Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT HELP PLEASE!!! Question 7 (1.25 points) You have a chance to buy an annuity that pays $22,451.67 at the beginning of each year for

URGENT HELP PLEASE!!!

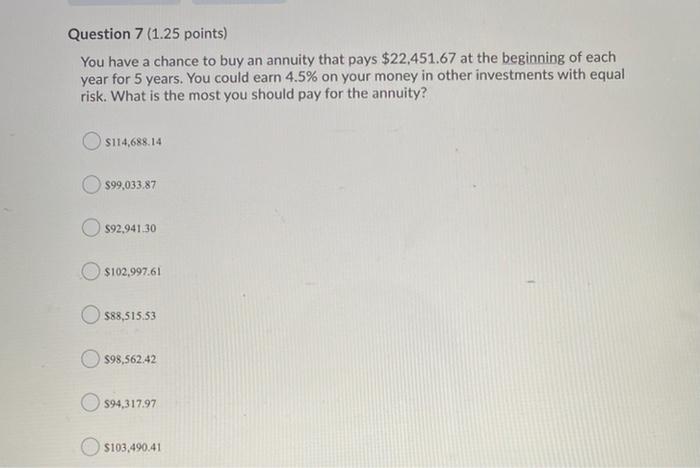

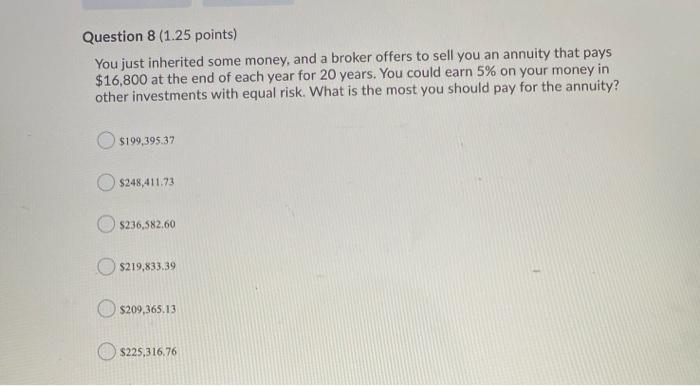

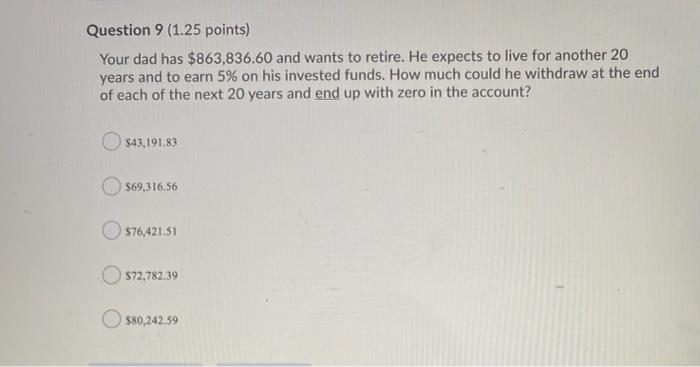

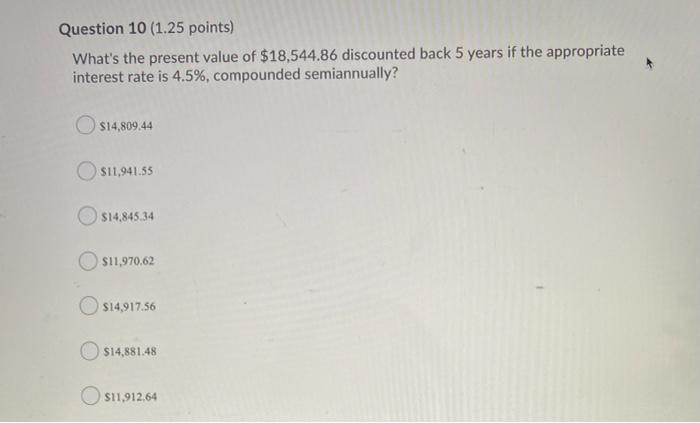

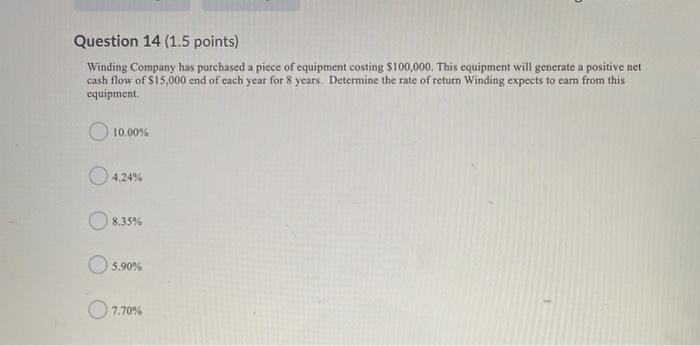

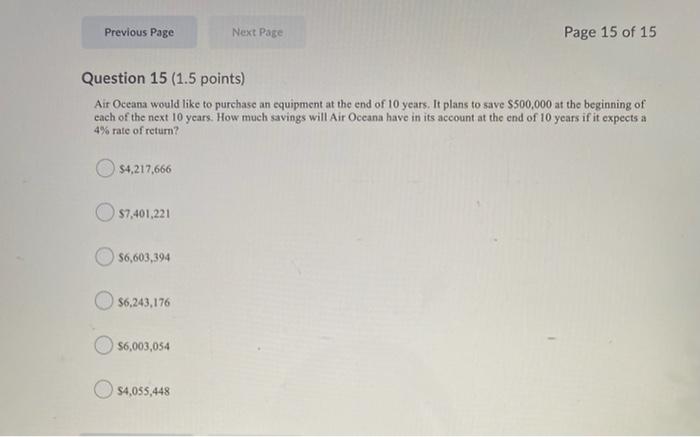

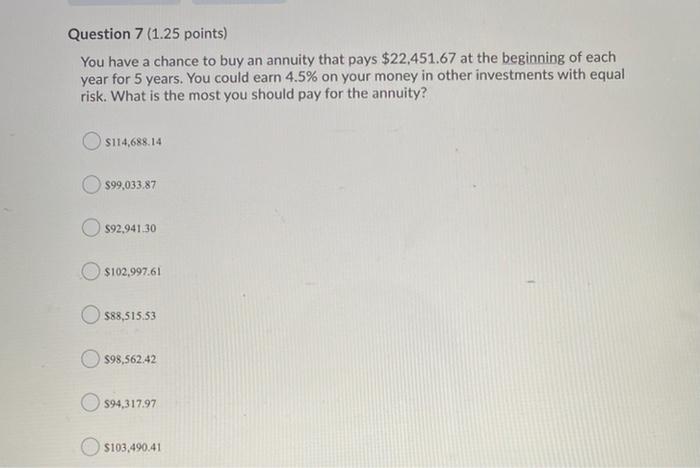

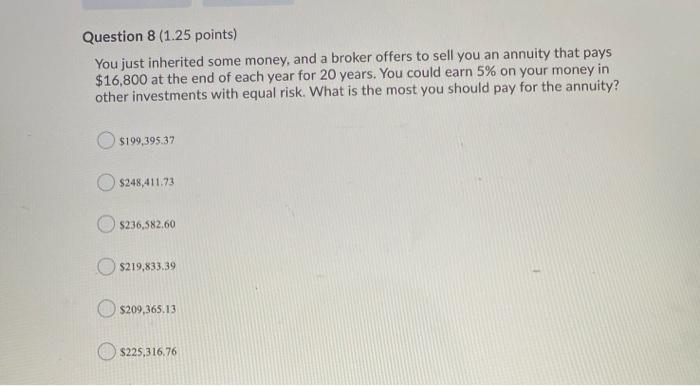

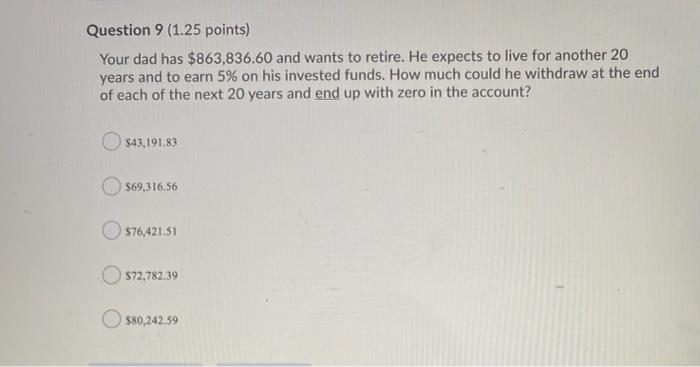

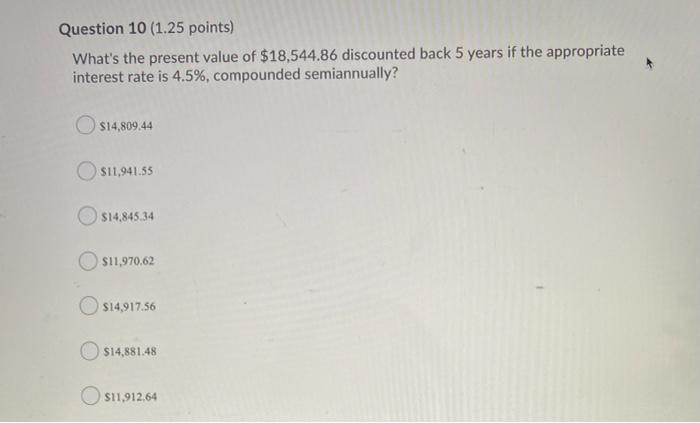

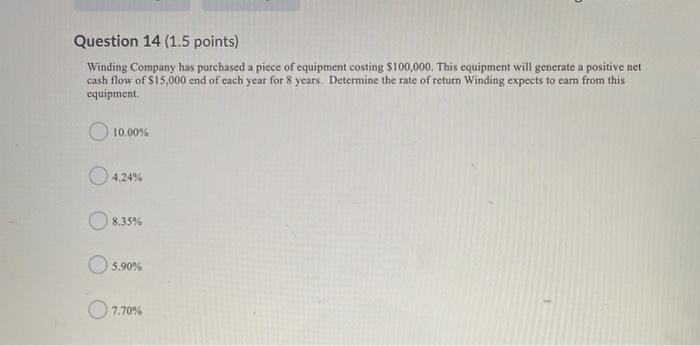

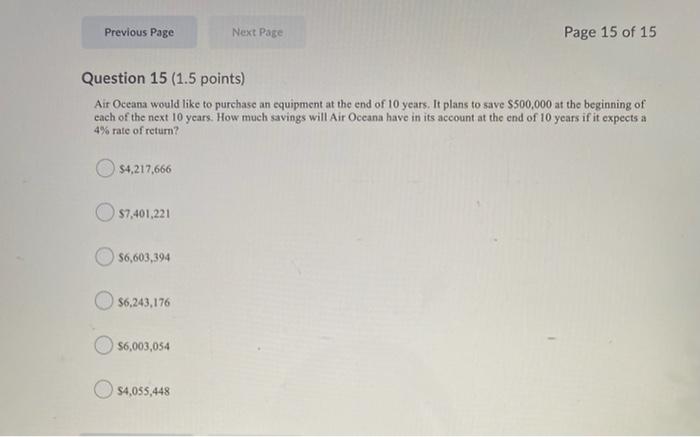

Question 7 (1.25 points) You have a chance to buy an annuity that pays $22,451.67 at the beginning of each year for 5 years. You could earn 4.5% on your money in other investments