Urgent, its totally okay even if it's wrong because I also feel that the question is weird, but please provide me any answer that looks somewhat realistic and makes sense.

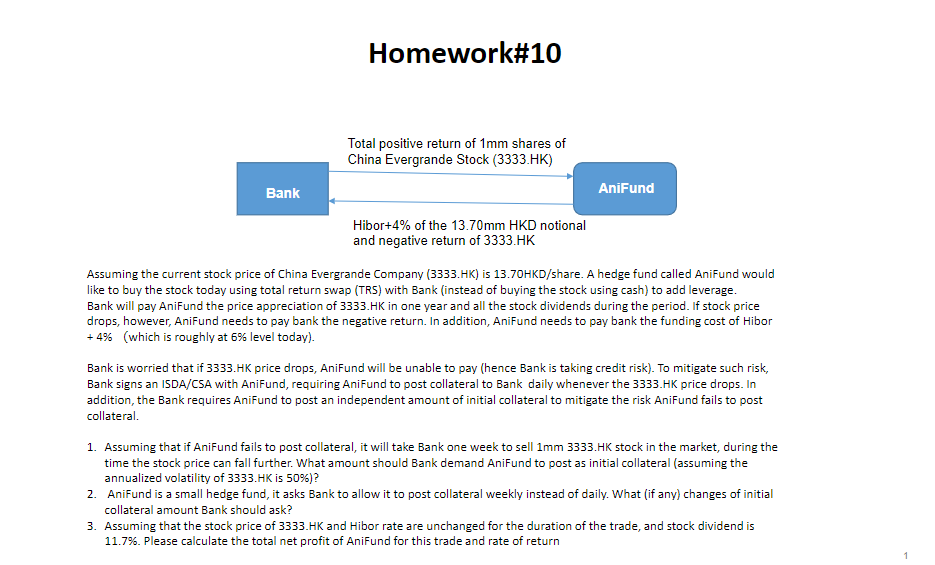

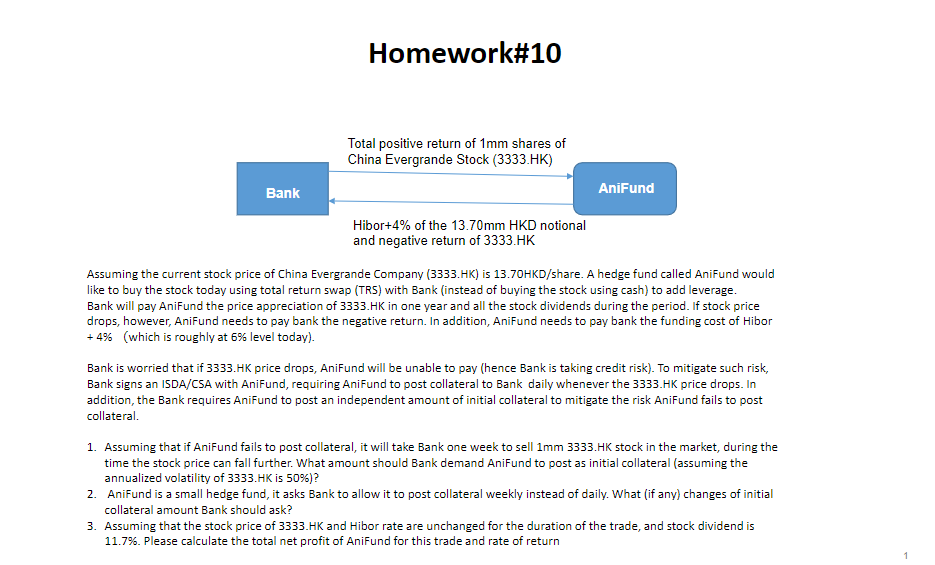

Homework#10 Total positive return of 1mm shares of China Evergrande Stock (3333.HK) Bank AniFund Hibor+4% of the 13.70mm HKD notional and negative return of 3333.HK Assuming the current stock price of China Evergrande Company (3333.HK) is 13.70HKD/share. A hedge fund called AniFund would like to buy the stock today using total return swap (TRS) with Bank (instead of buying the stock using cash) to add leverage. Bank will pay AniFund the price appreciation of 3333.HK in one year and all the stock dividends during the period. If stock price drops, however, AniFund needs to pay bank the negative return. In addition, AniFund needs to pay bank the funding cost of Hibor + 4% (which is roughly at 6% level today). Bank is worried that if 3333.HK price drops, AniFund will be unable to pay (hence Bank is taking credit risk). To mitigate such risk, Bank signs an ISDA/CSA with AniFund, requiring AniFund to post collateral to Bank daily whenever the 3333.HK price drops. In addition, the Bank requires AniFund to post an independent amount of initial collateral to mitigate the risk AniFund fails to post collateral. 1. Assuming that if AniFund fails to post collateral, it will take Bank one week to sell 1mm 3333.HK stock in the market, during the time the stock price can fall further. What amount should Bank demand AniFund to post as initial collateral (assuming the annualized volatility of 3333.HK is 50%)? 2. AniFund is a small hedge fund, it asks Bank to allow it to post collateral weekly instead of daily. What (if any) changes of initial collateral amount Bank should ask? 3. Assuming that the stock price of 3333.HK and Hibor rate are unchanged for the duration of the trade, and stock dividend is 11.7%. Please calculate the total net profit of AniFund for this trade and rate of return Homework#10 Total positive return of 1mm shares of China Evergrande Stock (3333.HK) Bank AniFund Hibor+4% of the 13.70mm HKD notional and negative return of 3333.HK Assuming the current stock price of China Evergrande Company (3333.HK) is 13.70HKD/share. A hedge fund called AniFund would like to buy the stock today using total return swap (TRS) with Bank (instead of buying the stock using cash) to add leverage. Bank will pay AniFund the price appreciation of 3333.HK in one year and all the stock dividends during the period. If stock price drops, however, AniFund needs to pay bank the negative return. In addition, AniFund needs to pay bank the funding cost of Hibor + 4% (which is roughly at 6% level today). Bank is worried that if 3333.HK price drops, AniFund will be unable to pay (hence Bank is taking credit risk). To mitigate such risk, Bank signs an ISDA/CSA with AniFund, requiring AniFund to post collateral to Bank daily whenever the 3333.HK price drops. In addition, the Bank requires AniFund to post an independent amount of initial collateral to mitigate the risk AniFund fails to post collateral. 1. Assuming that if AniFund fails to post collateral, it will take Bank one week to sell 1mm 3333.HK stock in the market, during the time the stock price can fall further. What amount should Bank demand AniFund to post as initial collateral (assuming the annualized volatility of 3333.HK is 50%)? 2. AniFund is a small hedge fund, it asks Bank to allow it to post collateral weekly instead of daily. What (if any) changes of initial collateral amount Bank should ask? 3. Assuming that the stock price of 3333.HK and Hibor rate are unchanged for the duration of the trade, and stock dividend is 11.7%. Please calculate the total net profit of AniFund for this trade and rate of return