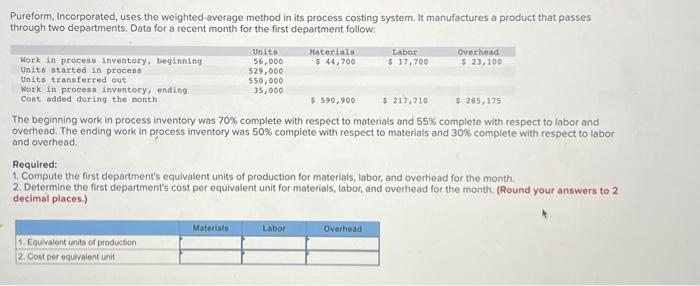

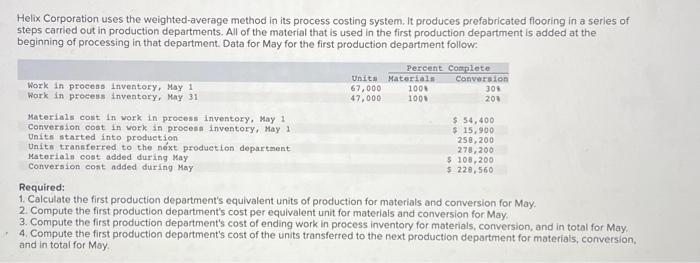

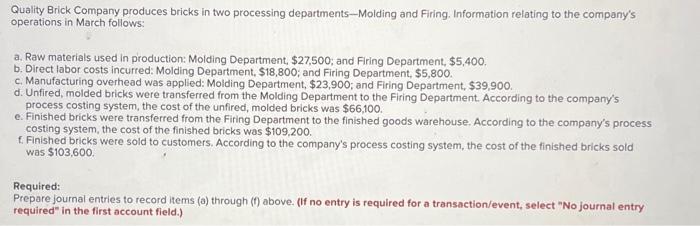

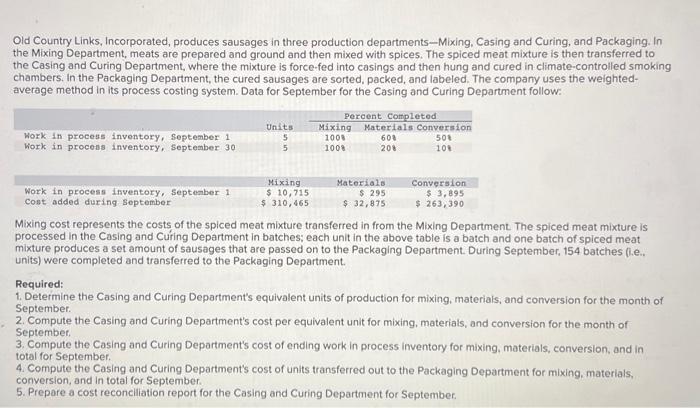

Ureform, Incorporated, uses the weighted-average method in its process costing system. It manufactures a product that passes hrough two departments. Data for a recent month for the first department follow: The beginning work in process inventory was 70% complete with respect to materials and 55% complete with respect to labor and overhead. The ending work in process inventory was 50% complete with respect to materials and 30% complete with respect to labor and overhead. Required: 1. Compute the first department's equivalent units of production for materials, labor, and overhead for the month. 2. Determine the first department's cost per equivalent unit for materials, labor, and overhead for the month. (Round your answers to 2 decimal places.) Helix Corporation uses the weighted-average method in its process costing system. It produces prefabricated flooring in a series of steps carricd out in production departments. All of the material that is used in the first production department is added at the beginning of processing in that department. Data for May for the first production department follow: Required: 1. Calculate the first production department's equivalent units of production for materials and conversion for May. 2. Compute the first production department's cost per equivalent unit for materials and conversion for May, 3. Compute the first production department's cost of ending work in process inventory for materials, conversion, and in total for May, 4. Compute the first production deportment's cost of the units transferred to the next production department for materials, conversion, and in total for Moy. Quality Brick Company produces bricks in two processing departments-Molding and Firing. Information relating to the company's operations in March follows: a. Raw materials used in production: Molding Department, $27,500; and Firing Department, $5,400. b. Direct labor costs incurred: Molding Department, $18,800; and Firing Department, $5,800. c. Manufacturing overhead was applied: Molding Department, $23,900; and Firing Department, $39,900. d. Unfired, molded bricks were transferred from the Molding Department to the Firing Department. According to the company's process costing system, the cost of the unfired, molded bricks was $66,100. e. Finished bricks were transferred from the Firing Department to the finished goods warehouse. According to the company's process costing system, the cost of the finished bricks was $109,200. f. Finished bricks were sold to customers. According to the company's process costing system, the cost of the finished bricks sold was $103,600. Required: Prepare journal entries to record items (a) through (f) above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Old Country Links, Incorporated, produces sausages in three production departments-Mixing, Casing and Curing, and Packaging. In the Mixing Department, meats are prepared and ground and then mixed with spices. The spiced meat mixture is then transferred to the Casing and Curing Department, where the mixture is force-fed into casings and then hung and cured in climate-controlled smoking chambers. In the Packaging Department, the cured sausages are sorted, packed, and labeled. The company uses the weightedaverage method in its process costing system. Data for September for the Casing and Curing Department follow: Mixing cost represents the costs of the spiced meat mixture transferred in from the Mixing Department. The spiced meat mixture is processed in the Casing and Curing Department in batches; each unit in the above table is a batch and one batch of spiced meat mixture produces a set amount of sausages that are passed on to the Packaging Department. During September, 154 batches fie.. units) were completed and transferred to the Packaging Department. Required: 1. Determine the Casing and Curing Department's equivalent units of production for mixing, materials, and conversion for the month of September. 2. Compute the Casing and Curing Department's cost per equivalent unit for mixing, materials, and conversion for the month of September. 3. Compute the Casing and Curing Department's cost of ending work in process inventory for mixing, materials, conversion, and in total for September. 4. Compute the Casing and Curing Department's cost of units transferred out to the Packaging Department for mixing, materials, conversion, and in total for September. 5. Prepare a cost reconclilation report for the Casing and Curing Department for September