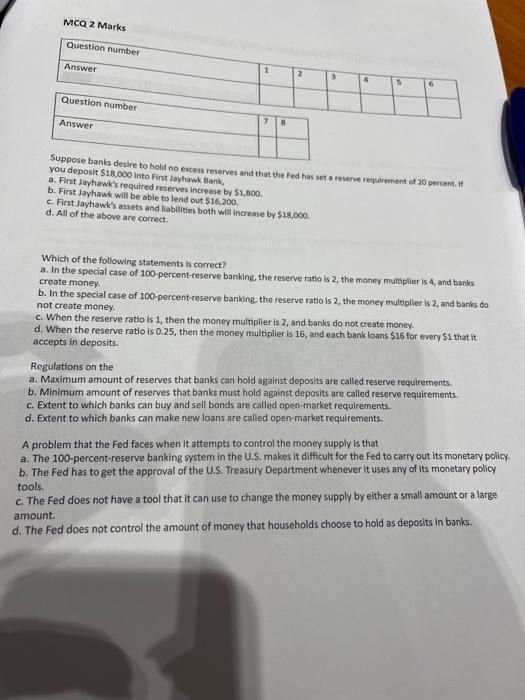

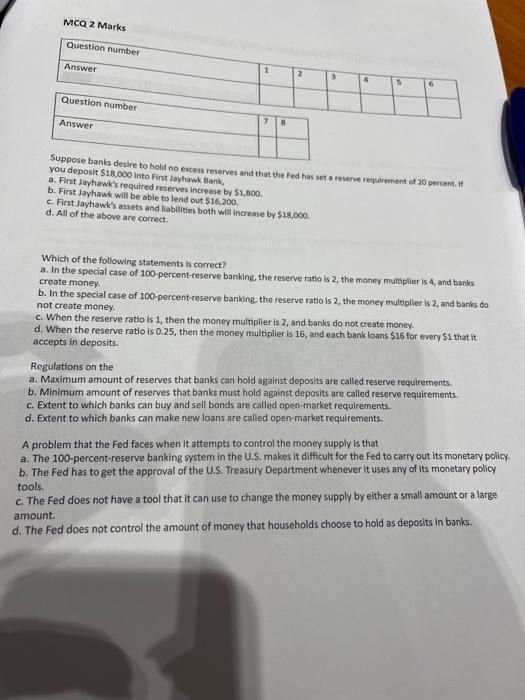

URGENT

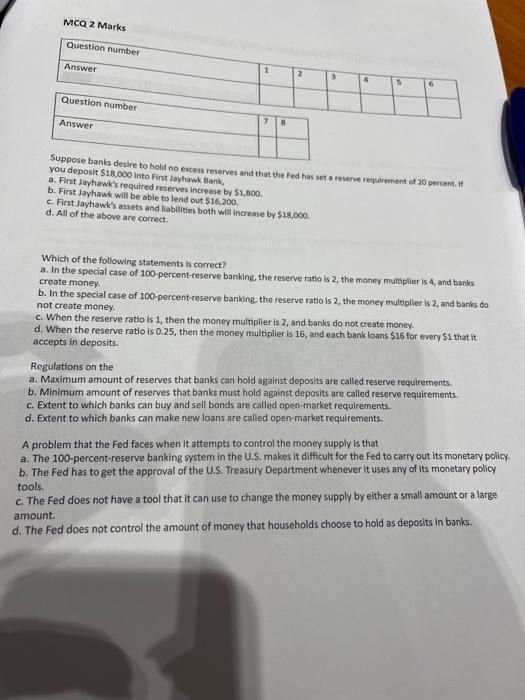

you deposit $18,000 to hold no excess reserves and that the Fed has set a reserve requirement of 20 percent. If a. First Jayhawk, $1800 into First Jayhawk Bank. b. First Jay hawk's required reserves increase by $1,800. c. First Jayhawk will be able to lend out $16,200. d. All of the ask's assets and liabilities both will increase by $18,000. d. All of the above are correct. Which of the following statements is correct? a. In the special case of 100 -percent-reserve banking, the reserve ratio is 2 , the money multiplier is 4 , and banks create money. b. In the special case of 100-percent-reserve banking, the reserve ratio is 2, the money multiplier is 2 , and banks do not create money. c. When the reserve ratio is 1 , then the money multiplier is 2 , and banks do not create money. d. When the reserve ratio is 0.25 , then the money multiplier is 16 , and each bank loans $16 for every $1 that it accepts in deposits. Regulations on the a. Maximum amount of reserves that banks can hold against deposits are called reserve requirements. b. Minimum amount of reserves that banks must hold against deposits are called reserve requirements. c. Extent to which banks can buy and sell bonds are called open-market requirements. d. Extent to which banks can make new loans are called open-market requirements. A problem that the Fed faces when it attempts to control the money supply is that a. The 100-percent-reserve banking system in the U.S. makes it difficult for the Fed to carry out its monetary policy. b. The Fed has to get the approval of the U.S. Treasury Department whenever it uses any of its monetary policy tools. c. The Fed does not have a tool that it can use to change the money supply by elther a small amount or a large amount. d. The Fed does not control the amount of money that households choose to hold as deposits in banks. If the reserve ratio is 25 percent, then $11,200 of money can be generated by a. $128 of new reserves. c. $1,400 of new reserves. d. $1,600 of new reserves. If the reserve ratio is 8 percent, then $162,500 of new money can be generated by a. $650 of new reserves. b. $6,500 of new reserves. c. $40,625 of new reserves. d. $4,062,500 of new reserves. The manager of the bank where you work tells you that your bank has $10 million in excess reserves. She atso tells you that the bank has $600 million in deposits and $510 million dollars in loans. Given this informaston, you tind that the reserve requirement must be a. 100/510. b. 80/510. c. 100/600. d. 80/600. Suppose the banking system currently has $600 billion in reserves; the reserve requirement is 20 percent; and excess reserves amount to $6 billion. What is the level of deposits? a. $6,600 billion b. $5,940 billion c. $5,400 billion d. $5,346 billion