Answered step by step

Verified Expert Solution

Question

1 Approved Answer

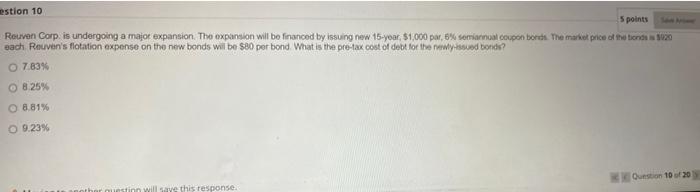

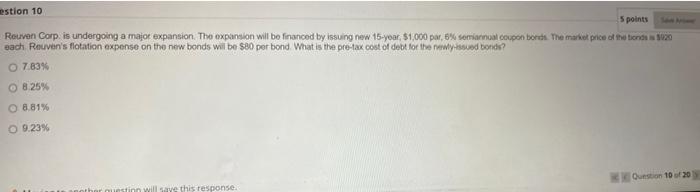

Urgent pleas help me solve these Urgent pleas help me solve these estion 10 5 points Reuven Corp. is undergoing a major expansion. The expansion

Urgent pleas help me solve these

Urgent pleas help me solve these

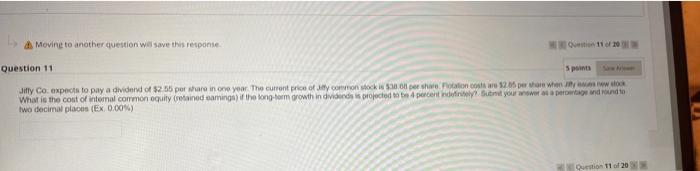

estion 10 5 points Reuven Corp. is undergoing a major expansion. The expansion will be financed by issuing new 15-year $1,000 par, 6% semiannual coupon bolets. The market price of the tienes each Rouven's flotation expense on the new bonds will be $80 per bond What is the pre-tax cost of debt for the wissued bonds? O 7 83% 8.25% 8.81% 9.23% Question 10 20 sinn will save this response. Movine to another question will save this response Question 11 5 points Jilly Co expect to pay a dividend of $255 per are in one year. The current price of a common stock 50 peshobition cost o 125 per here we woor What is the cost of internal common oquity retained caring the long-term growth individendesojected to the percent of your inspiroud to two decimal places (Ex. 0.00%) Question 11 of 20 Moving to another question will save this response 10 20 uestion 10 5 points Reuven Corp is undergoing a major expansion. The expansion will be financed by issuing new t5y 31.000 pw..con bonds Themet prende is 1923 each Rouvon's flotation expense on the new bonds will be 580 per bond What is the pre-tax cost of Sett for the newly issued bonds? O 7.63% O 8.2596 O 8.81% O 0.23% Question completion STATUS Moving to another question will save this response 120 estion 11 Spoints Jiffy Co expects to pay a dividend of $2.55 per share in one year. The current price of my common stock is $38.68 peshore Flotation costs are $2 pers when it was new What is the cost of internal common equity retained camings) at the long-term growth individonds is projected to be percentinde Submit your own percentage and round to two decimal places (Ex. 0.00%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started