Answered step by step

Verified Expert Solution

Question

1 Approved Answer

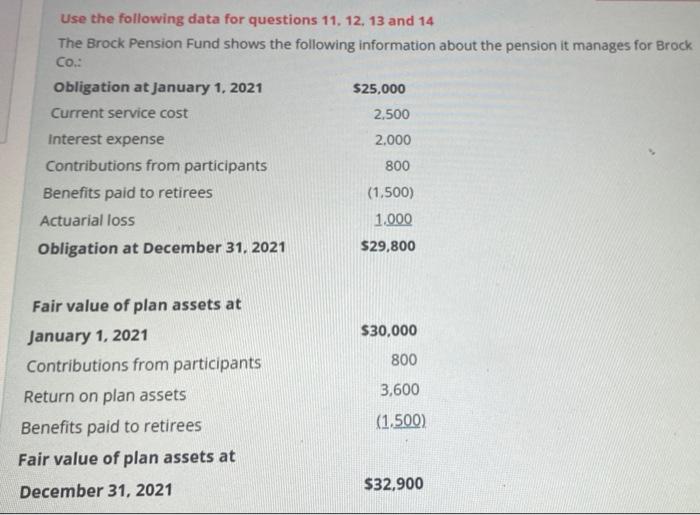

urgent please Use the following data for questions 11, 12, 13 and 14 The Brock Pension Fund shows the following information about the pension it

