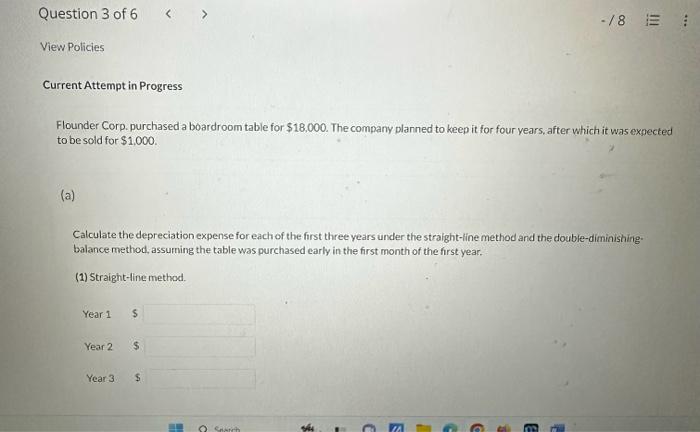

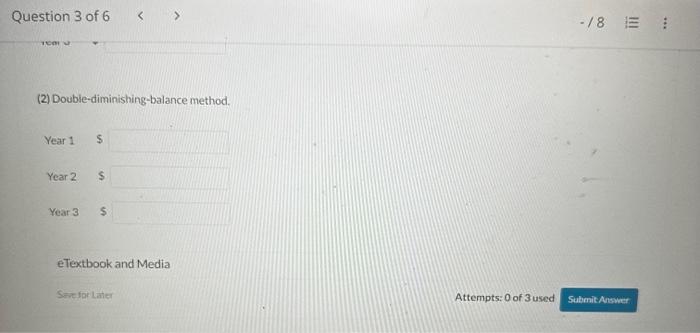

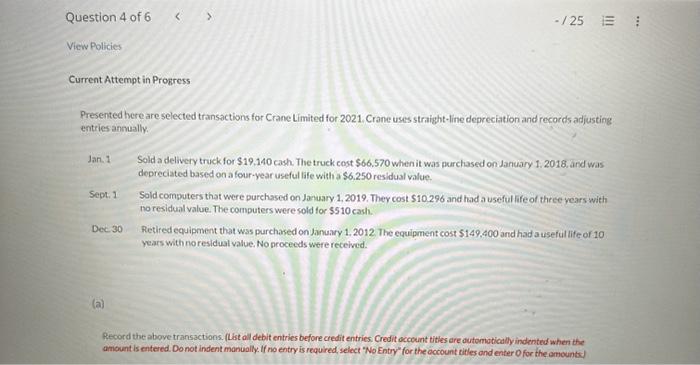

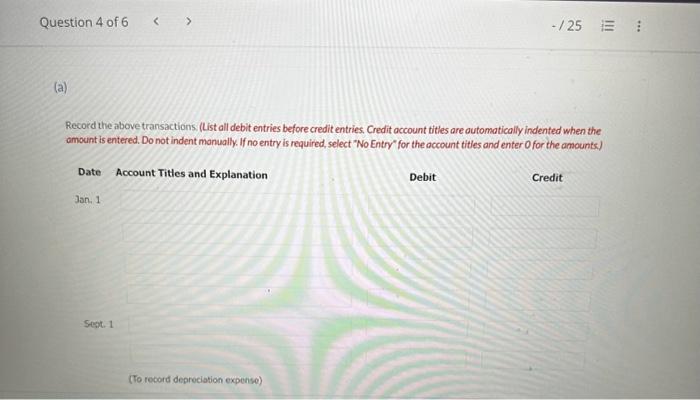

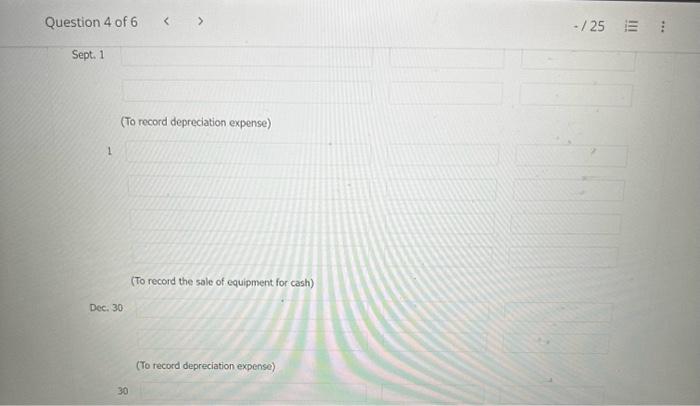

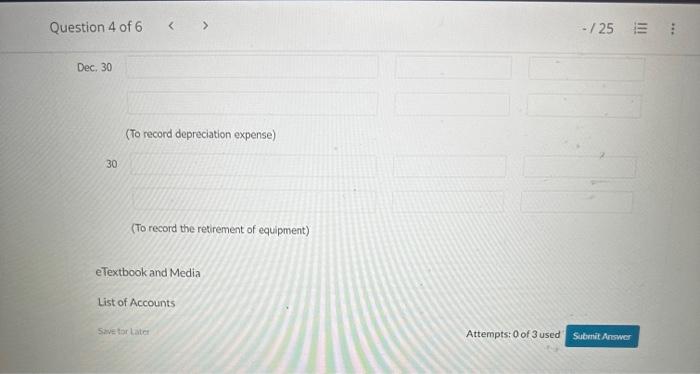

urrent Attempt in Progress Flounder Corp. purchased a boardroom table for $18,000. The company planned to keep it for four years, after which it was expected to be sold for $1,000. (a) Calculate the depreciation expense for each of the first three years under the straight-line method and the double-diminishing: balance method, assuming the table was purchased early in the first month of the first year. (1) Straight-fine method. Year 1 \$ Year 2 \$ Year 3 \$ (2) Double-diminishing-balance method. Year 1$ Year 2$ Year 3$ Current Attempt in Progress Presented here are selected transactions for Crane Limited for 2021. Crane uses straight-line depreciation and records adjusting entries annually. Jan.1 Sold a delivery truck for $19.140 cash. The truck cost \$66.570 when it was purchased on January 1.2018, and was depreciated based on a four-year useful life with a $6.250 residual value. Sept.1 Sold computers that were purchased on January 1, 2019. Ther cost $10,296 and had a useful life of three vears with no residual value. The computers were sold for $510cash. Dec. 30 Retired equipment that was purchased on fanury 1.2012. The equipment cost 5149,400 and had a useful life of 10 Years with no residual value. No proceeds were recelved. (a) Pecord the above transactions. (List all debit entries before credit entries. Credit occount tities are outomotically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry' for the occount tilles and enter O for the amounts) Recoid the above transactions. (List all debit entries before credit entries. Credit account titles are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Question 4 of 6 125 Sept. 1 (To record depreciation expense) 1 (To record the sale of equipment for cash) Dec. 30 (To record depreciation expenso) 30 Question 4 of 6 125 Dec. 30 (To record depreciation expense) 30 (To record the retirement of equipment) eTextbook and Media List of Accounts Swetor Latet Attempts: 0 of 3 used Sulbmit