urgent please

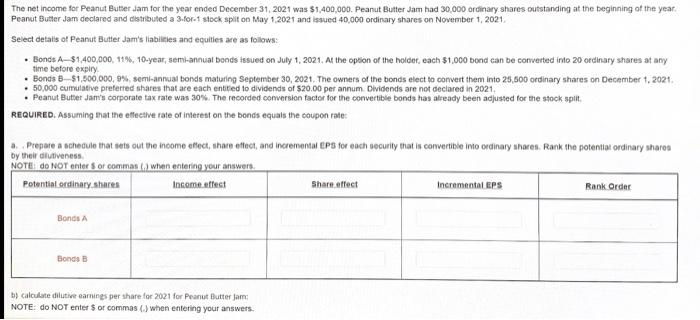

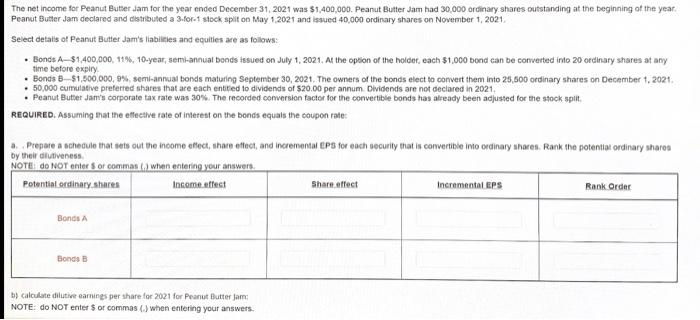

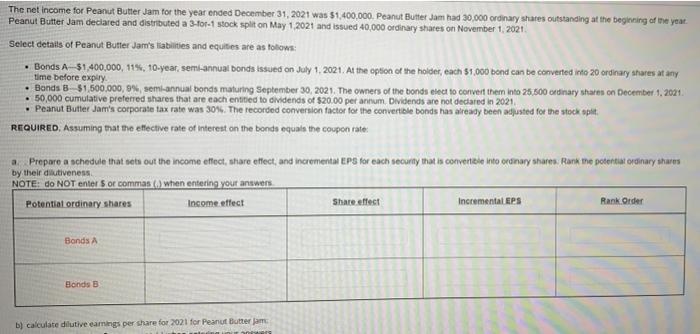

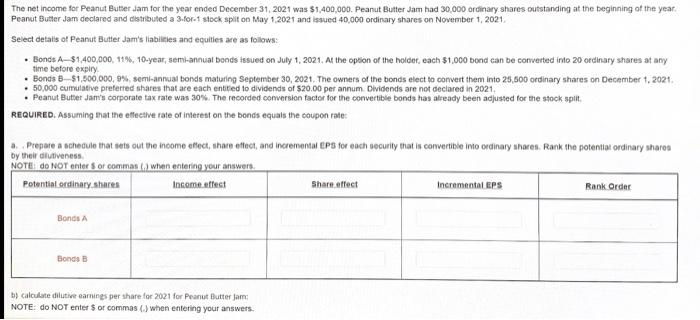

The net income for Peanut Butter Jam for the year ended December 31, 2021 was $1,400,000. Peanut Butter Jam had 30,000 ordinary shares outstanding at the beginning of the year Peanut Butter Jam declared and distributed a 3-for-1 stock split on May 1,2021 and issued 40,000 ordinary shares on November 1, 2021 Select details of Peanut Butter Jam's liabilities and equities are as follows: Bonds A $1,400,000, 119, 10-year, semi-annual bonds issued on July 1, 2021. At the option of the holder, each $1,000 bond can be converted imo 20 ordinary shares at any time before expiry Bonds B_S1.500.000,9% semi-annual bonds maturing September 30, 2021. The owners of the bonds elect to convert them into 25,600 ordinary shares on December 1, 2024 Peanut Butter Jam's corporate tax rate was 30%. The recorded conversion factor for the convertible bonds has already been adjusted for the stock spilt REQUIRED. Assuming that the effective rate of interest on the bonds equals the coupon rate: Prepare a schedule that sets out the income effect, share effect, and incremental EPS for each security that is convertible into ordinary shares. Rank the potential ordinary sharos by their dutiveness NOTE do NOT enters or comman when entering your answers Potential ordinary shares Income effect Share effect Incremental EPS Bank Order Bonds Bonds B b) calculate dilutive earnings per share for 2021 for Peanut Butter jam NOTE: do NOT enter $ or commas () when entering your answers. The net income for Peanut Butter Jam for the year ended December 31, 2021 was 51,400,000. Peanut Butter Jam had 30.000 ordinary shares outstanding at the beginning of the you. Peanut Butter Jam declared and distributed a 3-for-1 stock split on May 1,2021 and issued 40,000 ordinary shares on November 1, 2021 Select details of Peanut Butter Jara's liabilities and equities are as follows: . Bonds A $1,400,000, 119, 10-year, semi-annual bonds issued on July 1, 2021 At the option of the holder, each $1,000 bond can be converted into 20 ordinary shares at any Bands B $1.500.000,9%, semi-annual bonds maturing September 30, 2021. The owners of the bonds elect to convert them into 25.500 ordinary share on December 1, 2021 Peanut Butter Jam's corporate tax rate was 30%. The recorded conversion factor for the convertible bonds has already been adjusted for the stock spilt REQUIRED, Assuming that the effective rate of interest on the bonds equals the coupon rate: a Prepare a schedule that sets out the income effect, share effect, and incremental EPS for each security that is convertible into ordinary shares. Rank me potential ordinary shares by their dutiveness NOTE: do NOT enters or commas () when entering your answers Potential ordinary shares Income ettect Share effect Incremental EPS Rank Order Bonds A Bonds B b) calculate dilutive earnings per chare for 2021 for Peanut Butter om