urgent please

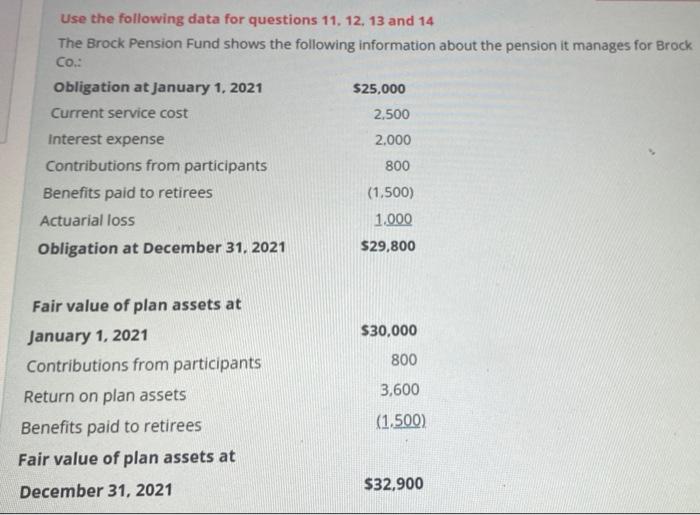

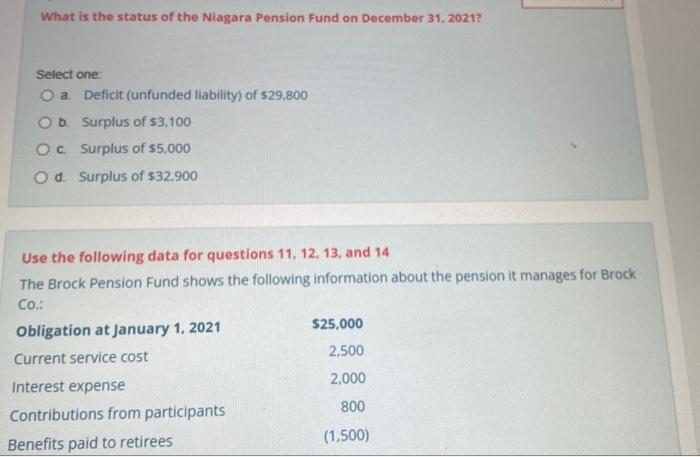

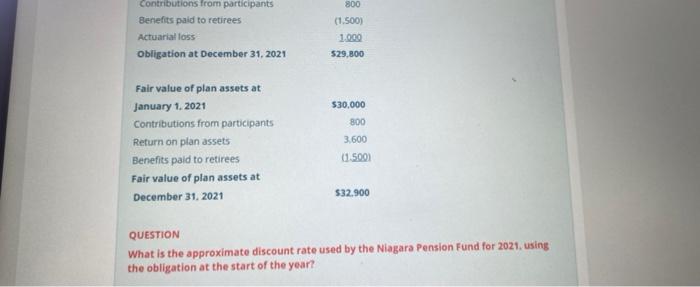

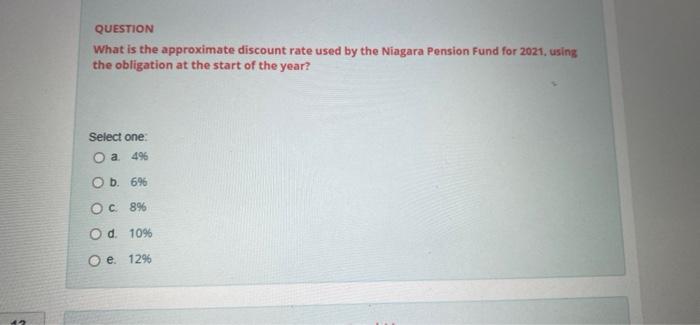

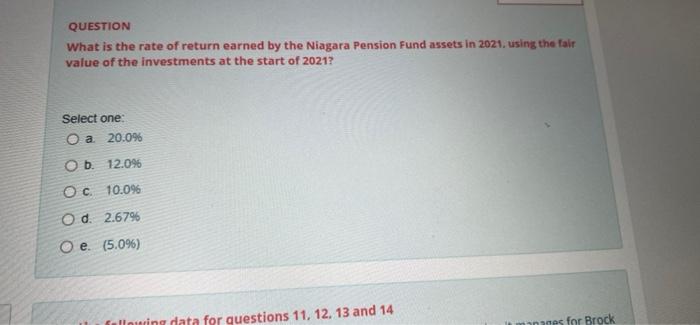

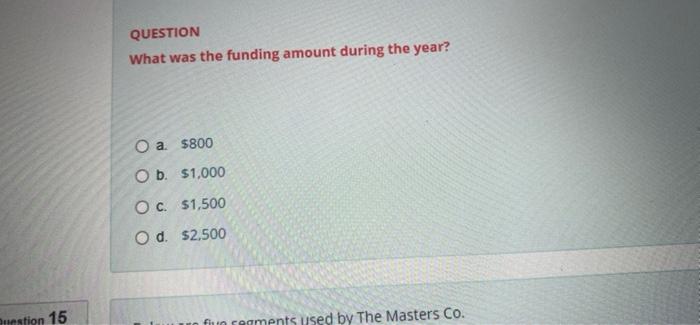

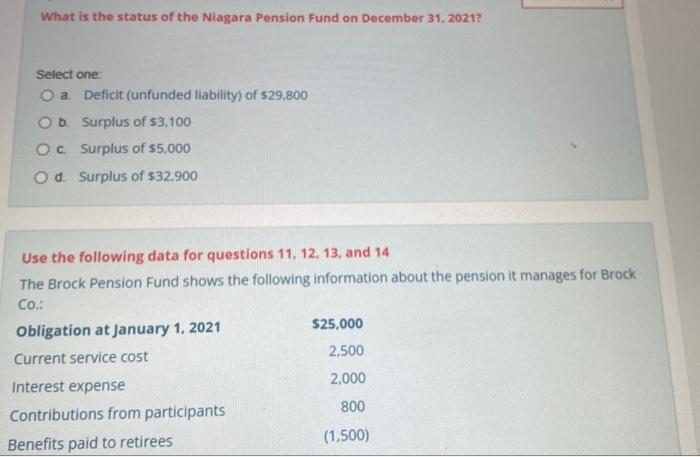

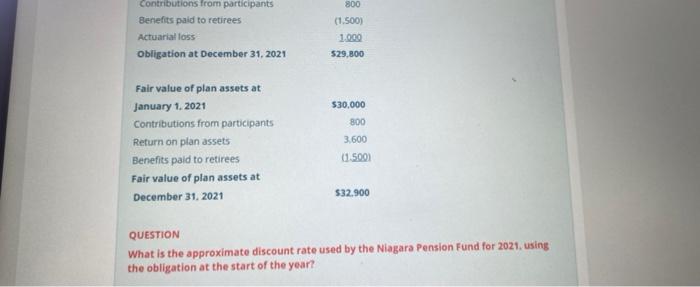

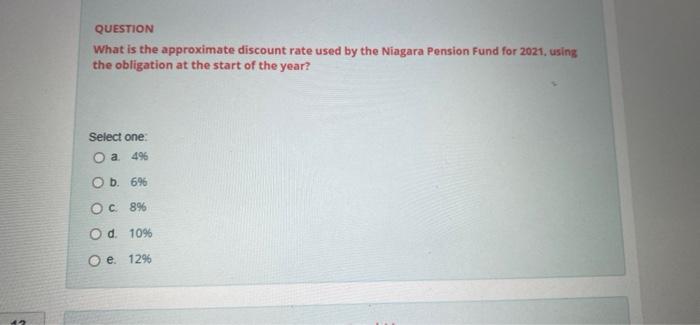

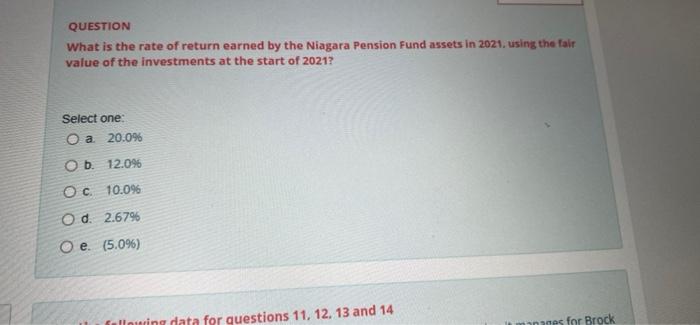

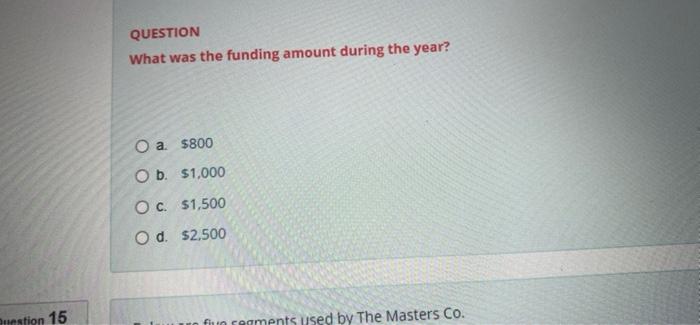

Use the following data for questions 11, 12, 13 and 14 The Brock Pension Fund shows the following information about the pension it manages for Brock Co.: Obligation at January 1, 2021 $25,000 Current service cost 2.500 Interest expense 2.000 Contributions from participants 800 Benefits paid to retirees (1.500) Actuarial loss 1.000 Obligation at December 31, 2021 $29,800 $30,000 800 3,600 Fair value of plan assets at January 1, 2021 Contributions from participants Return on plan assets Benefits paid to retirees Fair value of plan assets at December 31, 2021 (1.500) $32,900 What is the status of the Niagara Pension Fund on December 31, 2021? Select one: O a Deficit (unfunded liability of $29,800 OD. Surplus of $3.100 Oc Surplus of $5,000 Od Surplus of $32.900 Use the following data for questions 11, 12, 13, and 14 The Brock Pension Fund shows the following