Answered step by step

Verified Expert Solution

Question

1 Approved Answer

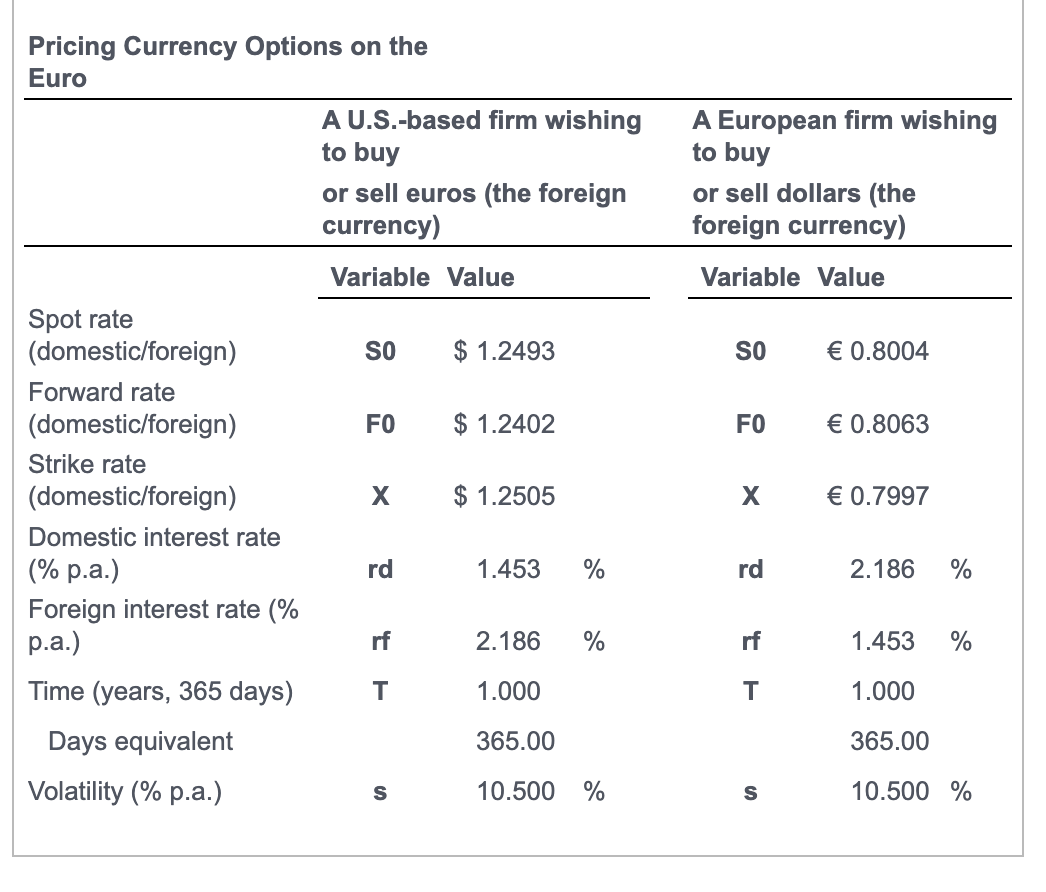

U.S. Dollar-Euro. The table, = indicates that a 1-year call option on euros at a strike rate of $1.2505 1.00 will cost the buyer

U.S. Dollar-Euro. The table, = indicates that a 1-year call option on euros at a strike rate of $1.2505 1.00 will cost the buyer $0.0464 per , or 3.71%. But that assumed a volatility of 10.500% when the spot rate was $1.2493 = 1.00. What would that same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2479 = 1.00? The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2479 = 1.00 would be $ /. (Round to four decimal places.) Pricing Currency Options on the Euro A U.S.-based firm wishing to buy or sell euros (the foreign currency) Variable Value A European firm wishing to buy or sell dollars (the foreign currency) Variable Value Spot rate (domestic/foreign) Forward rate (domestic/foreign) SO $ 1.2493 SO 0.8004 FO $ 1.2402 FO 0.8063 Strike rate (domestic/foreign) X $ 1.2505 X 0.7997 Domestic interest rate (% p.a.) rd 1.453 % rd 2.186 % Foreign interest rate (% p.a.) rf 2.186 % rf 1.453 % Time (years, 365 days) T 1.000 T 1.000 Days equivalent 365.00 365.00 Volatility (% p.a.) S 10.500 % S 10.500 %

Step by Step Solution

★★★★★

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the cost of the same call option when the volatility is reduced to 10500 and the spot r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started