Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENTTTTT!!!! PLEASE ANSWER ASAPPPP!!!!!!!!!!!1 ANSWERS MUST BE TYPED BUT DONT USE EXCEL !!!!!! THANK YOU 2. (a) Megat is considering investing in either two outstanding

URGENTTTTT!!!! PLEASE ANSWER ASAPPPP!!!!!!!!!!!1 ANSWERS MUST BE TYPED BUT DONT USE EXCEL !!!!!! THANK YOU

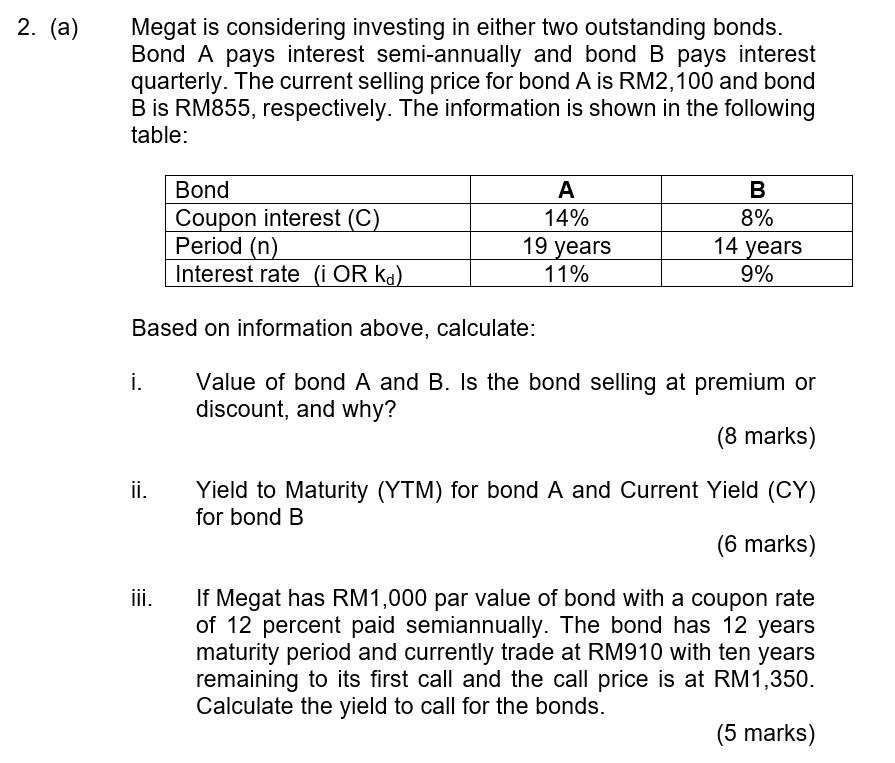

2. (a) Megat is considering investing in either two outstanding bonds. Bond A pays interest semi-annually and bond B pays interest quarterly. The current selling price for bond A is RM2,100 and bond B is RM855, respectively. The information is shown in the following table: Bond Coupon interest (C) Period (n) Interest rate (i OR kd) A 14% 19 years 11% B 8% 14 years 9% Based on information above, calculate: i. Value of bond A and B. Is the bond selling at premium or discount, and why? (8 marks) ii. Yield to Maturity (YTM) for bond A and Current Yield (CY) for bond B (6 marks) If Megat has RM1,000 par value of bond with a coupon rate of 12 percent paid semiannually. The bond has 12 years maturity period and currently trade at RM910 with ten years remaining to its first call and the call price is at RM1,350. Calculate the yield to call for the bondsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started