Answered step by step

Verified Expert Solution

Question

1 Approved Answer

U.S. Industries has a subsidiary in Switzerland. The subsidiary's financial statements are maintained in Swiss francs (CHF). Exchange rates ($/CHF) for selected dates are

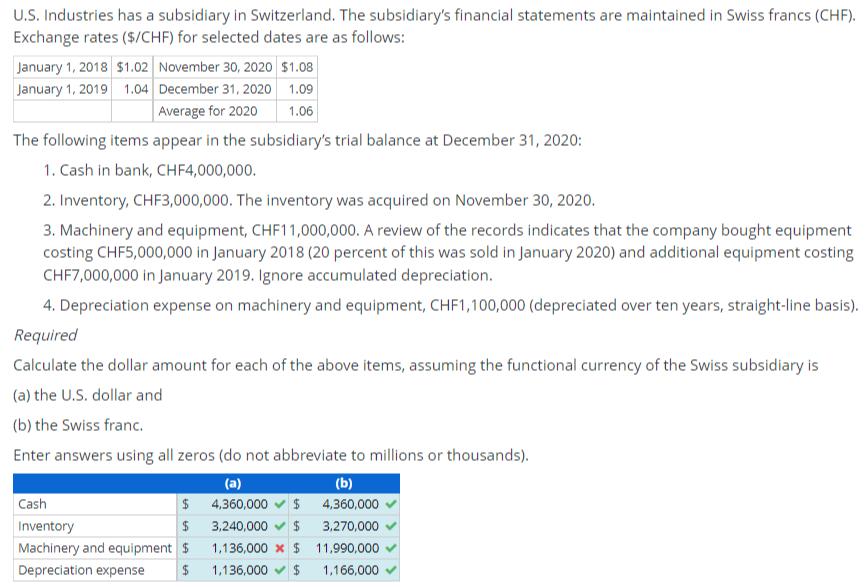

U.S. Industries has a subsidiary in Switzerland. The subsidiary's financial statements are maintained in Swiss francs (CHF). Exchange rates ($/CHF) for selected dates are as follows: January 1, 2018 $1.02 November 30, 2020 $1.08 January 1, 2019 1.04 December 31, 2020 1.09 Average for 2020 1.06 The following items appear in the subsidiary's trial balance at December 31, 2020: 1. Cash in bank, CHF4,000,000. 2. Inventory, CHF3,000,000. The inventory was acquired on November 30, 2020. 3. Machinery and equipment, CHF11,000,000. A review of the records indicates that the company bought equipment costing CHF5,000,000 in January 2018 (20 percent of this was sold in January 2020) and additional equipment costing CHF7,000,000 in January 2019. Ignore accumulated depreciation. 4. Depreciation expense on machinery and equipment, CHF1,100,000 (depreciated over ten years, straight-line basis). Required Calculate the dollar amount for each of the above items, assuming the functional currency of the Swiss subsidiary is (a) the U.S. dollar and (b) the Swiss franc. Enter answers using all zeros (do not abbreviate to millions or thousands). (a) (b) Cash $ 4,360,000 $ 4,360,000 Inventory $ 3,240,000 $ 3,270,000 11.990,000 Machinery and equipment $ 1,136,000 x $ Depreciation expense $ 1,136,000 $ 1,166,000

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer for a which is already solved Method Re measurement Note Particulars use...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started