Answered step by step

Verified Expert Solution

Question

1 Approved Answer

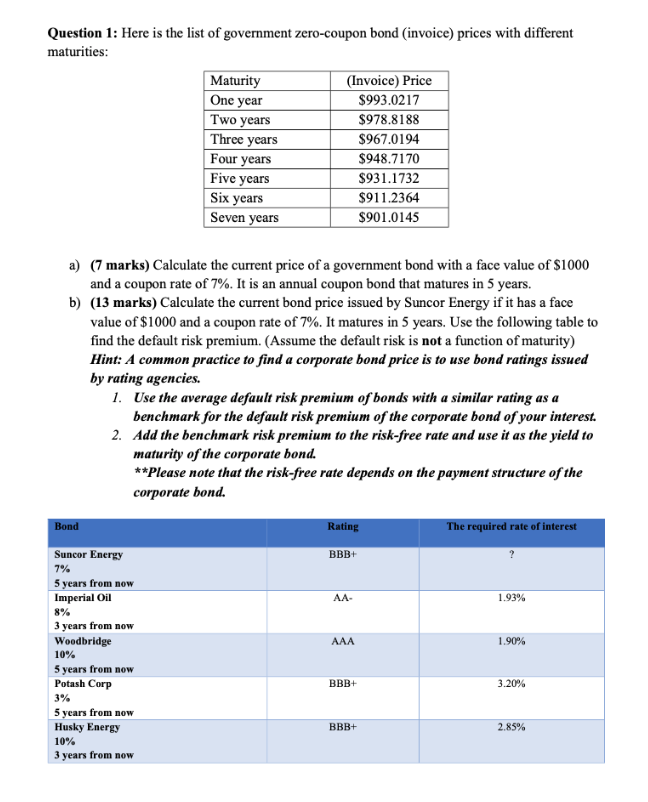

Urgent!!! Please answer, I will upvote. Answer only PART B, but if possible answer both. Thank you! Question 1: Here is the list of government

Urgent!!! Please answer, I will upvote.

Answer only PART B, but if possible answer both. Thank you!

Question 1: Here is the list of government zero-coupon bond invoice) prices with different maturities: Maturity (Invoice) Price One year $993.0217 Two years $978.8188 Three years $967.0194 Four years $948.7170 Five years $931.1732 Six years $911.2364 Seven years $901.0145 a) (7 marks) Calculate the current price of a government bond with a face value of $1000 and a coupon rate of 7%. It is an annual coupon bond that matures in 5 years. b) (13 marks) Calculate the current bond price issued by Suncor Energy if it has a face value of $1000 and a coupon rate of 7%. It matures in 5 years. Use the following table to find the default risk premium. (Assume the default risk is not a function of maturity) Hint: A common practice to find a corporate bond price is to use bond ratings issued by rating agencies. 1. Use the average default risk premium of bonds with a similar rating as a benchmark for the default risk premium of the corporate bond of your interest. 2. Add the benchmark risk premium to the risk-free rate and use it as the yield to maturity of the corporate bond. **Please note that the risk-free rate depends on the payment structure of the corporate bond. Bond Rating The required rate of interest BBB+ AA- 1.93% AAA 1.90% Suncor Energy 7% 5 years from now Imperial Oil 8% 3 years from now Woodbridge 10% 5 years from now Potash Corp 3% 5 years from now Husky Energy 10% 3 years from now BBB+ 3.20% BBB+ 2.85%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started