Answered step by step

Verified Expert Solution

Question

1 Approved Answer

urgent Question 3 An investor is considering the purchase of an option-free corporate bond with an annual coupon rate of 7.25 percent (paid semiannually) and

urgent

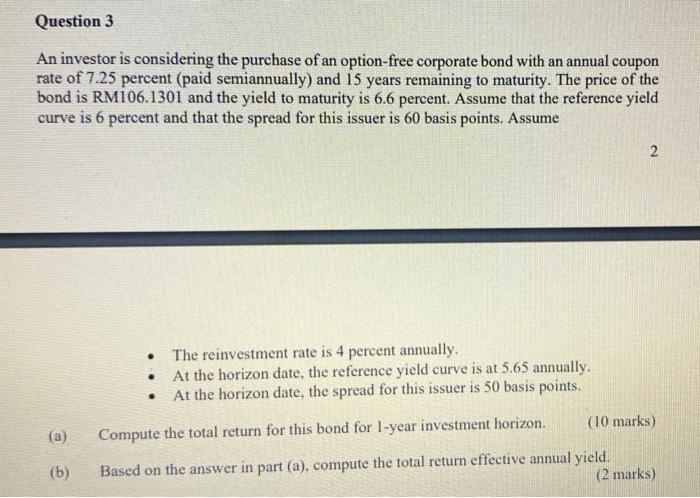

Question 3 An investor is considering the purchase of an option-free corporate bond with an annual coupon rate of 7.25 percent (paid semiannually) and 15 years remaining to maturity. The price of the bond is RM106.1301 and the yield to maturity is 6.6 percent. Assume that the reference yield curve is 6 percent and that the spread for this issuer is 60 basis points. Assume 2 . The reinvestment rate is 4 percent annually. At the horizon date, the reference yield curve is at 5.65 annually. At the horizon date, the spread for this issuer is 50 basis points. (10 marks) (a) Compute the total return for this bond for 1-year investment horizon. (b) Based on the answer in part (a), compute the total return effective annual yield. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started