Answered step by step

Verified Expert Solution

Question

1 Approved Answer

urgent uk taxation HUGH THOMAS Hugh Thomas is employed by Com-Tech plc as a computer programmer- Hugh has tried to prepare his own income tax

urgent

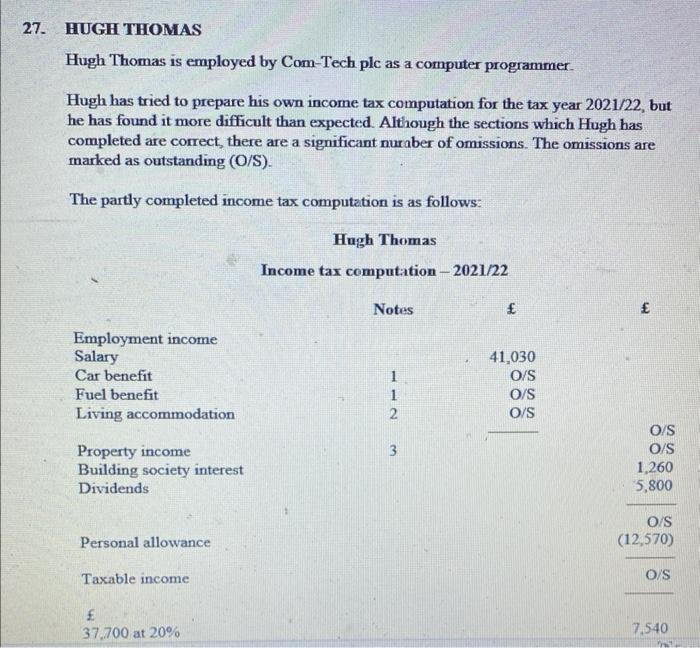

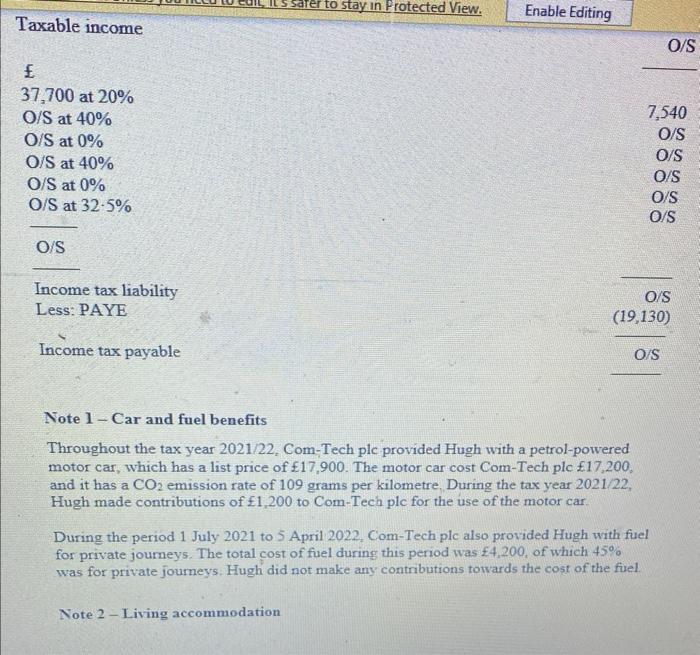

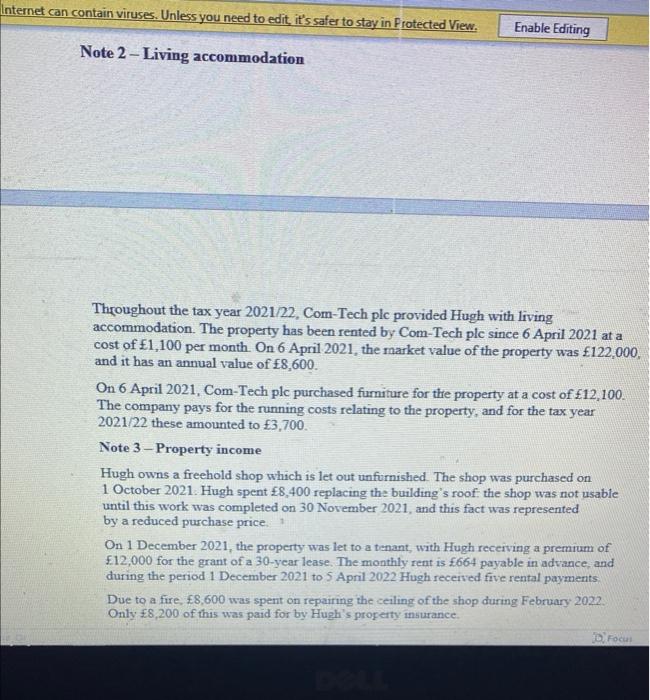

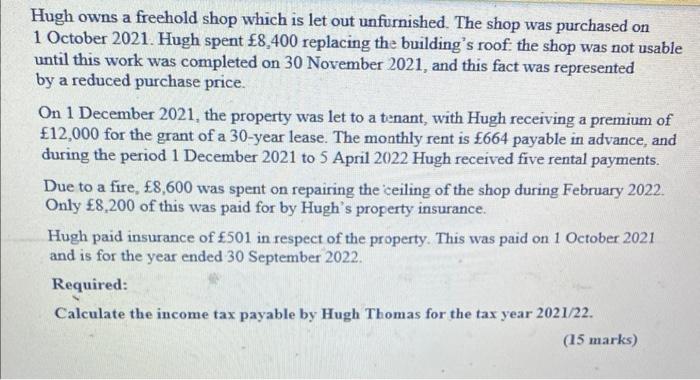

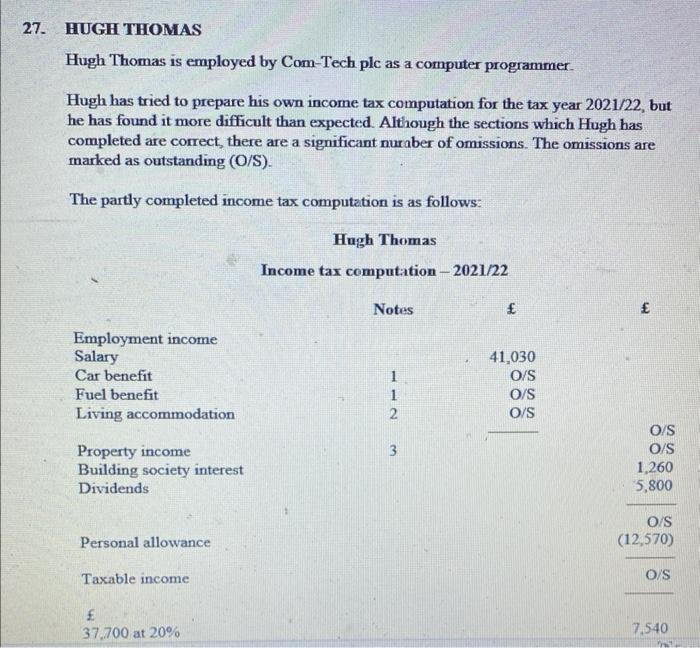

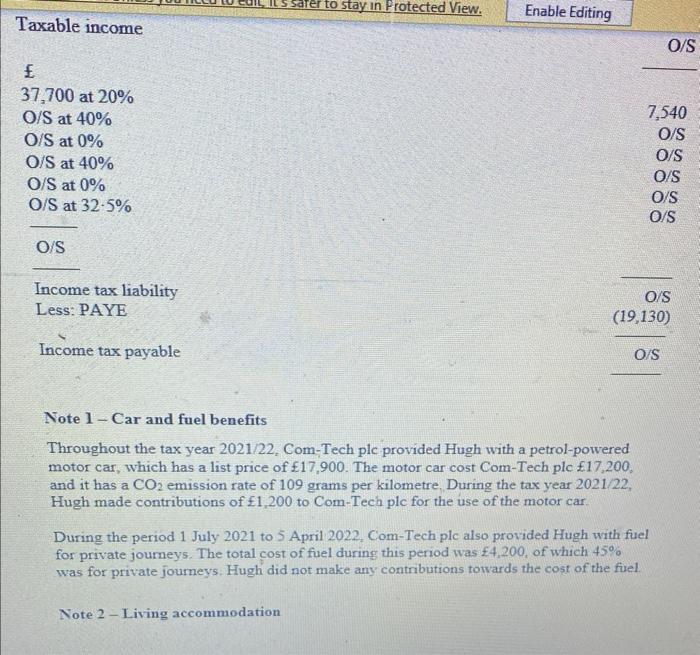

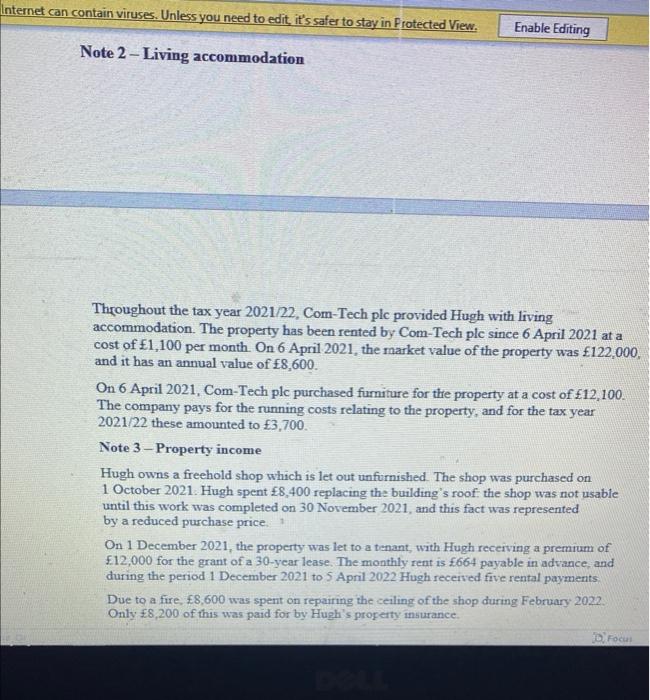

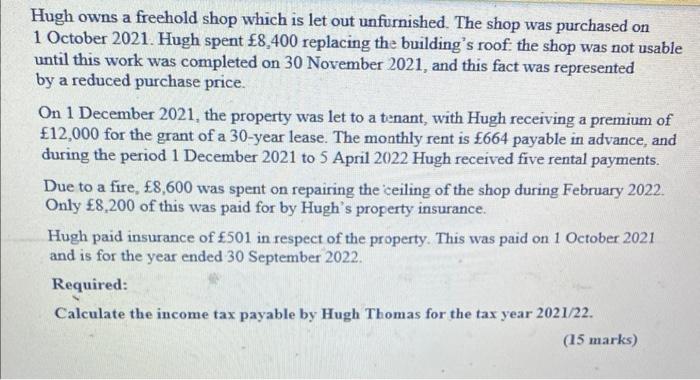

HUGH THOMAS Hugh Thomas is employed by Com-Tech plc as a computer programmer- Hugh has tried to prepare his own income tax computation for the tax year 2021/22, but he has found it more difficult than expected. Although the sections which Hugh has completed are correct, there are a significant nuraber of omissions. The omissions are marked as outstanding (O/S). The partly completed income tax computation is as follows: Note 1 - Car and fuel benefits Throughout the tax year 2021/22, Com-Tech plc provided Hugh with a petrol-powered motor car, which has a list price of 17,900. The motor car cost Com-Tech plc 17,200, and it has a CO2 emission rate of 109 grams per kilometre, During the tax year 2021/22, Hugh made contributions of 1,200 to Com-Tech plc for the use of the motor car. During the period 1 July 2021 to 5 April 2022, Com-Tech ple also provided Hugh with fuel for private journeys. The total cost of fuel during this period was 4,200, of which 45% was for private journeys. Hugh did not make any contributions towards the cost of the fuel. Note 2 - Living accommodation Note 2-Living accommodation Throughout the tax year 2021/22, Com-Tech plc provided Hugh with living accommodation. The property has