Answered step by step

Verified Expert Solution

Question

1 Approved Answer

US guidlines a The National Company for investments was established at 30/6/2018 and you were assigned as an auditor to audit the company's financial statements

US guidlines

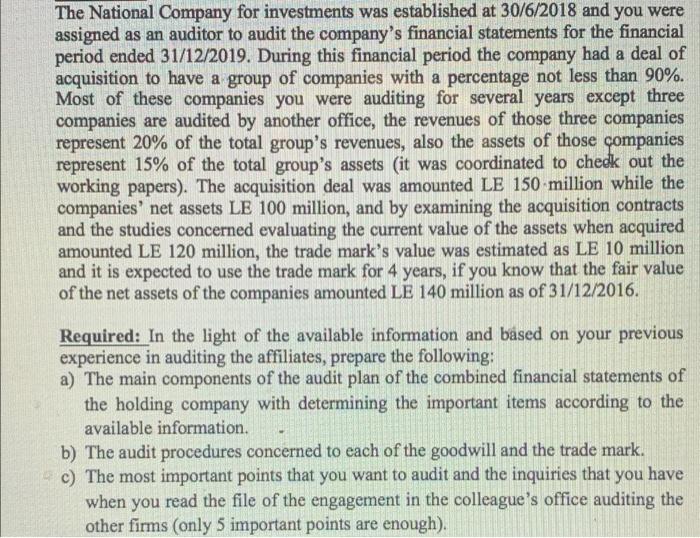

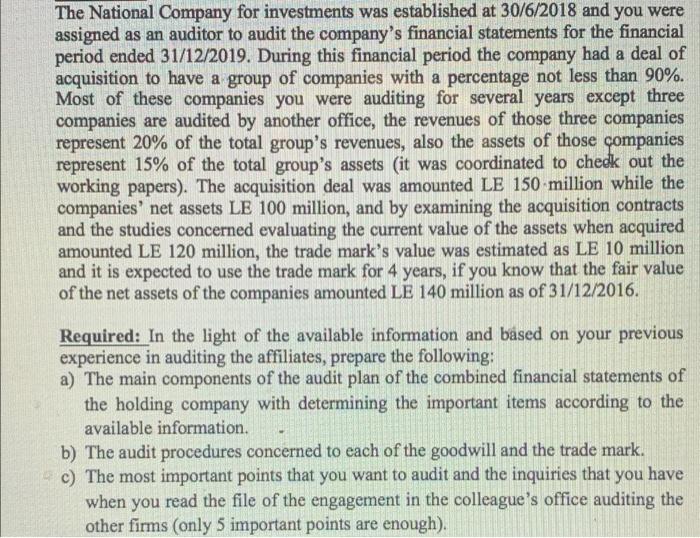

a The National Company for investments was established at 30/6/2018 and you were assigned as an auditor to audit the company's financial statements for the financial period ended 31/12/2019. During this financial period the company had a deal of acquisition to have a group of companies with a percentage not less than 90%. Most of these companies you were auditing for several years except three companies are audited by another office, the revenues of those three companies represent 20% of the total group's revenues, also the assets of those companies represent 15% of the total group's assets (it was coordinated to check out the working papers). The acquisition deal was amounted LE 150 million while the companies' net assets LE 100 million, and by examining the acquisition contracts and the studies concerned evaluating the current value of the assets when acquired amounted LE 120 million, the trade mark's value was estimated as LE 10 million and it is expected to use the trade mark for 4 years, if you know that the fair value of the net assets of the companies amounted LE 140 million as of 31/12/2016. Required: In the light of the available information and based on your previous experience in auditing the affiliates, prepare the following: a) The main components of the audit plan of the combined financial statements of the holding company with determining the important items according to the available information. b) The audit procedures concerned to each of the goodwill and the trade mark. c) The most important points that you want to audit and the inquiries that you have when you read the file of the engagement in the colleague's office auditing the other firms (only 5 important points are enough)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started