Answered step by step

Verified Expert Solution

Question

1 Approved Answer

U.S. Dollar/Euro. The table indicates that a 1-year call option on euros at a strike rate of TYPED ANSWER ONLY or EXCEL Problem 7-12 (algorithmic)

U.S. Dollar/Euro. The table indicates that a 1-year call option on euros at a strike rate of

TYPED ANSWER ONLY or EXCEL

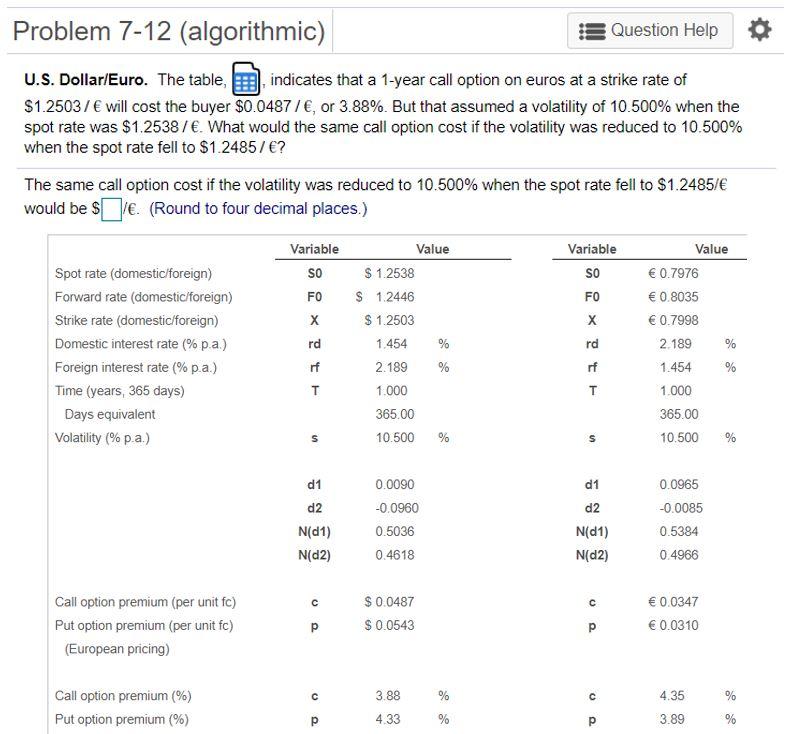

Problem 7-12 (algorithmic) Question Help U.S. Dollar/Euro. The table, indicates that a 1-year call option on euros at a strike rate of $1.25037 will cost the buyer $0.0487/, or 3.88%. But that assumed a volatility of 10.500% when the spot rate was $1.25387. What would the same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.24857 ? The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2485/ would be $. (Round to four decimal places.) Variable SO FO Spot rate (domestic foreign) Forward rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (% p.a.) Foreign interest rate (% p.a.) Time (years, 365 days) Days equivalent Volatility (% p.a.) Value $ 1.2538 $ 1.2446 $ 1.2503 1.454 % 2.189 % 1.000 365.00 10.500 % Variable SO FO X rd rf GET Value 0.7976 0.8035 0.7998 2.189 % 1.454 % 1.000 365.00 10.500 % S s d1 d2 N(D1) N(D2) 0.0090 -0.0960 0.5036 0.4618 d1 d2 N(d1) N(D2) 0.0965 -0.0085 0.5384 0.4966 Call option premium (per unit fc) Put option premium (per unit fc) (European pricing) $ 0.0487 $ 0.0543 0.0347 0.0310 p 3.88 4.35 Call option premium (%) Put option premium (%) p 4.33 % p 3.89 % Problem 7-12 (algorithmic) Question Help U.S. Dollar/Euro. The table, indicates that a 1-year call option on euros at a strike rate of $1.25037 will cost the buyer $0.0487/, or 3.88%. But that assumed a volatility of 10.500% when the spot rate was $1.25387. What would the same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.24857 ? The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2485/ would be $. (Round to four decimal places.) Variable SO FO Spot rate (domestic foreign) Forward rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (% p.a.) Foreign interest rate (% p.a.) Time (years, 365 days) Days equivalent Volatility (% p.a.) Value $ 1.2538 $ 1.2446 $ 1.2503 1.454 % 2.189 % 1.000 365.00 10.500 % Variable SO FO X rd rf GET Value 0.7976 0.8035 0.7998 2.189 % 1.454 % 1.000 365.00 10.500 % S s d1 d2 N(D1) N(D2) 0.0090 -0.0960 0.5036 0.4618 d1 d2 N(d1) N(D2) 0.0965 -0.0085 0.5384 0.4966 Call option premium (per unit fc) Put option premium (per unit fc) (European pricing) $ 0.0487 $ 0.0543 0.0347 0.0310 p 3.88 4.35 Call option premium (%) Put option premium (%) p 4.33 % p 3.89 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started