Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Urgently needed. Thank you so much ! The amendment for the unclear parts: The year end dividend is 16000 The Carmen Group's owners' equity at

Urgently needed. Thank you so much !

The amendment for the unclear parts:

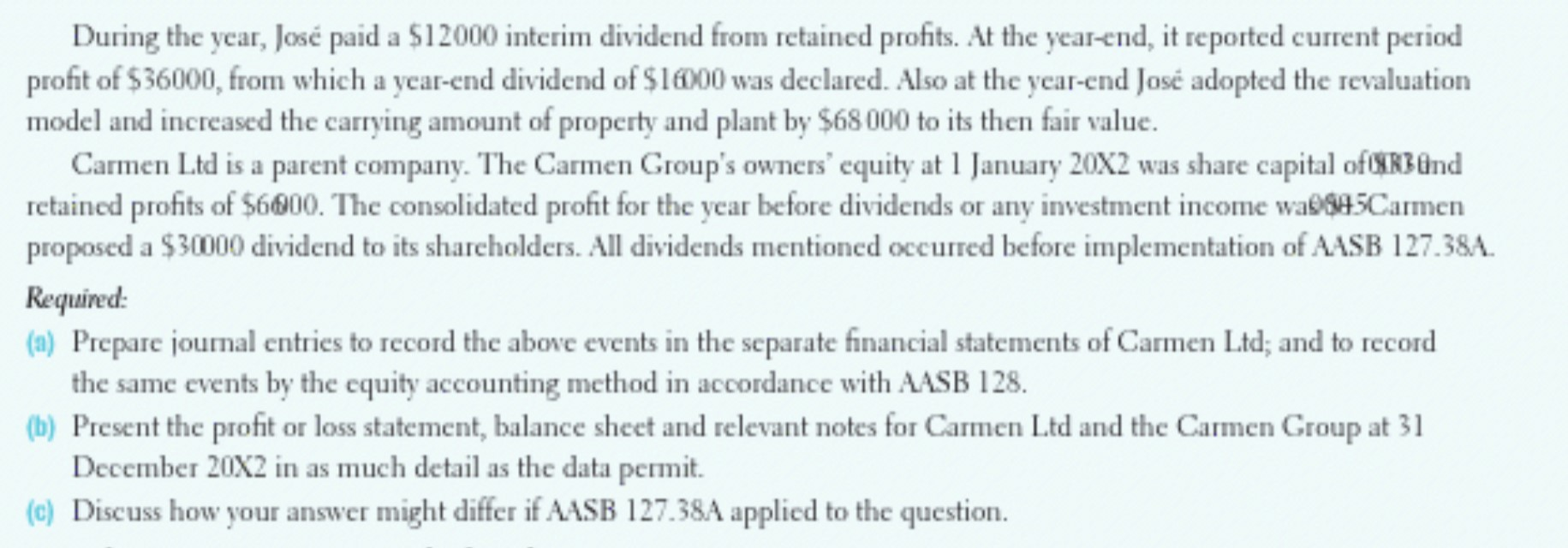

The year end dividend is 16000

The Carmen Group's owners' equity at 1 January 20X2 was share capital of 83000 And retained profits of $6000

The consolidated profit for the year before dividends or any investment income was $45000 Carmen proposed a $30000 dividend to its shareholders.

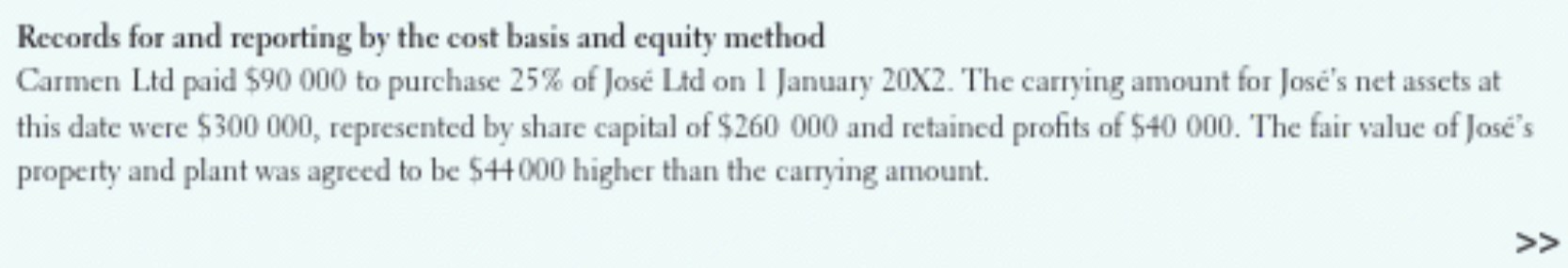

Records for and reporting by the cost basis and equity method Carmen Ltd paid $90 000 to purchase 25% of Jose Ltd on 1 January 20X2. The carrying amount for Jose's net assets at this date were $300 000, represented by share capital of $260 000 and retained profits of $40 000. The fair value of Jose's property and plant was agreed to be $44000 higher than the carrying amount. >> During the year, Jos paid a $12000 interim dividend from retained profits. At the year-end, it reported current period profit of $36000, from which a year-end dividend of $16000 was declared. Also at the year-end Jos adopted the revaluation model and increased the carrying amount of property and plant by $68000 to its then fair value. Carmen Ltd is a parent company. The Carmen Group's owners' equity at 1 January 20X2 was share capital of 83 And retained profits of $6000. The consolidated profit for the year before dividends or any investment income wa $45Carmen proposed a $30000 dividend to its shareholders. All dividends mentioned occurred before implementation of AASB 127.38A. Required: (a) Prepare journal entries to record the above events in the separate financial statements of Carmen Ltd; and to record the same events by the equity accounting method in accordance with AASB 128. (b) Present the profit or loss statement, balance sheet and relevant notes for Carmen Ltd and the Carmen Group at 31 December 20X2 in as much detail as the data permit. (c) Discuss how your answer might differ if AASB 127.38A applied to the question. Records for and reporting by the cost basis and equity method Carmen Ltd paid $90 000 to purchase 25% of Jose Ltd on 1 January 20X2. The carrying amount for Jose's net assets at this date were $300 000, represented by share capital of $260 000 and retained profits of $40 000. The fair value of Jose's property and plant was agreed to be $44000 higher than the carrying amount. >> During the year, Jos paid a $12000 interim dividend from retained profits. At the year-end, it reported current period profit of $36000, from which a year-end dividend of $16000 was declared. Also at the year-end Jos adopted the revaluation model and increased the carrying amount of property and plant by $68000 to its then fair value. Carmen Ltd is a parent company. The Carmen Group's owners' equity at 1 January 20X2 was share capital of 83 And retained profits of $6000. The consolidated profit for the year before dividends or any investment income wa $45Carmen proposed a $30000 dividend to its shareholders. All dividends mentioned occurred before implementation of AASB 127.38A. Required: (a) Prepare journal entries to record the above events in the separate financial statements of Carmen Ltd; and to record the same events by the equity accounting method in accordance with AASB 128. (b) Present the profit or loss statement, balance sheet and relevant notes for Carmen Ltd and the Carmen Group at 31 December 20X2 in as much detail as the data permit. (c) Discuss how your answer might differ if AASB 127.38A applied to theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started