Urgent

Please use the link below to access and complete the questions. For questions not requiring calculations, please type here or in the new spreadsheet. I will finalize it later. Ignore question 1. Mostly need help on question 2-5.

Group questions 2 and 3 are provided in the spreadsheet.

https://drive.google.com/file/d/1UAN0RtCpRiTdStUVNue-RtNj5cTVPISC/view?usp=sharing

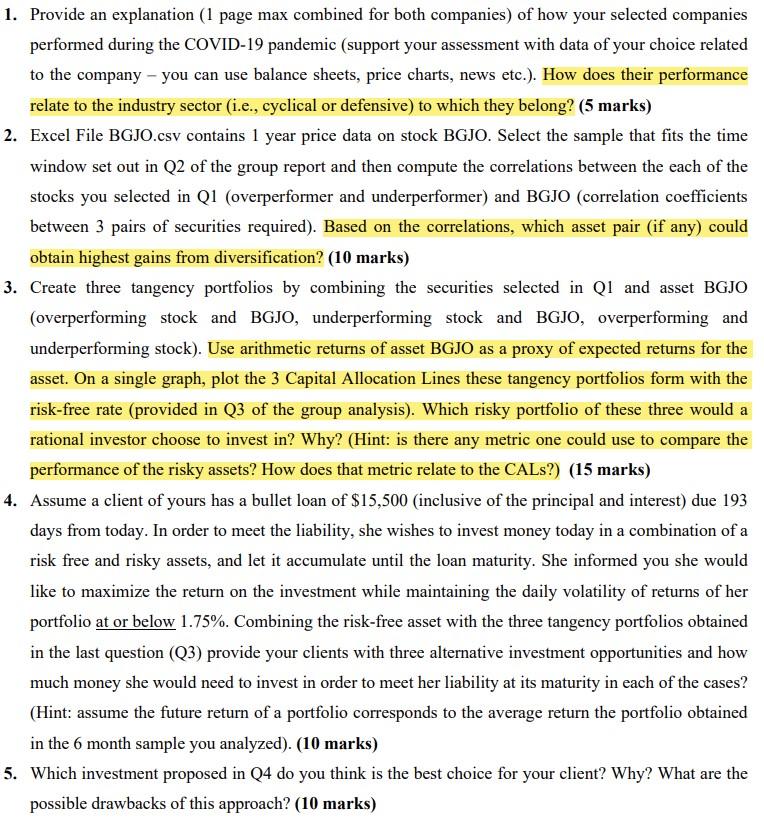

1. Provide an explanation (1 page max combined for both companies) of how your selected companies performed during the COVID-19 pandemic (support your assessment with data of your choice related to the company - you can use balance sheets, price charts, news etc.). How does their performance relate to the industry sector (i.e., cyclical or defensive) to which they belong? (5 marks) 2. Excel File BGJO.csv contains 1 year price data on stock BGJO. Select the sample that fits the time window set out in Q2 of the group report and then compute the correlations between the each of the stocks you selected in Q1 (overperformer and underperformer) and BGJO (correlation coefficients between 3 pairs of securities required). Based on the correlations, which asset pair (if any) could obtain highest gains from diversification? (10 marks) 3. Create three tangency portfolios by combining the securities selected in QI and asset BGJO (overperforming stock and BGJO, underperforming stock and BGJO, overperforming and underperforming stock). Use arithmetic returns of asset BGJO as a proxy of expected returns for the asset. On a single graph, plot the 3 Capital Allocation Lines these tangency portfolios form with the risk-free rate (provided in Q3 of the group analysis). Which risky portfolio of these three would a rational investor choose to invest in? Why? (Hint: is there any metric one could use to compare the performance of the risky assets? How does that metric relate to the CALs?) (15 marks) 4. Assume a client of yours has a bullet loan of $15,500 (inclusive of the principal and interest) due 193 days from today. In order to meet the liability, she wishes to invest money today in a combination of a risk free and risky assets, and let it accumulate until the loan maturity. She informed you she would like to maximize the return on the investment while maintaining the daily volatility of returns of her portfolio at or below 1.75%. Combining the risk-free asset with the three tangency portfolios obtained in the last question (Q3) provide your clients with three alternative investment opportunities and how much money she would need to invest in order to meet her liability at its maturity in each of the cases? (Hint: assume the future return of a portfolio corresponds to the average return the portfolio obtained in the 6 month sample you analyzed) (10 marks) 5. Which investment proposed in Q4 do you think is the best choice for your client? Why? What are the possible drawbacks of this approach? (10 marks) 1. Provide an explanation (1 page max combined for both companies) of how your selected companies performed during the COVID-19 pandemic (support your assessment with data of your choice related to the company - you can use balance sheets, price charts, news etc.). How does their performance relate to the industry sector (i.e., cyclical or defensive) to which they belong? (5 marks) 2. Excel File BGJO.csv contains 1 year price data on stock BGJO. Select the sample that fits the time window set out in Q2 of the group report and then compute the correlations between the each of the stocks you selected in Q1 (overperformer and underperformer) and BGJO (correlation coefficients between 3 pairs of securities required). Based on the correlations, which asset pair (if any) could obtain highest gains from diversification? (10 marks) 3. Create three tangency portfolios by combining the securities selected in QI and asset BGJO (overperforming stock and BGJO, underperforming stock and BGJO, overperforming and underperforming stock). Use arithmetic returns of asset BGJO as a proxy of expected returns for the asset. On a single graph, plot the 3 Capital Allocation Lines these tangency portfolios form with the risk-free rate (provided in Q3 of the group analysis). Which risky portfolio of these three would a rational investor choose to invest in? Why? (Hint: is there any metric one could use to compare the performance of the risky assets? How does that metric relate to the CALs?) (15 marks) 4. Assume a client of yours has a bullet loan of $15,500 (inclusive of the principal and interest) due 193 days from today. In order to meet the liability, she wishes to invest money today in a combination of a risk free and risky assets, and let it accumulate until the loan maturity. She informed you she would like to maximize the return on the investment while maintaining the daily volatility of returns of her portfolio at or below 1.75%. Combining the risk-free asset with the three tangency portfolios obtained in the last question (Q3) provide your clients with three alternative investment opportunities and how much money she would need to invest in order to meet her liability at its maturity in each of the cases? (Hint: assume the future return of a portfolio corresponds to the average return the portfolio obtained in the 6 month sample you analyzed) (10 marks) 5. Which investment proposed in Q4 do you think is the best choice for your client? Why? What are the possible drawbacks of this approach? (10 marks)