Urgent help with case study please!

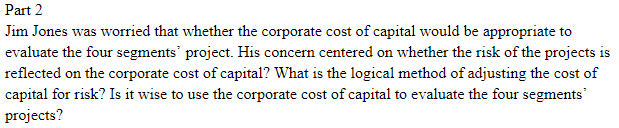

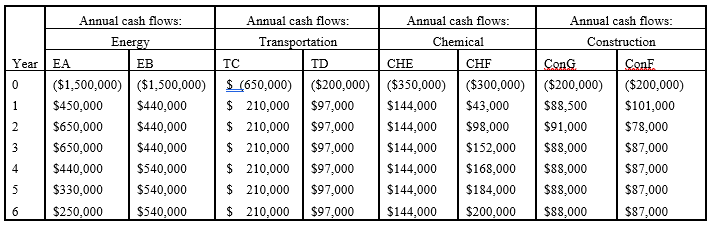

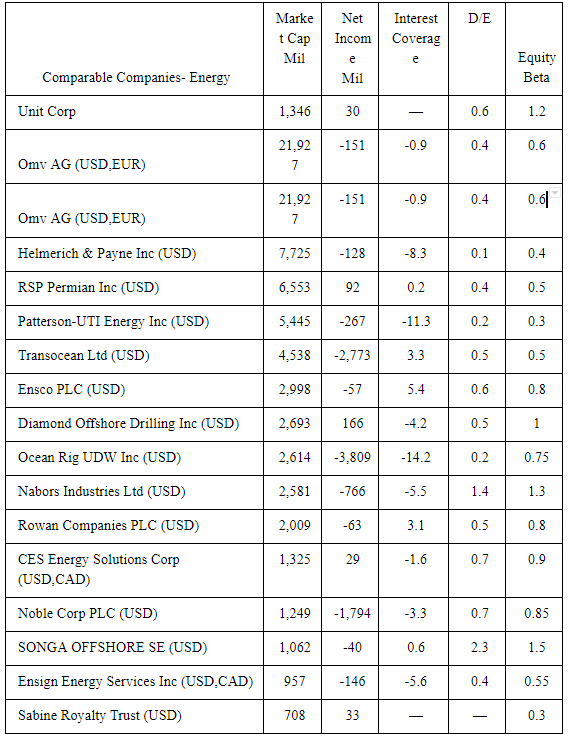

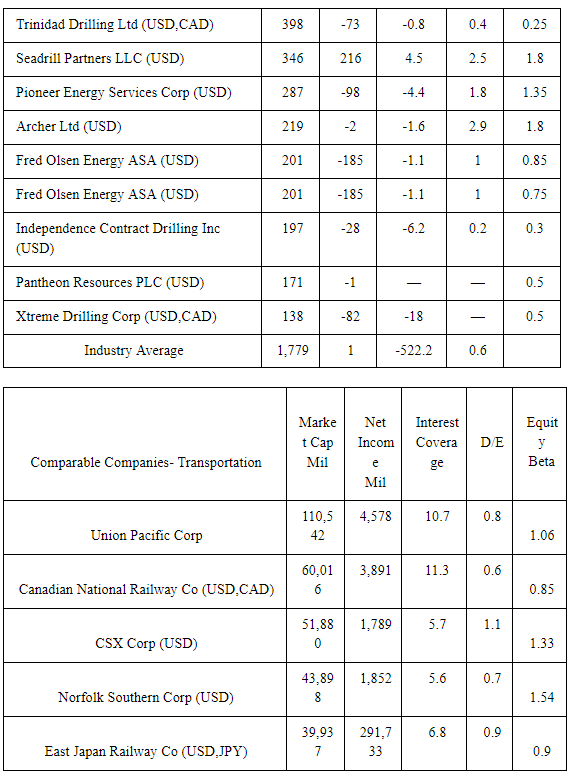

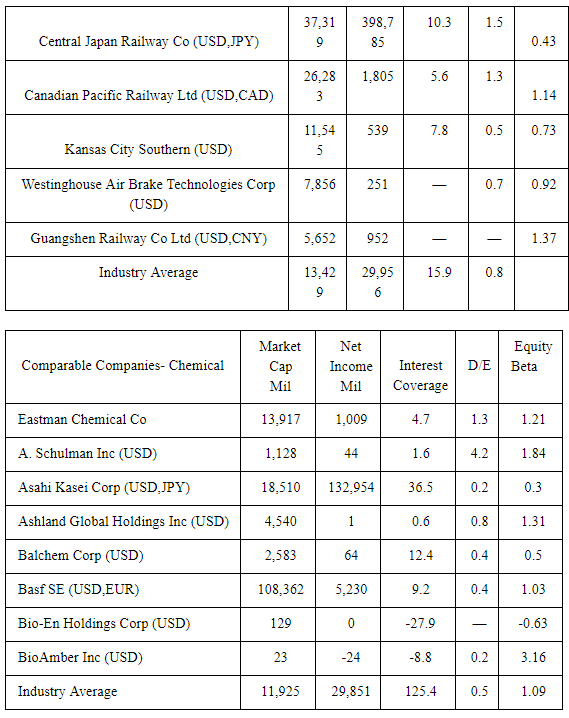

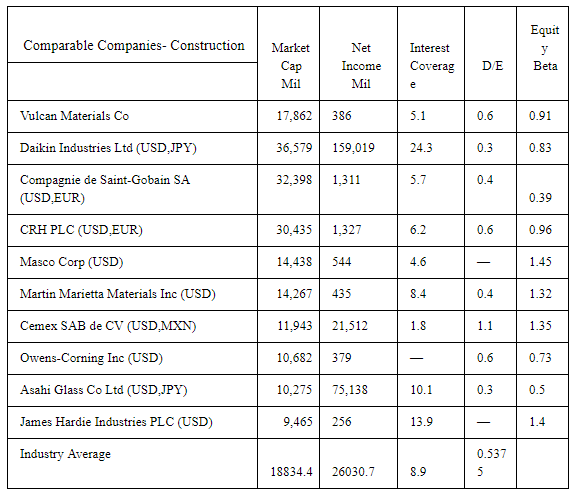

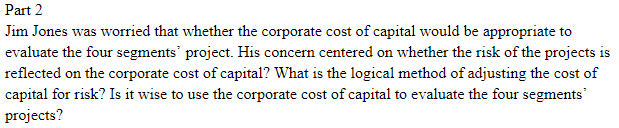

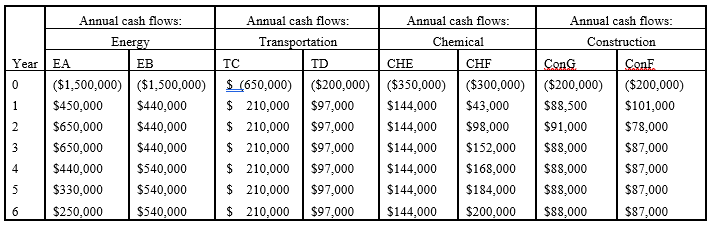

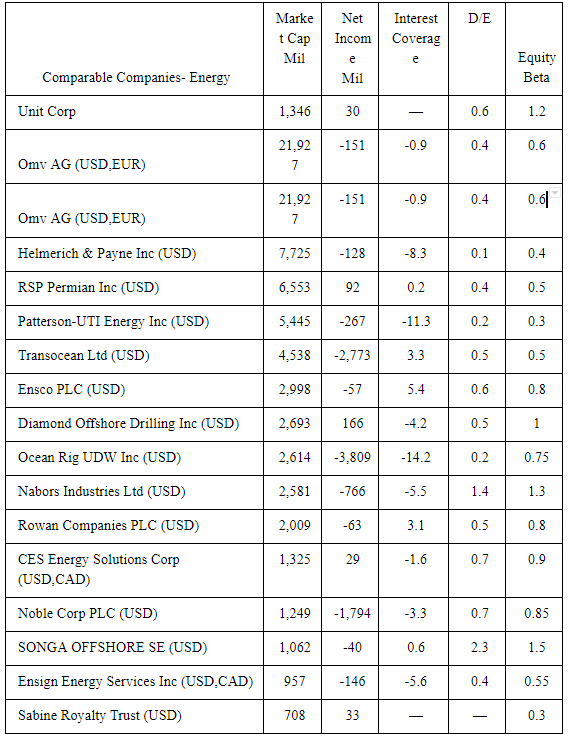

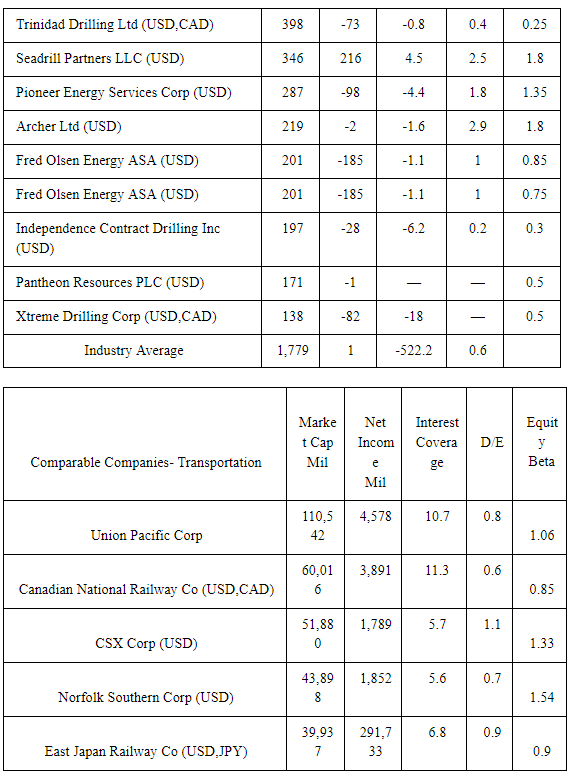

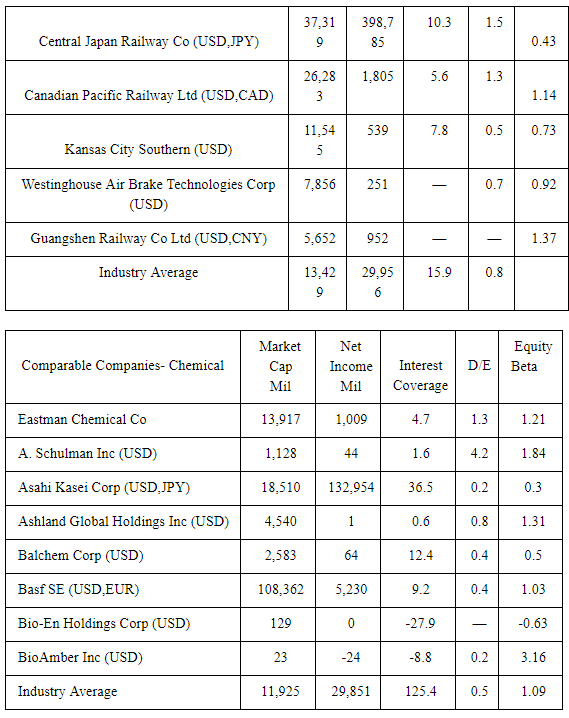

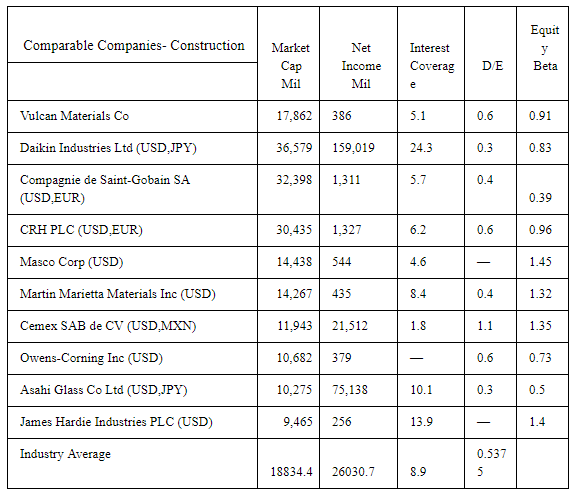

Part 2 Jim Jones was worried that whether the corporate evaluate the four segments' project. His concern centered on whether the risk of the projects is reflected on the corporate cost of capital? What is the logical method of adjusting the cost of capital for risk? Is it wise to use the corporate cost of capital to evaluate the four segments projects? cost of capital would be appropriate