Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT: Please help A project under consideration costs $500,000, has a five-year life and has no salvage value. Depreciation is straight-line to zero. The firm

URGENT: Please help

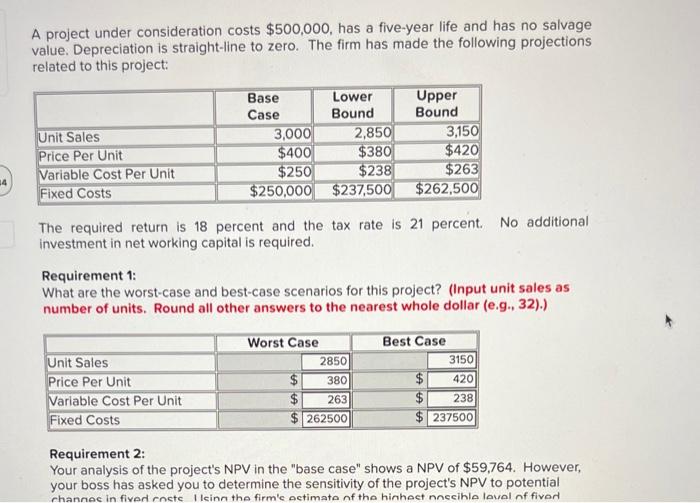

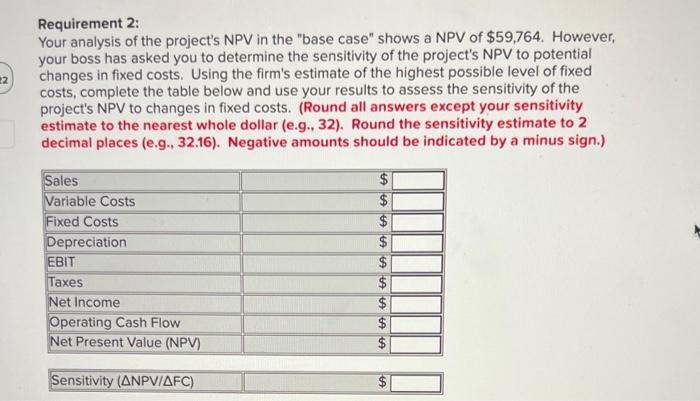

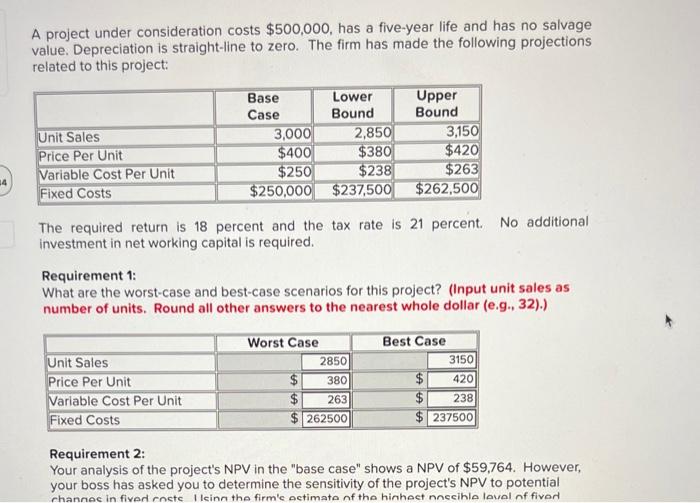

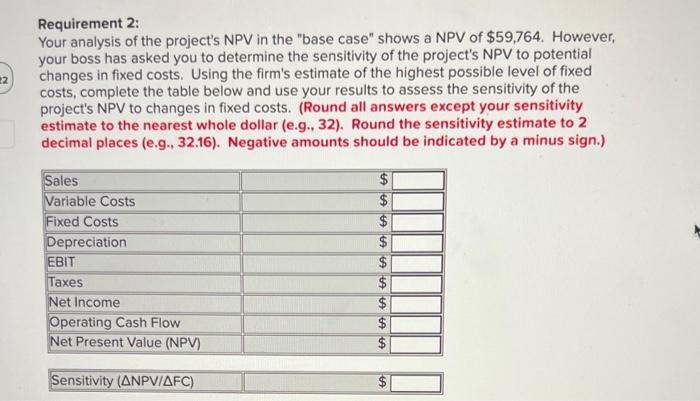

A project under consideration costs $500,000, has a five-year life and has no salvage value. Depreciation is straight-line to zero. The firm has made the following projections related to this project: The required return is 18 percent and the tax rate is 21 percent. No additional investment in net working capital is required. Requirement 1: What are the worst-case and best-case scenarios for this project? (Input unit sales as number of units. Round all other answers to the nearest whole dollar (e.g., 32).) Requirement 2: Your analysis of the project's NPV in the "base case" shows a NPV of $59,764. However, your boss has asked you to determine the sensitivity of the project's NPV to potential channec in fiver rocte Ileinn the firm'e setimate of the hinheet nnecihle laval nf fiver Requirement 2: Your analysis of the project's NPV in the "base case" shows a NPV of $59,764. However, your boss has asked you to determine the sensitivity of the project's NPV to potential changes in fixed costs. Using the firm's estimate of the highest possible level of fixed costs, complete the table below and use your results to assess the sensitivity of the project's NPV to changes in fixed costs. (Round all answers except your sensitivity estimate to the nearest whole dollar (e.g., 32). Round the sensitivity estimate to 2 decimal places (e.g., 32.16). Negative amounts should be indicated by a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started