31 Study 2017 2016

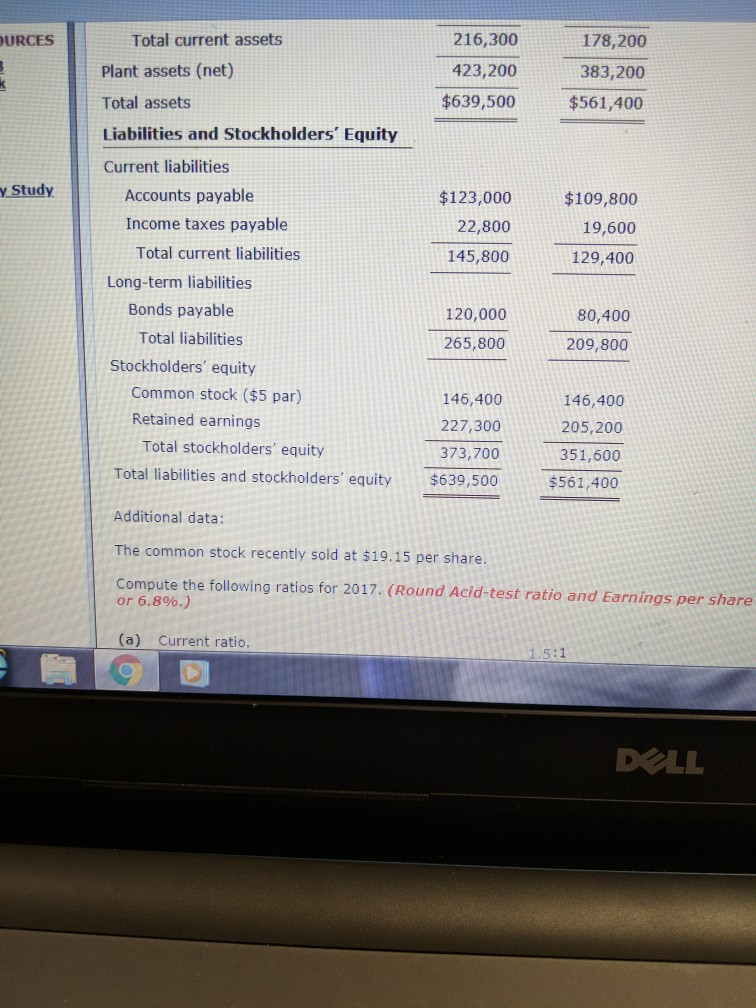

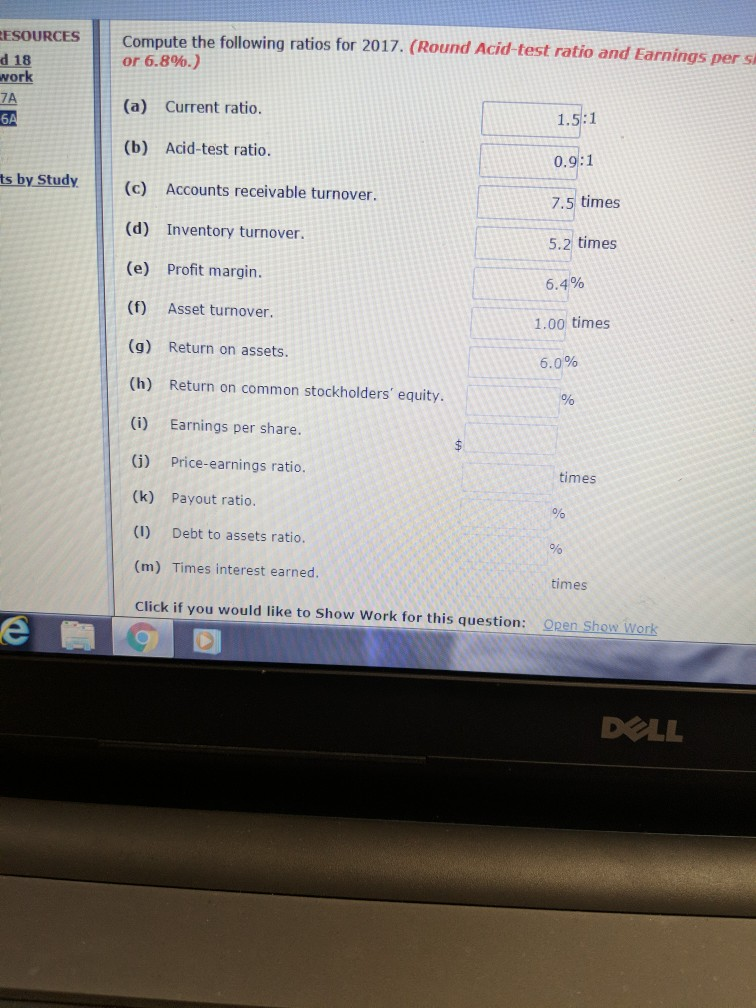

URCES Problem 18-6A The comparative statements of Corbin Company are presented below. CORBIN COMPANY Income Statement For the Years Ended December 31 Study 2017 2016 Net sales (all on account) Expenses $600,800 $519,600 Cost of goods sold Selling and administrative Interest expense Income tax expense 415,200 120,800 8,400 18,100 562,500 $38,300 353,000 113,900 6,000 14,100 487,000 Total expenses Net income $32,600 CORBIN COMPANY Balance Sheets December 31 Assets 2017 2016 Current assets Cash Short-term investments Accounts receivable (net) Inventory $ 21,400 18,300 86,600 90000 18,800 14,500 74,000 Total current assets Plant assets (net) Total assets Liabilities and Stockholders Equity Current liabilities 216,300 423,200 178,200 383,200 URCES $639,500 $61 400 $123,00 09,800 19,600 129,400 y Study Accounts payable Income taxes payable 22,800 145,800 Total current liabilities Long-term liabilities Bonds payable 120,000 265,800 80,400 209,800 Total liabilities Stockholders' equity Common stock ($5 par) Retained earnings 146,400 227,300 146,400 205,200 351,600 $561,400 Total stockholders' equity Total liabilities and stockholders equity $639,500 Additional data: The common stock recently sold at $19.15 per share. Compute the following ratios for 2017. (Round Acid-test ratio and Earnings per share 373,700 or 6.8%.) (a) Current ratic 1.5:1 DOLL ESOURCES Compute the following ratios for 2017. (Round Acid-test ratio and Earnings per si or 6.8%.) (a) Current ratio. (b) Acid-test ratio. d 18 work 7A 1.5:1 0.9:1 ts by Study. c Accounts receivable turnover. 7.5 times itA (d) Inventory turnover. (e) Profit margin. (f) Asset turnover. (g) Return on assets. (h) Return on common stockholders equity (i) Earnings per share. (i) Price-earnings ratio. (k) Payout ratio. 5.2 times 6.4% 1.00 times 6.0% times (I) Debt to assets ratio. (m) Times interest earned times Click if you would like to Show Work for this question: Open Show Work DOLL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started