information about the pension it manages for Brock Co.: Obligation at January 1, 2021 $25,000 Current service cost 2.500 Interest expense 2,000 Contributions from participants 800 Benefits paid to retirees (1,500) contributions from participants Benefits paid to retirees Actuarial loss obligation at December 31, 2021 800 (1.500) 1.000 529,800 $30,000 800 Fair value of plan assets at January 1, 2021 Contributions from participants Return on plan assets Benefits paid to retirees Fair value of plan assets at December 31, 2021 3.600 015001 $32.900 QUESTION What is the approximate discount rate used by the Niagara Pension Fund for 2021, using the obligation at the start of the year? QUESTION What is the approximate discount rate used by the Niagara Pension Fund for 2021, using the obligation at the start of the year? Select one O a 496 O b. 696 Oc8% Od 10% O e1296 2 QUESTION What is the rate of return earned by the Niagara Pension Fund assets in 2021, using the fair value of the investments at the start of 2021? Select one: O a 20.09 Ob 12.096 Oc. 10.09 Od 2.6796 O e. (5.0%) following data for questions 11, 12, 13 and 14 for Brock : QUESTION What was the funding amount during the year? O a $800 O b. $1,000 O c. $1,500 O d. $2.500 Question 15 fun reaments used by The Masters Co

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started