Answered step by step

Verified Expert Solution

Question

1 Approved Answer

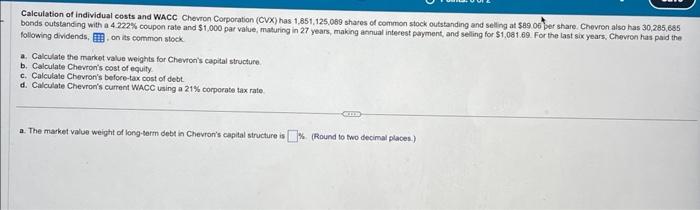

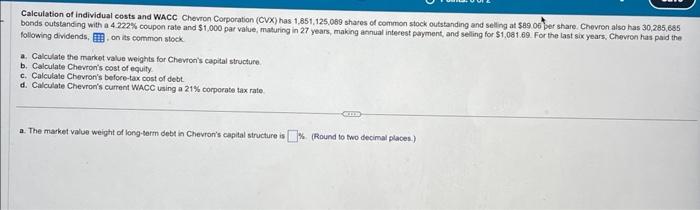

Urgent Calculation of individual costs and WACc Chevron Corporation (CVX) has 1,851,125,069 shares of common stock outstanding and selling at $89.06 per share. Chevron also

Urgent

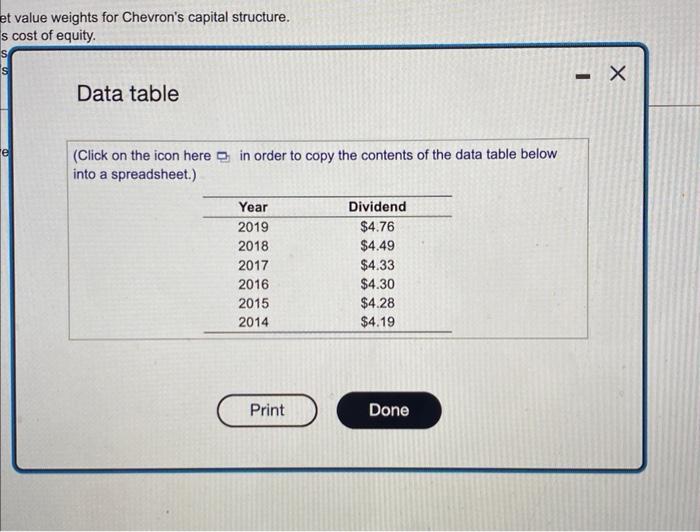

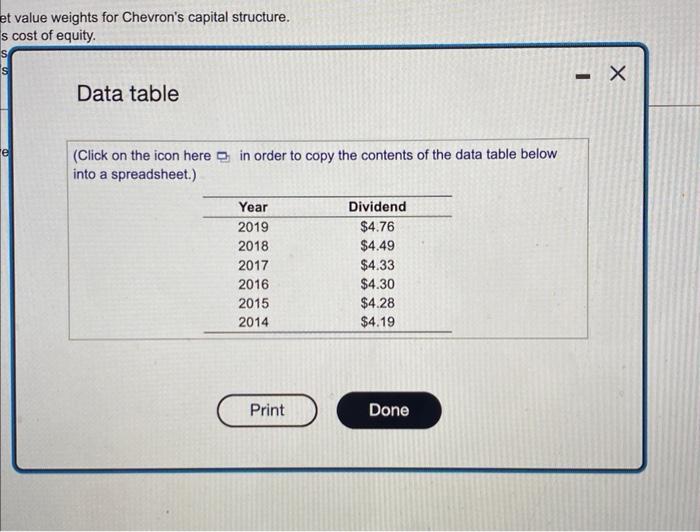

Calculation of individual costs and WACc Chevron Corporation (CVX) has 1,851,125,069 shares of common stock outstanding and selling at $89.06 per share. Chevron also has 30,285, 685 bonds cutstanding with a 4.222% coupon rate and $1,000 par value, maturing in 27 years, making annual intecest payment, and selling for $1,081.69. For the last six years, Chevron has paid the following dividends, , on its common stock a. Calculate the market value woights for Chevion's capital structure. b. Calculate Chevron's cost of equity. c. Calculale Chevion's before-tax cost of debt. d. Calculate Chevror's current WACC using a 21% corporate tax rate a. The market value weight of long-term debt in Chevron's capital structure is k. (Round to two decimal places) et value weights for Chevron's capital structure. cost of equity. Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started