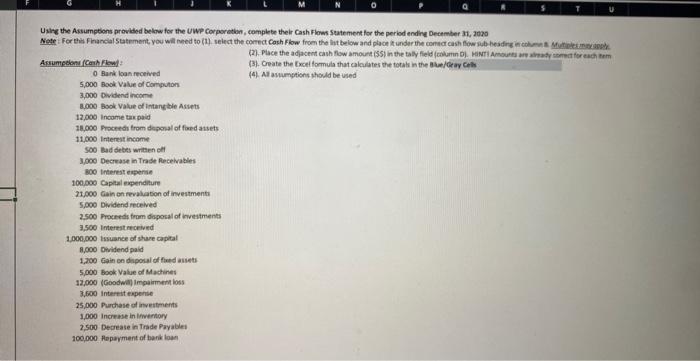

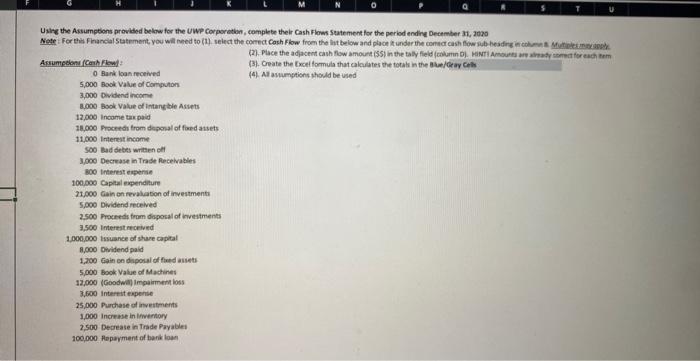

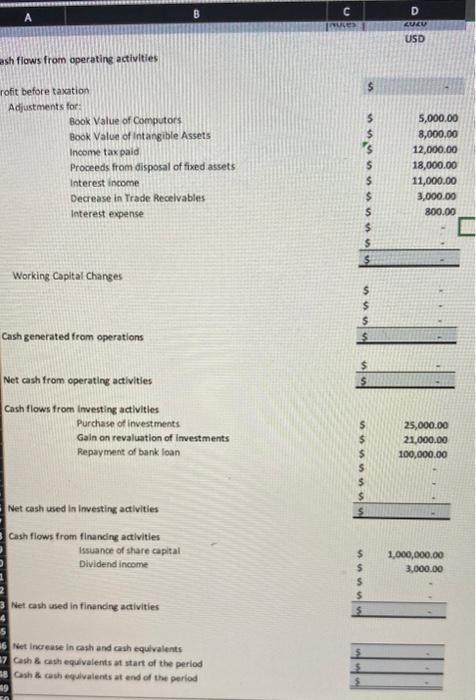

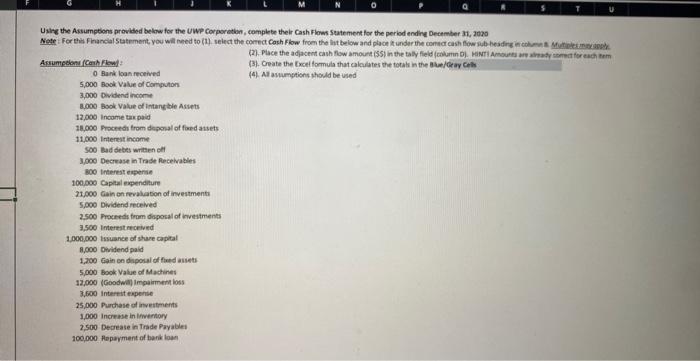

Urgent, need help assembling a statement of cash flows, disregard any numbers i put on the cash flow as im not sure if theyre correct, all assumptions must be used

Using the Assumptons provided below for the UWP Corporetion, complete their Cash Flows statement for the period endire December 31 , 2020 Acrumedons (Corit Flowl: (3). Opate the Excel formula that calcalates the totals in the alueicroy Cols (4) Al anumptions thould be used 5,000 Book Value of Compution 3,000 pevident netome 3,000 Book Value of tintang bie Astets 12,000 Income taxpald 1h,000 Proceed trom deponal of foed atsets 11,000 Irterest income 500 bad bebes witben olf 1,000 Decrease in Trade fecehables Boo therest expense 100,000 Captal expenditure 21,000 Cain en revalation of investments 5,000 Dividend molved 2500 Prouedsts from doposal of investments 3,500 Interestrocived 1.,000,000 tssuance of share capital 8,000 Dwidend paid 1,200 Gain on daposal of fiutd asets 5,000 book Value of Machines 12,000 (Goodwit) impairment lioss 3,600 intereit experise 25,000 Purchase of investments 1,000 increme in imemory 2,500 Detrease in Trade Payablet 100,000 fopayment of hanik loan ash flows from operating activities rofit before taxation Adjustments for: Cash flows from investing activities Purchase of investme-st Gain on revaluation of Repayment of bank I in investing activities Net cash used is investing activities Cash flows from finanding activities issuance of share capital Dividend income Net cash used in finanding activities Wet ing ease in cash and ash equivalents Cash 8 are equivalents at start of the period Cash 3 cath equivalents at end of the period Using the Assumptons provided below for the UWP Corporetion, complete their Cash Flows statement for the period endire December 31 , 2020 Acrumedons (Corit Flowl: (3). Opate the Excel formula that calcalates the totals in the alueicroy Cols (4) Al anumptions thould be used 5,000 Book Value of Compution 3,000 pevident netome 3,000 Book Value of tintang bie Astets 12,000 Income taxpald 1h,000 Proceed trom deponal of foed atsets 11,000 Irterest income 500 bad bebes witben olf 1,000 Decrease in Trade fecehables Boo therest expense 100,000 Captal expenditure 21,000 Cain en revalation of investments 5,000 Dividend molved 2500 Prouedsts from doposal of investments 3,500 Interestrocived 1.,000,000 tssuance of share capital 8,000 Dwidend paid 1,200 Gain on daposal of fiutd asets 5,000 book Value of Machines 12,000 (Goodwit) impairment lioss 3,600 intereit experise 25,000 Purchase of investments 1,000 increme in imemory 2,500 Detrease in Trade Payablet 100,000 fopayment of hanik loan ash flows from operating activities rofit before taxation Adjustments for: Cash flows from investing activities Purchase of investme-st Gain on revaluation of Repayment of bank I in investing activities Net cash used is investing activities Cash flows from finanding activities issuance of share capital Dividend income Net cash used in finanding activities Wet ing ease in cash and ash equivalents Cash 8 are equivalents at start of the period Cash 3 cath equivalents at end of the period