Urgent help please

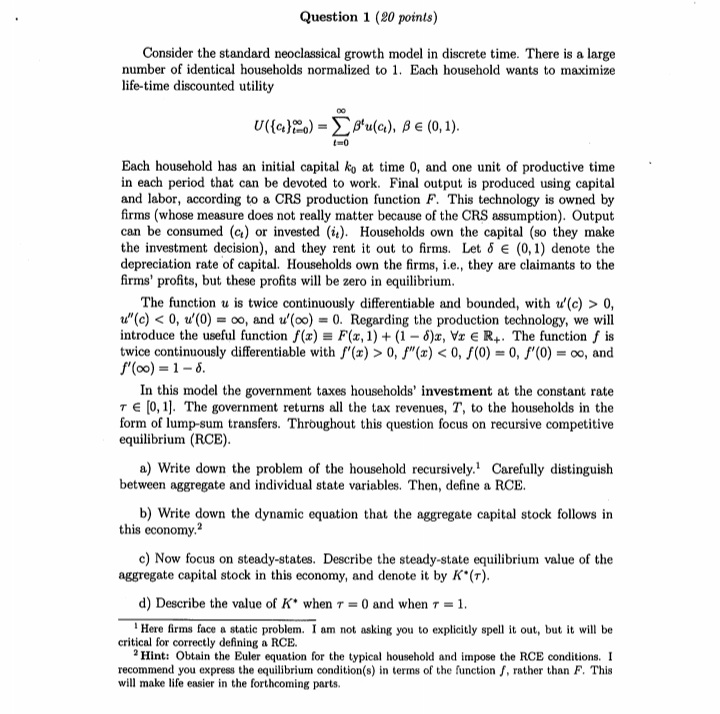

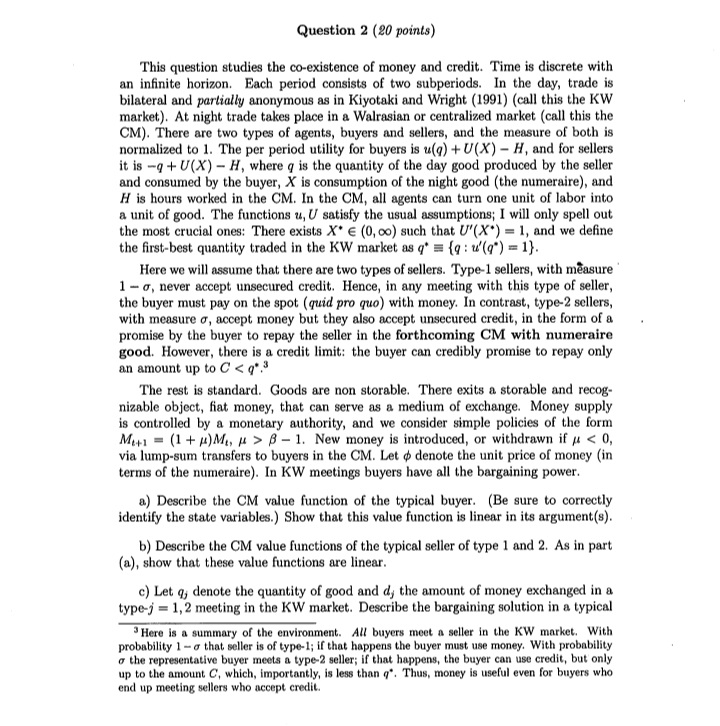

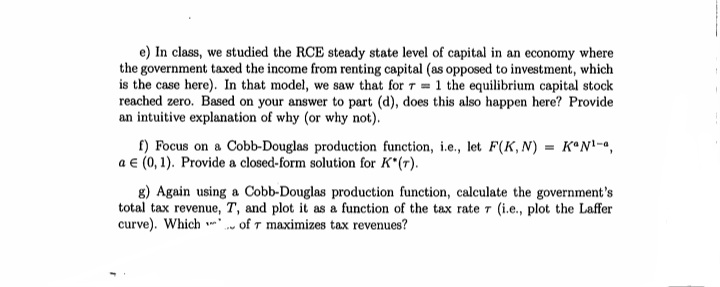

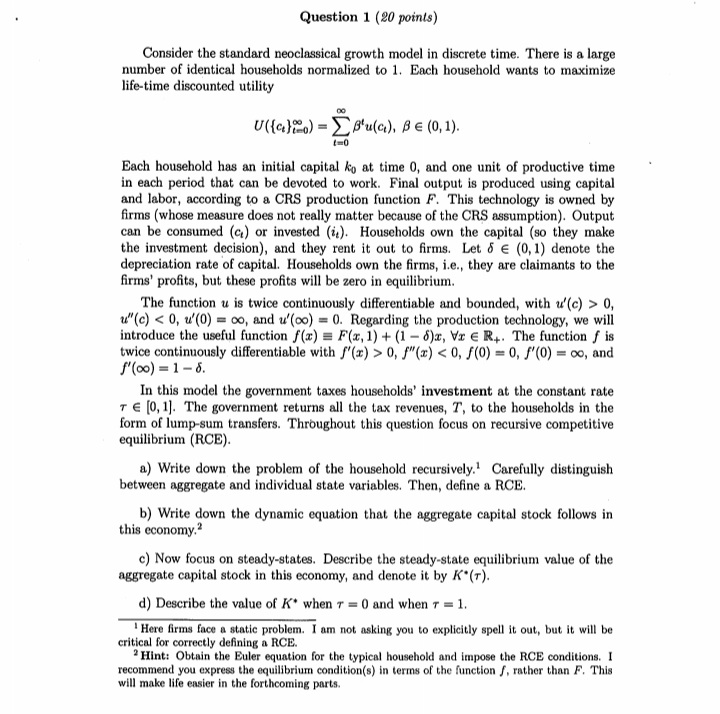

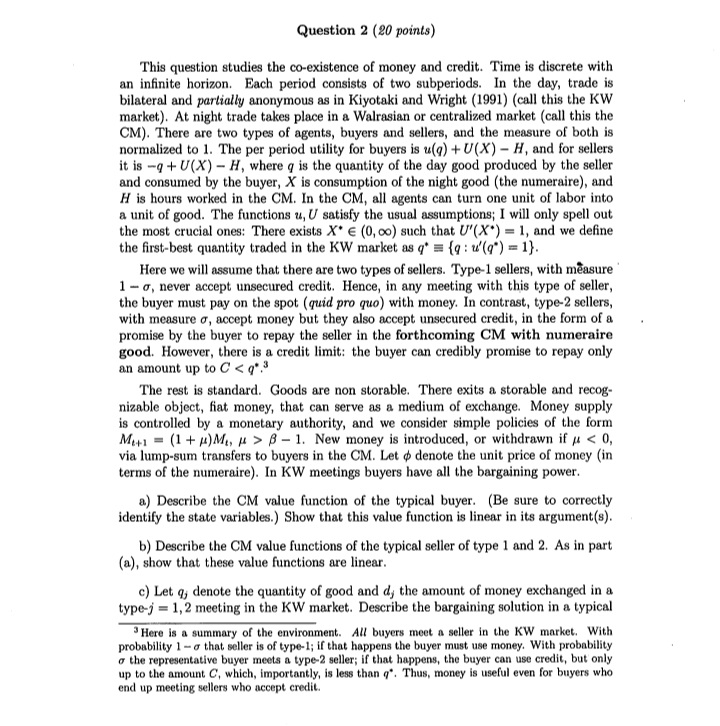

e) In class, we studied the RCE steady state level of capital in an economy where the government taxed the income from renting capital (as opposed to investment, which is the case here). In that model, we saw that for 7 = 1 the equilibrium capital stock reached zero. Based on your answer to part (d), does this also happen here? Provide an intuitive explanation of why (or why not). [) Focus on a Cobb-Douglas production function, i.e., let F(K, N) = Kavl-a, a E (0, 1). Provide a closed-form solution for K*(T). g) Again using a Cobb-Douglas production function, calculate the government's total tax revenue, T, and plot it as a function of the tax rate r (i.e., plot the Laffer curve). Which w . of T maximizes tax revenues?Question 1 (20 points) Consider the standard neoclassical growth model in discrete time. There is a large number of identical households normalized to 1. Each household wants to maximize life-time discounted utility U(also) = [pu(a), BE (0, 1). 1=0 Each household has an initial capital ko at time 0, and one unit of productive time in each period that can be devoted to work. Final output is produced using capital and labor, according to a CRS production function F. This technology is owned by firms (whose measure does not really matter because of the CRS assumption). Output can be consumed (c) or invested (i). Households own the capital (so they make the investment decision), and they rent it out to firms. Let & e (0, 1) denote the depreciation rate of capital. Households own the firms, i.e., they are claimants to the firms' profits, but these profits will be zero in equilibrium. The function u is twice continuously differentiable and bounded, with u'(c) > 0, u"(c) 0, f"(x) 8 - 1. New money is introduced, or withdrawn if # 0. Is this intuition (always) correct in this model and why? Hint: Feel free to analyze the bargaining problems in detail, but I think that with a little intuitive thinking you can answer this question in a couple of minutes. In particular, you should think how the amount of money exchanged in a type-2 meeting is affected by the exogenous credit limit C. "Hint: Here you should feel free to skip all the (formal) work that leads to the objective function, and simply guess the form of J. Notice that for the determination of J, it is important to distinguish between two cases: m' > m; and m'