URGENNNN PLSSS

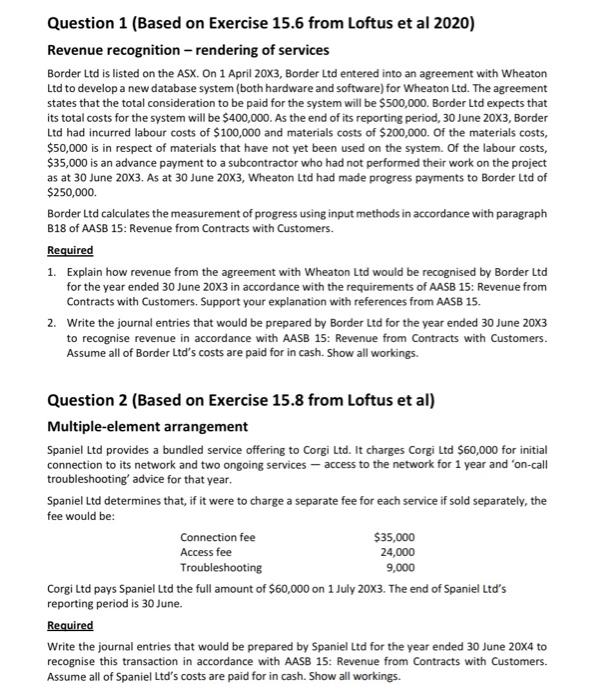

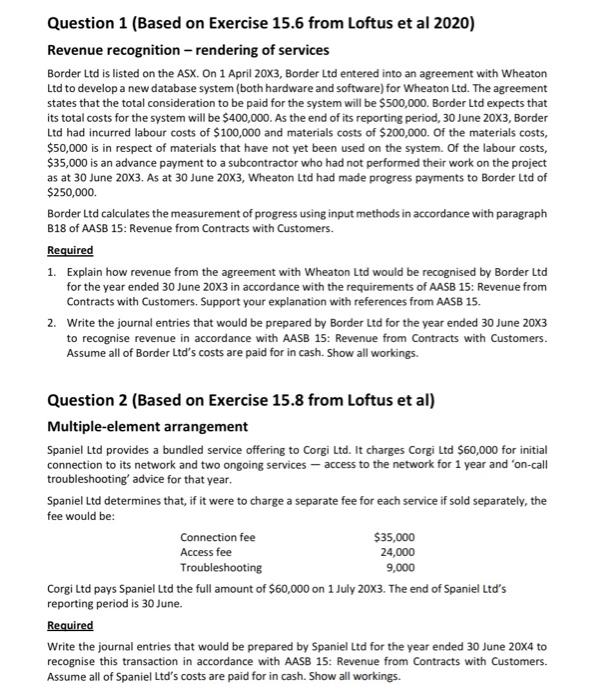

Question 1 (Based on Exercise 15.6 from Loftus et al 2020) Revenue recognition - rendering of services Border Ltd is listed on the ASX. On 1 April 20X3, Border Ltd entered into an agreement with Wheaton Ltd to develop a new database system (both hardware and software) for Wheaton Ltd. The agreement states that the total consideration to be paid for the system will be $500,000. Border Ltd expects that its total costs for the system will be $400,000. As the end of its reporting period, 30 June 20X3, Border Ltd had incurred labour costs of $100,000 and materials costs of $200,000. Of the materials costs, $50,000 is in respect of materials that have not yet been used on the system. Of the labour costs, $35,000 is an advance payment to a subcontractor who had not performed their work on the project as at 30 June 20X3. As at 30 June 20X3, Wheaton Ltd had made progress payments to Border Ltd of $250,000. Border Ltd calculates the measurement of progress using input methods in accordance with paragraph B18 of AASB 15: Revenue from Contracts with Customers. Required 1. Explain how revenue from the agreement with Wheaton Ltd would be recognised by Border Ltd for the year ended 30 June 203 in accordance with the requirements of AASB 15: Revenue from Contracts with Customers. Support your explanation with references from AASB 15. 2. Write the journal entries that would be prepared by Border Ltd for the year ended 30 June 203 to recognise revenue in accordance with AASB 15: Revenue from Contracts with Customers. Assume all of Border Ltd's costs are paid for in cash. Show all workings. Question 2 (Based on Exercise 15.8 from Loftus et al) Multiple-element arrangement Spaniel Ltd provides a bundled service offering to Corgi Ltd. It charges Corgi Ltd \$60,000 for initial connection to its network and two ongoing services - access to the network for 1 year and 'on-call troubleshooting' advice for that year. Spaniel Ltd determines that, if it were to charge a separate fee for each service if sold separately, the fee would be: Corgi Ltd pays Spaniel Ltd the full amount of $60,000 on 1 July 203. The end of Spaniel Ltd's reporting period is 30 June. Required Write the journal entries that would be prepared by Spaniel Ltd for the year ended 30 June 204 to recognise this transaction in accordance with AASB 15: Revenue from Contracts with Customers. Assume all of Spaniel Ltd's costs are paid for in cash. Show all workings