with equal risk. What is the most you should pay for the annuity? $114,688.14 99,033.87 $92,941.30 $102,997.61 588,515.53 $98,562.42 594,317.97 S103,490.41 Question 8 (1.25 points) You just inherited some money, and a broker offers to sell you an annuity that pays $16,800 at the end of each year for 20 years. You could earn 5% on your money in other investments with equal risk. What is the most you should pay for the annuity? $199,395.37 $248,411.73 $236,582.60 $219,833.39 $209,365.13 $225,316.76 Question 9 (1.25 points) Your dad has $863,836.60 and wants to retire. He expects to live for another 20 years and to earn 5% on his invested funds. How much could he withdraw at the end of each of the next 20 years and end up with zero in the account? $43,191.83 $69,316,56 $76,421.51 $72,782.39 $80,242.59 Question 10 (1.25 points) What's the present value of $18,544.86 discounted back 5 years if the appropriate interest rate is 4.5%, compounded semiannually? $14,809.44 $11,941.55 $14,845.34 $11.970.62 $14,917.56 $14,881.48 O $11,912.64 Question 14 (1.5 points) Winding Company has purchased a piece of equipment costing $100,000. This equipment will generate a positive net cash flow of $15,000 end of each year for 8 years. Determine the rate of return Winding expects to earn from this equipment O 10.00% 4.24% 8.35% 5.90% 7.70 Previous Page Next Page Page 15 of 15 Question 15 (1.5 points) Air Oceana would like to purchase an equipment at the end of 10 years. It plans to save $500,000 at the beginning of each of the next 10 years. How much savings will Air Oceana have in its account at the end of 10 years if it expects a 4% rate of return? $4,217,666 $7,401,221 $6,603,394 86,243,176 $6,003,054 $4,055,448

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started