to Annual cash flows Annual cash flows Annual cash flows Annual cash flows En Chemical Constructior Year EA EB CHF 0 ($1,500,000)1,500,000) (50,000)($200,000) ($350,000) ($300,000)($200,000) ($200,000) $88,500 $91,000 $450,000 $650,000 $650,000 $440,000 $330,000 $250,000 $440,000 $440,000 $440,000 $540,000 $540,000 $540,000 $ 210,000 $97,000 $144,000 $43,000 $ 210,000 $97,000 $144,000 $98,000 $ 210,000 $97,000 $144,000 $152,000 $88,000 $ 210,000 $97,000 $144,000 $168,000 $88,000 $ 210,000 $97,000 $144,000 $184,000 $88,000 $ 210,000 $97,000 $144,000 $200,000 $88,000 $101,000 $78,000 $87,000 $87,000 $87,000 $87,000 398 346 287 219 201-185 201-185 197 -73 216 -98 -2 0.4 0.25 Trinidad Drilling Ltd (USD,CAD) Seadrill Partners LLC (USD) Pioneer Energy Services Corp (USD) Archer Ltd (USD) Fred Olsen Energy ASA (USD) Fred Olsen Energy ASA (USD) Independence Contract Drilling Inc 0.8 1.35 1.6 2.9 0.85 0.75 0.3 28 -6.2 0.2 (USD) Pantheon Resources PLC (USD) Xtreme Drilling Corp (USD,CAD) -1 0.5 138 -82 18 0.5 Industry Average 1,779 -522.20.6 Mark Net Interest t Cap Incom CoveDEy Mil Equit Comparable Companies- Transportation Beta Mil 110,54,57810.70.8 Union Pacific Corp 1.06 60,01 3,89111.30.6 Canadian National Railway Co (USD,CAD)6 0.85 51,881,789 CSX Corp (USD) 1.33 43,89 1,852 5.6 Norfolk Southern Corp (USD) 1.54 39,93 291,7 6.8 0.9 East Japan Railway Co (USD,JPY) 0.9 37,31 398,710.31.5 Central Japan Railway Co (USD,JPY) 85 0.43 26,281,805 5.6 Canadian Pacific Railway Ltd (USD,CAD)3 1.14 11,54539 0.5 0.73 Kansas City Southern (USD) 7,856251 0.7 0.92 Westinghouse Air Brake Technologies Corp (USD) Guangshen Railway Co Ltd (USD,CNY)5,652952 1.37 Industry Average 13,4229,9515.90.8 Market Net IncomeIteest DEBeta Equity Comparable Companies- Chemical Cap Mil Mil Coverage Eastman Chemical Co A. Schulman Inc (USD) Asahi Kasei Corp (USD,JPY) Ashland