Question

Urgent!! Please Help me!! Thank you! 1) Take the Starbucks balance sheet (2018) and calculate the % of each account to the total of that

Urgent!! Please Help me!!

Thank you!

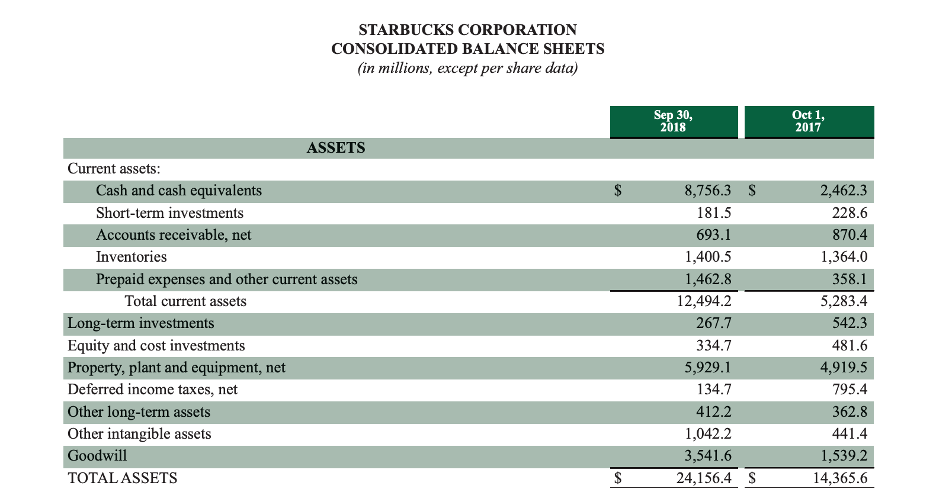

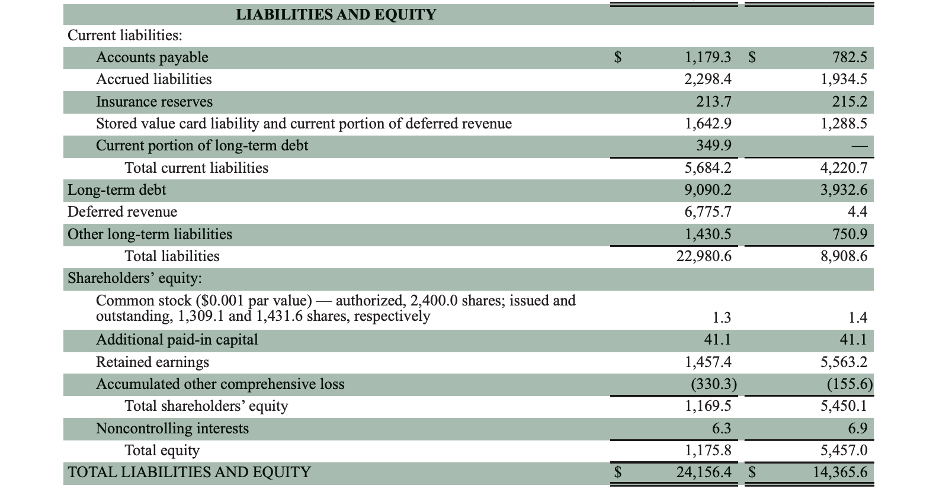

1) Take the Starbucks balance sheet (2018) and calculate the % of each account to the total of that section of the balance sheet (cash as a % of total assets, ST investments as a % of total assets......., then A/P as a % total of total liabilities, etc). Do this for all categories under assets, liability. Do not do the equity section. Perform the calculations in 2018 only.

2) What is the accounting equation for Starbucks as of 2017 and 2018? Write it out for both years providing the numbers.

Please Help!!!!

Thank you, so much!!

STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (in millions, except per share data) Sep 30, 2018 Oct 1, 2017 $ ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Long-term investments Equity and cost investments Property, plant and equipment, net Deferred income taxes, net Other long-term assets Other intangible assets Goodwill TOTAL ASSETS 8,756.3 S 181.5 693.1 1,400.5 1,462.8 12,494.2 267.7 334.7 5,929.1 134.7 412.2 1,042.2 3,541.6 24,156.4 S 2,462.3 228.6 870.4 1,364.0 358.1 5,283.4 542.3 481.6 4,919.5 795.4 362.8 441.4 1,539.2 14,365.6 $ 782.5 1,934.5 215.2 1,288.5 LIABILITIES AND EQUITY Current liabilities: Accounts payable Accrued liabilities Insurance reserves Stored value card liability and current portion of deferred revenue Current portion of long-term debt Total current liabilities Long-term debt Deferred revenue Other long-term liabilities Total liabilities Shareholders' equity: Common stock ($0.001 par value) authorized, 2,400.0 shares; issued and outstanding, 1,309.1 and 1,431.6 shares, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total shareholders' equity Noncontrolling interests Total equity TOTAL LIABILITIES AND EQUITY 1,179.3 S 2,298.4 213.7 1,642.9 349.9 5,684.2 9,090.2 6,775.7 1,430.5 22,980.6 4,220.7 3,932.6 4.4 750.9 8,908.6 1.3 41.1 1,457.4 (330.3) 1,169.5 6.3 1,175.8 24,156.4 S 1.4 41.1 5,563.2 (155.6) 5,450.1 6.9 5,457.0 14,365.6 $ STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (in millions, except per share data) Sep 30, 2018 Oct 1, 2017 $ ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Long-term investments Equity and cost investments Property, plant and equipment, net Deferred income taxes, net Other long-term assets Other intangible assets Goodwill TOTAL ASSETS 8,756.3 S 181.5 693.1 1,400.5 1,462.8 12,494.2 267.7 334.7 5,929.1 134.7 412.2 1,042.2 3,541.6 24,156.4 S 2,462.3 228.6 870.4 1,364.0 358.1 5,283.4 542.3 481.6 4,919.5 795.4 362.8 441.4 1,539.2 14,365.6 $ 782.5 1,934.5 215.2 1,288.5 LIABILITIES AND EQUITY Current liabilities: Accounts payable Accrued liabilities Insurance reserves Stored value card liability and current portion of deferred revenue Current portion of long-term debt Total current liabilities Long-term debt Deferred revenue Other long-term liabilities Total liabilities Shareholders' equity: Common stock ($0.001 par value) authorized, 2,400.0 shares; issued and outstanding, 1,309.1 and 1,431.6 shares, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total shareholders' equity Noncontrolling interests Total equity TOTAL LIABILITIES AND EQUITY 1,179.3 S 2,298.4 213.7 1,642.9 349.9 5,684.2 9,090.2 6,775.7 1,430.5 22,980.6 4,220.7 3,932.6 4.4 750.9 8,908.6 1.3 41.1 1,457.4 (330.3) 1,169.5 6.3 1,175.8 24,156.4 S 1.4 41.1 5,563.2 (155.6) 5,450.1 6.9 5,457.0 14,365.6 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started