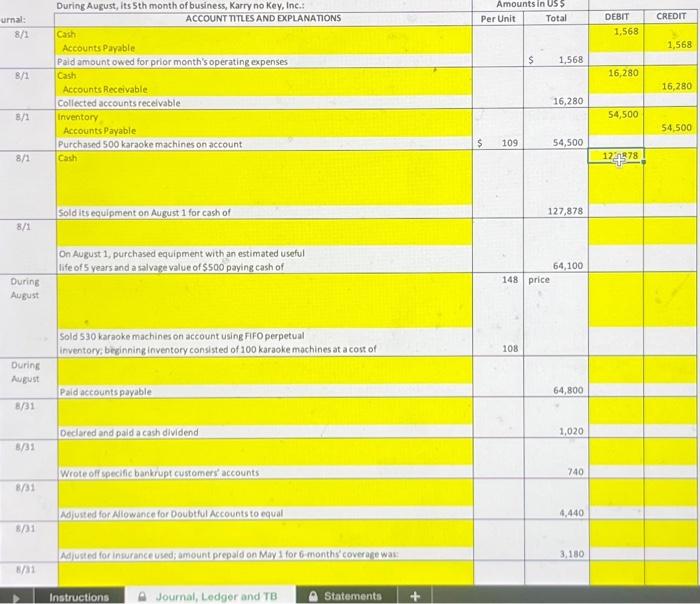

urnal: 8/1 8/1 8/1 8/1 8/1 During August During August 8/31 8/31 8/31 8/31 8/31 During August, its 5th month of business, Karry no Key, Inc.: ACCOUNT TITLES AND EXPLANATIONS Cash Accounts Payable Paid amount owed for prior month's operating expenses Cash Accounts Receivable Collected accounts receivable Inventory Accounts Payable Purchased 500 karaoke machines on account Cash Sold its equipment on August 1 for cash of On August 1, purchased equipment with an estimated useful life of 5 years and a salvage value of $500 paying cash of Sold 530 karaoke machines on account using FIFO perpetual inventory; beginning inventory consisted of 100 karaoke machines at a cost of Paid accounts payable Declared and paid a cash dividend Wrote off specific bankrupt customers' accounts Adjusted for Allowance for Doubtful Accounts to equal Adjusted for insurance used; amount prepaid on May 1 for 6-months' coverage was: Instructions Journal, Ledger and TB Statements + Amounts in US $ Total Per Unit $ 109 148 108 $ 1,568 price 16,280 54,500 127,878 64,100 64,800 1,020 740 4,440 3,180 DEBIT 1,568 16,280 54,500 1224378 CREDIT 1,568 16,280 54,500

