Answered step by step

Verified Expert Solution

Question

1 Approved Answer

urgent !!! help 1. B plc is a hot air balloon manufacturer whose equity:debt ratio is 5:2. The company is considering a waterbed-manufacturing project. B

urgent !!! help

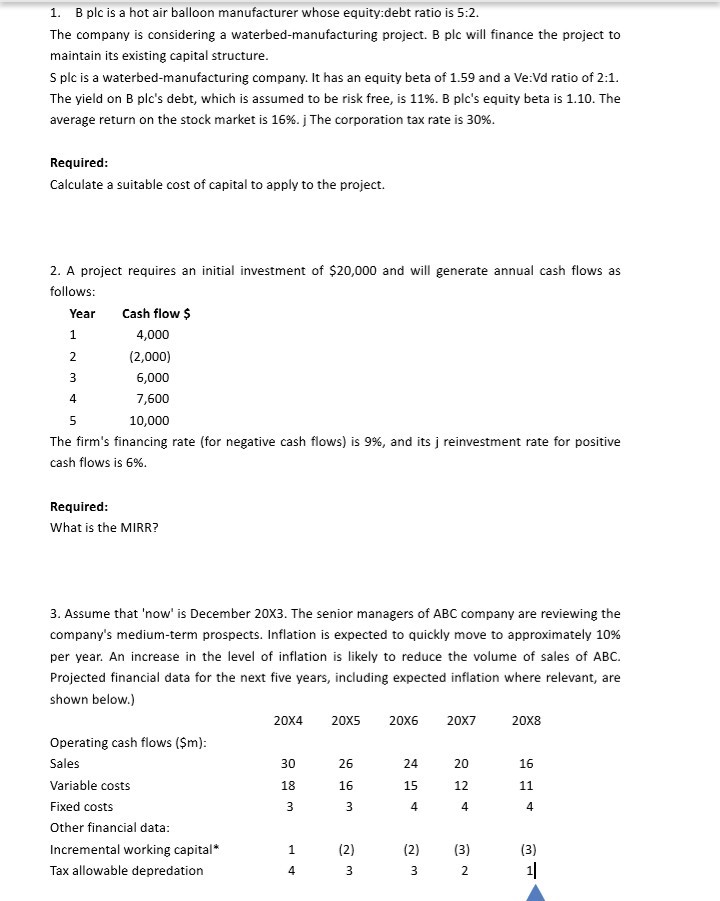

1. B plc is a hot air balloon manufacturer whose equity:debt ratio is 5:2. The company is considering a waterbed-manufacturing project. B plc will finance the project to maintain its existing capital structure S plc is a waterbed-manufacturing company. It has an equity beta of 1.59 and a Ve:Vd ratio of 2:1. The yield on B plc's debt, which is assumed to be risk free, is 11%. B plc's equity beta is 1.10. The average return on the stock market is 16%. j The corporation tax rate is 30% Required Calculate a suitable cost of capital to apply to the project. 2. A project requires an initial investment of $20,000 and will generate annual cash flows as follows: Cash flow $ 4,000 (2,000) 6,000 7,600 10,000 Year 4 The firm's financing rate (for negative cash flows) is 9%, and its j reinvestment rate for positive cash flows is 6% Required What is the MIRR? 3. Assume that 'now' is December 20X3. The senior managers of ABC company are reviewing the company's medium-term prospects. Inflation is expected to quickly move to approximately 10% per year. An increase in the level of inflation is likely to reduce the volume of sales of ABC. Projected financial data for the next five years, including expected inflation where relevant, are shown below.) 20X420X5 20X6 20X7 20X8 Operating cash flows (Sm) Sales Variable costs Fixed costs Other financial data Incremental working capital Tax allowable depredation 30 20 16 18 16 15 4 (2) 3) 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started