URGENT

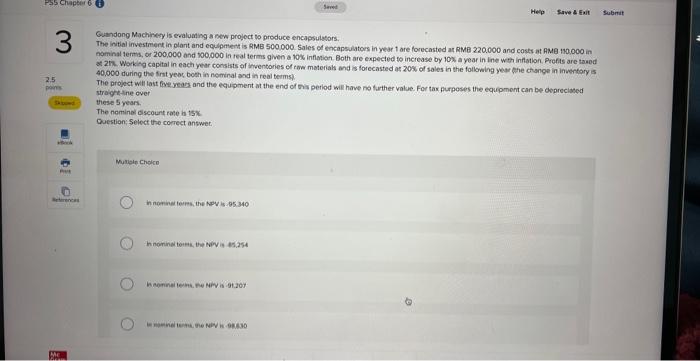

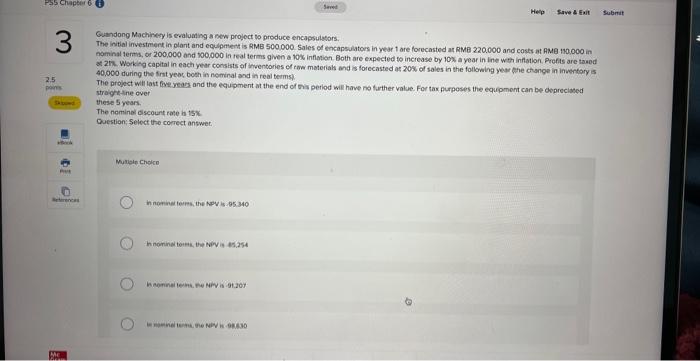

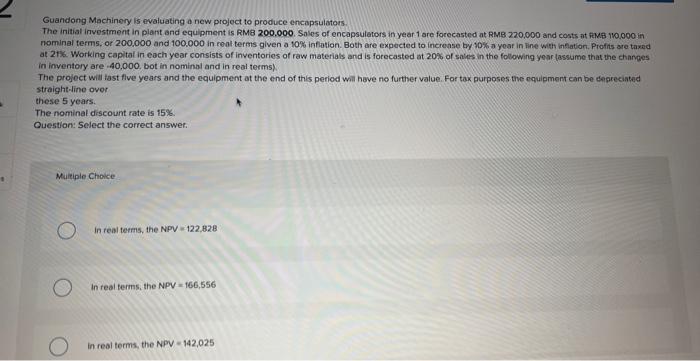

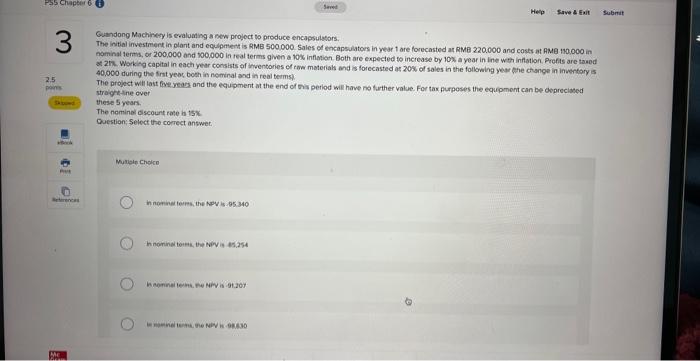

Guandong Machinery is cealuaing a new project to produce encapsulasors. The initial investmert in plant and equipmert is RMB 500.000. Sales of encapsulators in year 1 are forecasted at RMB 220.000 and casts at AME 130.000 in naminal tertis, or 200,000 and 100,000 in real terms given a 10x inflimion. Both are expected to increase by 10x a year in ine wer inflation. Prefis are taved at 2h. Working capital in each year consists of inventories cf raw materials and is forecasted at 20s of sales in the following year the change in invertary is 40,000 during the frat yeoc both in neminal and in real terms.) The project witl last five yeass and the equpment at the end of ona petiod will have no farther value. For tax purposes the equpmont can be oepreciased straight the over these 5 years. The neminal dscourt rate is 15x. Question; Select the correct answet. Muriein Choico in nominet term, the keV is.05.340 thoorinei teres, the Birvis 45.254 Guandong Machinery is evaluating a new project to produce encapsulators. The initial investment in plant and equipment is RMB 200.000. Sales of encapsulators in year 1 are forecasted at RMB 220.000 and costs nt it ik. 1.0.000 in nominal terms, or 200,000 and 100.000 in reat terms given a to\% inflation. Both are expected to increase by 10% a year in line with infination. Profits are taxed at 21.6. Working capital in eoch year consists of inventories of raw materials and is forecasted at 20 po of saies in the following year (assume that the changes in inventory are 40,000. bot in nominal and in real terms). The project will iast flve years and the equipment at the end of this period will have no further value. For tax purposes the oquipment can be depirecinted straight-line over these 5 years. The nominal discount rate is 15%. Question: Select the correct answer. Muitiple Choice In real terms, the NPV =122,828 In real terms, the NPV =166,556 In real terms, the NPV =142,025 Guandong Machinery is cealuaing a new project to produce encapsulasors. The initial investmert in plant and equipmert is RMB 500.000. Sales of encapsulators in year 1 are forecasted at RMB 220.000 and casts at AME 130.000 in naminal tertis, or 200,000 and 100,000 in real terms given a 10x inflimion. Both are expected to increase by 10x a year in ine wer inflation. Prefis are taved at 2h. Working capital in each year consists of inventories cf raw materials and is forecasted at 20s of sales in the following year the change in invertary is 40,000 during the frat yeoc both in neminal and in real terms.) The project witl last five yeass and the equpment at the end of ona petiod will have no farther value. For tax purposes the equpmont can be oepreciased straight the over these 5 years. The neminal dscourt rate is 15x. Question; Select the correct answet. Muriein Choico in nominet term, the keV is.05.340 thoorinei teres, the Birvis 45.254 Guandong Machinery is evaluating a new project to produce encapsulators. The initial investment in plant and equipment is RMB 200.000. Sales of encapsulators in year 1 are forecasted at RMB 220.000 and costs nt it ik. 1.0.000 in nominal terms, or 200,000 and 100.000 in reat terms given a to\% inflation. Both are expected to increase by 10% a year in line with infination. Profits are taxed at 21.6. Working capital in eoch year consists of inventories of raw materials and is forecasted at 20 po of saies in the following year (assume that the changes in inventory are 40,000. bot in nominal and in real terms). The project will iast flve years and the equipment at the end of this period will have no further value. For tax purposes the oquipment can be depirecinted straight-line over these 5 years. The nominal discount rate is 15%. Question: Select the correct answer. Muitiple Choice In real terms, the NPV =122,828 In real terms, the NPV =166,556 In real terms, the NPV =142,025