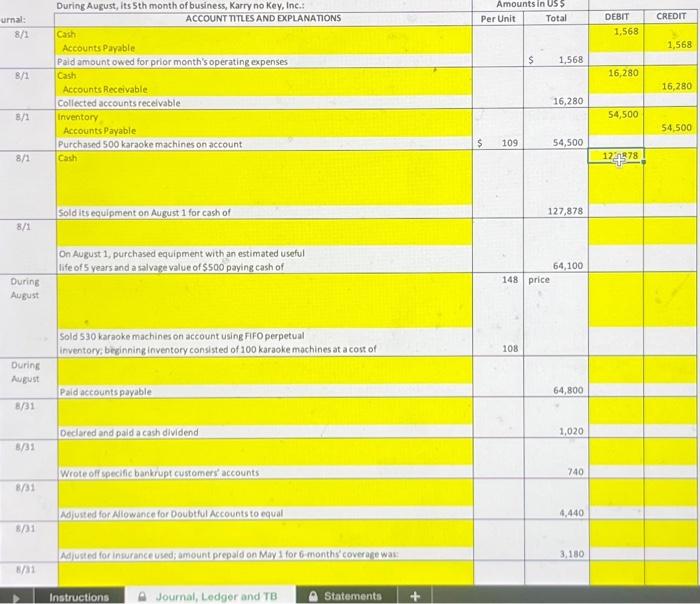

\begin{tabular}{|c|c|c|c|c|c|} \hline \multirow{2}{*}{ urnal: } & During August, its 5 th month of business, Karry no Key, Inc.: & \multicolumn{2}{|c|}{ Amountsin USS } & \multirow[b]{2}{*}{ DEBIT } & \multirow[b]{2}{*}{ CREDIT } \\ \hline & ACCOUNT TITLS AND EKPLANATIONS & Per Unit & Total & & \\ \hline \multirow[t]{3}{*}{8/1} & Carh & & & 1,568 & \\ \hline & Accounts Payable & & . & & 1,568 \\ \hline & Paid amount owed for prior month's operating expenses & & 1,568 & & \\ \hline \multirow[t]{3}{*}{8/1} & Cash: & & & 16,280 & \\ \hline & Accounts Receivable: & & & & 16,280 \\ \hline & Collected accounts receivable & & 16,280 & & \\ \hline \multirow[t]{3}{*}{8/1} & Inventory & 1= & & 54,500 & \\ \hline & Accounts Payabie & & & & 54,500 \\ \hline & Purchased 500 karaoke machines on account & 109 & 54,500 & & \\ \hline \multirow[t]{2}{*}{8/1} & Cash & & & 123278 & \\ \hline & Sold its equipment on August 1 for cash of & & 127,878 & & \\ \hline \multirow[t]{2}{*}{8/1} & & & & & \\ \hline & \begin{tabular}{l} On August 1, purchased equipment with an estimated useful \\ life of 5 vears and a salvage value of $500 paying cash of \end{tabular} & 2. & 64,100 & 8 & \\ \hline \multirow{4}{*}{\begin{tabular}{l} During \\ August \end{tabular}} & & 148 & price & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & \begin{tabular}{l} Sold 530 karaoke machines on account using FFO perpetual \\ inventory; brginning inventory consisted of 100 karaoke machines at a cost of \end{tabular} & 108 & & & \\ \hline \multirow{2}{*}{\begin{tabular}{l} During \\ August \end{tabular}} & & & & & \\ \hline & Paid accounts payable & & 64,800 & & \\ \hline \multirow[t]{2}{*}{8/31} & & & & & \\ \hline & Declared and paid a cash dividend & i. & 1,020 & & \\ \hline \multirow[t]{2}{*}{8/31} & & & & & \\ \hline & Wrote off specific bankrupt customers' accounts & & 740 & & \\ \hline \multirow[t]{2}{*}{8/31} & & & & & \\ \hline & Adjusted for Nilowance for Doubthul Accounts to equal & & 4,440 & 4 & \\ \hline \multirow[t]{2}{*}{8/81} & & & & & \\ \hline & Adjusted for insurance used; amount prepald on May 1 for 6 month' coverape was: & & 3.180 & & \\ \hline \multicolumn{6}{|l|}{8/31} \\ \hline 12 & A Journal, Ledger and TB & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow{2}{*}{ urnal: } & During August, its 5 th month of business, Karry no Key, Inc.: & \multicolumn{2}{|c|}{ Amountsin USS } & \multirow[b]{2}{*}{ DEBIT } & \multirow[b]{2}{*}{ CREDIT } \\ \hline & ACCOUNT TITLS AND EKPLANATIONS & Per Unit & Total & & \\ \hline \multirow[t]{3}{*}{8/1} & Carh & & & 1,568 & \\ \hline & Accounts Payable & & . & & 1,568 \\ \hline & Paid amount owed for prior month's operating expenses & & 1,568 & & \\ \hline \multirow[t]{3}{*}{8/1} & Cash: & & & 16,280 & \\ \hline & Accounts Receivable: & & & & 16,280 \\ \hline & Collected accounts receivable & & 16,280 & & \\ \hline \multirow[t]{3}{*}{8/1} & Inventory & 1= & & 54,500 & \\ \hline & Accounts Payabie & & & & 54,500 \\ \hline & Purchased 500 karaoke machines on account & 109 & 54,500 & & \\ \hline \multirow[t]{2}{*}{8/1} & Cash & & & 123278 & \\ \hline & Sold its equipment on August 1 for cash of & & 127,878 & & \\ \hline \multirow[t]{2}{*}{8/1} & & & & & \\ \hline & \begin{tabular}{l} On August 1, purchased equipment with an estimated useful \\ life of 5 vears and a salvage value of $500 paying cash of \end{tabular} & 2. & 64,100 & 8 & \\ \hline \multirow{4}{*}{\begin{tabular}{l} During \\ August \end{tabular}} & & 148 & price & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & \begin{tabular}{l} Sold 530 karaoke machines on account using FFO perpetual \\ inventory; brginning inventory consisted of 100 karaoke machines at a cost of \end{tabular} & 108 & & & \\ \hline \multirow{2}{*}{\begin{tabular}{l} During \\ August \end{tabular}} & & & & & \\ \hline & Paid accounts payable & & 64,800 & & \\ \hline \multirow[t]{2}{*}{8/31} & & & & & \\ \hline & Declared and paid a cash dividend & i. & 1,020 & & \\ \hline \multirow[t]{2}{*}{8/31} & & & & & \\ \hline & Wrote off specific bankrupt customers' accounts & & 740 & & \\ \hline \multirow[t]{2}{*}{8/31} & & & & & \\ \hline & Adjusted for Nilowance for Doubthul Accounts to equal & & 4,440 & 4 & \\ \hline \multirow[t]{2}{*}{8/81} & & & & & \\ \hline & Adjusted for insurance used; amount prepald on May 1 for 6 month' coverape was: & & 3.180 & & \\ \hline \multicolumn{6}{|l|}{8/31} \\ \hline 12 & A Journal, Ledger and TB & & & & \\ \hline \end{tabular}