been rented by Com-Tech ple since 6 April 2021 at a cost of 1,100 per month. On 6 April 2021 , the market value of the property was 122,000, and it has an annual value of 8,600. On 6 April 2021, Com-Tech ple purchased furniture for the property at a cost of 12,100. The company pays for the running costs relating to the property, and for the tax year 2021/22 these amounted to 3,700. Note 3 -Property income Hugh owns a freehold shop which is let out unfurnished. The shop was purchased on 1 October 2021. Hugh spent 8,400 replacing the building's roof: the shop was not usable until this work was completed on 30 November 2021 , and this fact was represented by a reduced purchase price. On 1 December 2021 , the property was let to a tenant, with Hugh receiving a premium of 12,000 for the grant of a 30 -year lease. The monthly rent is 664 payable in advance, and during the period 1 December 2021 to 5 April 2022 Hugh recerved five rental payments: Due to a fire, 8,600 was spent on repairing the ceiling of the shop during February 2022 . Only 8,200 of this was paid for by Hugh's property insurance. Hugh owns a freehold shop which is let out unfurnished. The shop was purchased on 1 October 2021 . Hugh spent 8,400 replacing the building's roof the shop was not usable until this work was completed on 30 November 2021 , and this fact was represented by a reduced purchase price. On 1 December 2021 , the property was let to a tenant, with Hugh receiving a premium of 12,000 for the grant of a 30 -year lease. The monthly rent is 664 payable in advance, and during the period 1 December 2021 to 5 April 2022 Hugh received five rental payments. Due to a fire, 8,600 was spent on repairing the ceiling of the shop during February 2022. Only 8,200 of this was paid for by Hugh's