Answered step by step

Verified Expert Solution

Question

1 Approved Answer

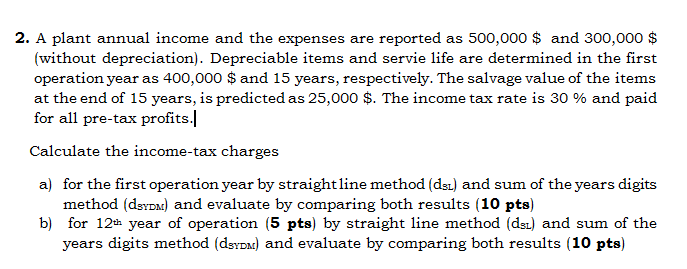

Urgent 1h !! 2. A plant annual income and the expenses are reported as 500,000 $ and 300,000 $ (without depreciation). Depreciable items and servie

Urgent 1h !!

2. A plant annual income and the expenses are reported as 500,000 $ and 300,000 $ (without depreciation). Depreciable items and servie life are determined in the first operation year as 400,000 $ and 15 years, respectively. The salvage value of the items at the end of 15 years, is predicted as 25,000 $. The income tax rate is 30 % and paid for all pre-tax profits. Calculate the income tax charges a) for the first operation year by straight line method (dsz) and sum of the years digits method (dsydu) and evaluate by comparing both results (10 pts) b) for 12th year of operation (5 pts) by straight line method (dez) and sum of the years digits method (dsyDM) and evaluate by comparing both results (10 pts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started