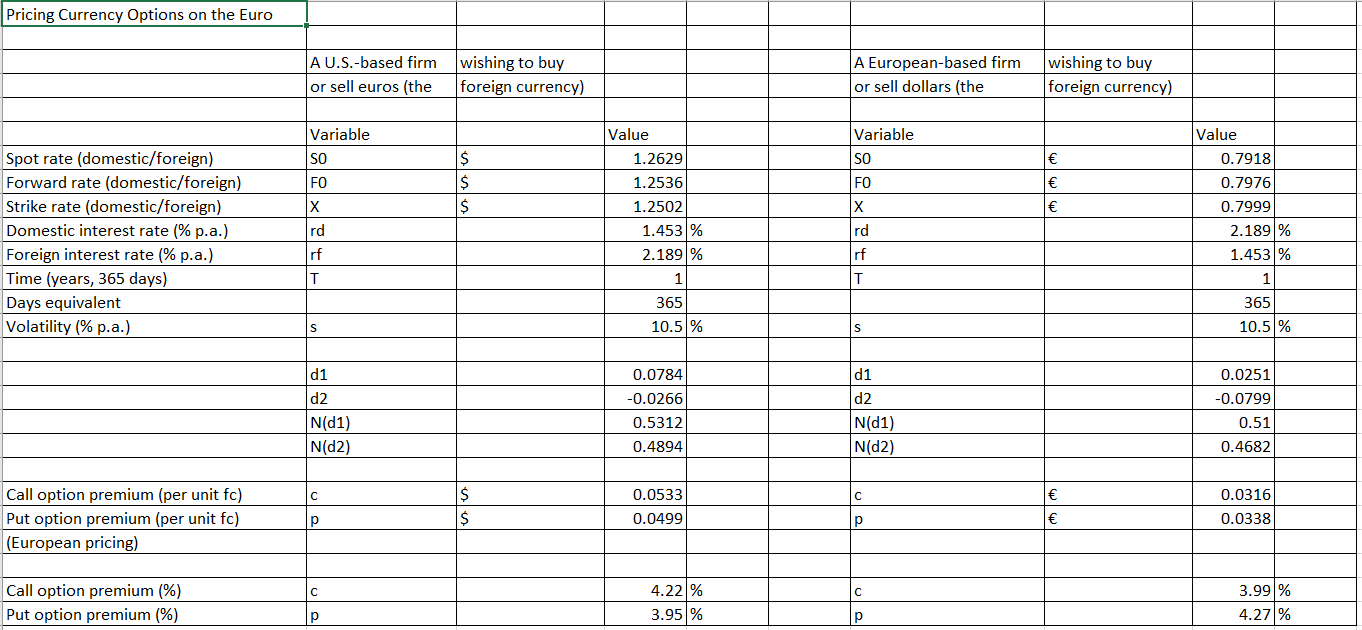

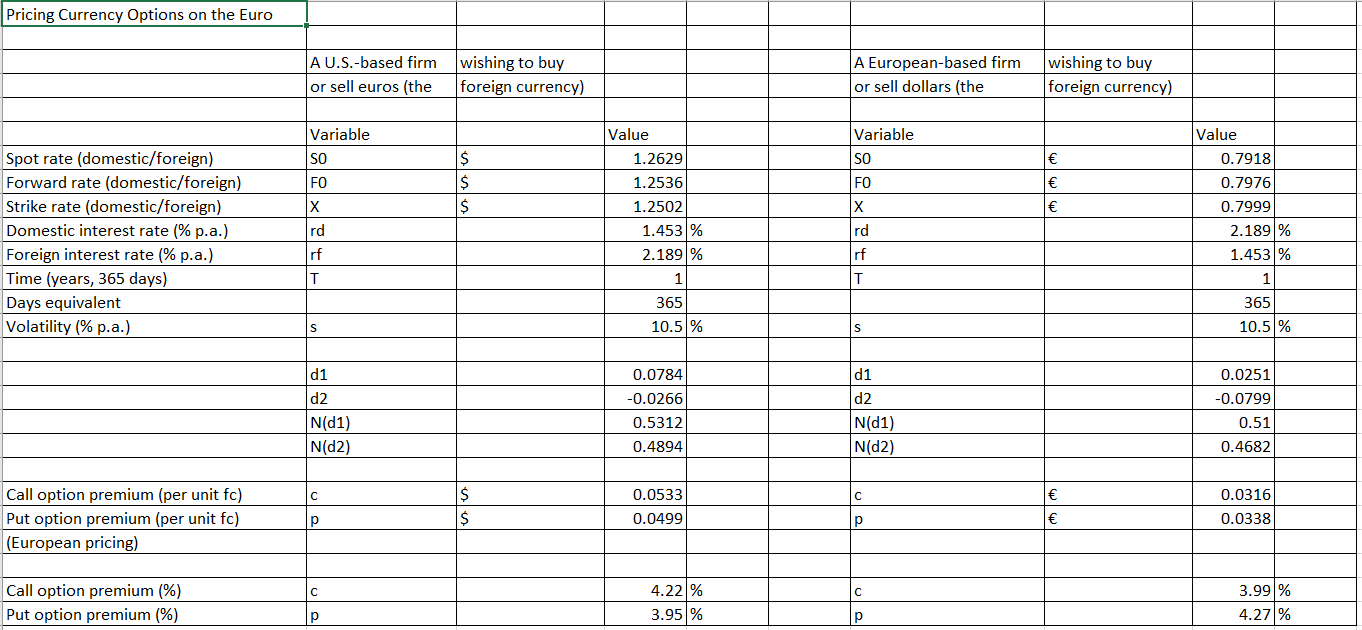

U.S. Dollar/Euro. The table, indicates that a 1-year call option on euros at a strike rate of $1.25027 will cost the buyer $0.05337 , or 4.22%. But that assumed a volatility of 10.500% when the spot rate was $1.2629/ . What would the same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2479/ ? The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2479/ would be $ /. (Round to four decimal places.) Pricing Currency Options on the Euro A U.S.-based firm or sell euros (the wishing to buy foreign currency) A European-based firm or sell dollars (the wishing to buy foreign currency) Variable Variable so SO ot FO ( t Value 1.2629 1.2536 1.2502 1.453 % 2.189 % Spot rate (domestic/foreign) Forward rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate % p.a.) Foreign interest rate % p.a.) Time (years, 365 days) Days equivalent Volatility (% p.a.) Ird Value 0.7918 0.7976 0.7999 2.189 % 1.453 % 1 365 10.5 % Irf 1 365 10.5% d1 d1 d2 0.0784 -0.0266 0.53121 0.4894 0.0251 -0.0799 0.51 0.4682 d2 N(1) N(2) N(1) N(2) C Call option premium (per unit fc) Put option premium (per unit fc) (European pricing) 0.0533 0.0499 0.0316 0.0338 Call option premium (%) Put