property insurance. Hugh paid insurance of 501 in respect of the property. This was paid on 1 October 2021 and is for the year ended 30 September 2022. Required: Calculate the income tax payable by Hugh Thomas for the tax year 2021/22. (15 marks) HUGH THOMAS Hugh Thomas is employed by Com-Tech plc as a computer programmer- Hugh has tried to prepare his own income tax computation for the tax year 2021/22, but he has found it more difficult than expected. Although the sections which Hugh has completed are correct, there are a significant nuraber of omissions. The omissions are marked as outstanding (O/S). The partly completed income tax computation is as follows: Note 1 - Car and fuel benefits Throughout the tax year 2021/22, Com-Tech plc provided Hugh with a petrol-powered motor car, which has a list price of 17,900. The motor car cost Com-Tech plc 17,200, and it has a CO2 emission rate of 109 grams per kilometre, During the tax year 2021/22, Hugh made contributions of 1,200 to Com-Tech plc for the use of the motor car. During the period 1 July 2021 to 5 April 2022, Com-Tech ple also provided Hugh with fuel for private journeys. The total cost of fuel during this period was 4,200, of which 45% was for private journeys. Hugh did not make any contributions towards the cost of the fuel. Note 2 - Living accommodation Note 2-Living accommodation Throughout the tax year 2021/22, Com-Tech plc provided Hugh with living accommodation. The property has been rented by Com-Tech ple since 6 April 2021 at a cost of 1,100 per month. On 6 April 2021 , the market value of the property was 122,000, and it has an annual value of 8,600. On 6 April 2021, Com-Tech ple purchased furniture for the property at a cost of 12,100. The company pays for the running costs relating to