Global Holdings Inc (USD)4,540 Balchem Corp (USD) Basf SE (USD,EUR) Bio-En Holdings Corp (USD) BioAmber Inc (USD) Industry Average 1.3 1.21 4.2 1.84 18.510132,954 36.5 0.20.3 0.8 131 0.4 0.5 0.4 1.03 -0.63 0.2 3.16 11,92529,851 125.4 0.5 1.09 13,9171,009 4.7 1,128 0.6 2,583 64 108,3625,230 9.2 27.9 8.8 129 23 -24 Equit Comparable Companies- ConstructionMarket Net Interest Cap Income ovg DEBeta Mil 17,862 386 36,579 159,019 2,39 1,311 Mil Vulcan Materials Co Daikin Industries Ltd (USD,JPY) Compagnie de Saint-Gobain SA 0.6 0.91 24.3 0.3 0.83 (USD EUR) CRH PLC (USD,EUR) Masco Corp (USD) Martin Marietta Materials Inc (USD) Cemex SAB de CV (USD MXN) Owens-Corning Inc (USD) Asahi Glass Co Ltd (USD,JPY) James Hardie Industries PLC (USD) Industry Average 30,435 1,327 14,438 544 4,267 435 11,943 21,512 10,682 379 10,275 75,138 9,465 256 0.39 0.96 1.45 1.32 1.35 0.73 0.5 6.2 0.6 1.8 0.6 10.1 0.3 13.9 0.537 18834.4 26030.7 8.9