option premium (%) 4.22 % 3.95% 3.99% 4.27% U.S. Dollar/Euro. The table, indicates that a 1-year call option on euros at a strike rate of $1.25027 will cost the buyer $0.05337 , or 4.22%. But that assumed a volatility of 10.500% when the spot rate was $1.2629/ . What would the same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2479/ ? The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2479/ would be $ /. (Round to four decimal places.) Pricing Currency Options on the Euro A U.S.-based firm or sell euros (the wishing to buy foreign currency) A European-based firm or sell dollars (the wishing to buy foreign currency) Variable Variable so SO ot FO ( t Value 1.2629 1.2536 1.2502 1.453 % 2.189 % Spot rate (domestic/foreign) Forward rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate % p.a.) Foreign interest rate % p.a.) Time (years, 365 days) Days equivalent Volatility (% p.a.) Ird Value 0.7918 0.7976 0.7999 2.189 % 1.453 % 1 365 10.5 % Irf 1 365 10.5% d1 d1 d2 0.0784 -0.0266 0.53121 0.4894 0.0251 -0.0799 0.51 0.4682 d2 N(1) N(2) N(1) N(2) C Call option premium (per unit fc) Put option premium (per unit fc) (European pricing) 0.0533 0.0499 0.0316 0.0338 Call option premium (%) Put option premium (%) 4.22 % 3.95% 3.99% 4.27%