the property, and for the tax year 2021/22 these amounted to 3,700. Note 3 -Property income Hugh owns a freehold shop which is let out unfurnished. The shop was purchased on 1 October 2021. Hugh spent 8,400 replacing the building's roof: the shop was not usable until this work was completed on 30 November 2021 , and this fact was represented by a reduced purchase price. On 1 December 2021 , the property was let to a tenant, with Hugh receiving a premium of 12,000 for the grant of a 30 -year lease. The monthly rent is 664 payable in advance, and during the period 1 December 2021 to 5 April 2022 Hugh recerved five rental payments: Due to a fire, 8,600 was spent on repairing the ceiling of the shop during February 2022 . Only 8,200 of this was paid for by Hugh's property insurance. Hugh owns a freehold shop which is let out unfurnished. The shop was purchased on 1 October 2021 . Hugh spent 8,400 replacing the building's roof the shop was not usable until this work was completed on 30 November 2021 , and this fact was represented by a reduced purchase price. On 1 December 2021 , the property was let to a tenant, with Hugh receiving a premium of 12,000 for the grant of a 30 -year lease. The monthly rent is 664 payable in advance, and during the period 1 December 2021 to 5 April 2022 Hugh received five rental payments. Due to a fire, 8,600 was spent on repairing the ceiling of the shop during February 2022. Only 8,200 of this was paid for by Hugh's property insurance. Hugh paid insurance of 501 in respect of the property. This was paid on 1 October 2021 and is for the year ended 30 September 2022. Required: Calculate the income tax payable by Hugh Thomas for the tax year 2021/22. (15 marks) uk taxation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started