Answered step by step

Verified Expert Solution

Question

1 Approved Answer

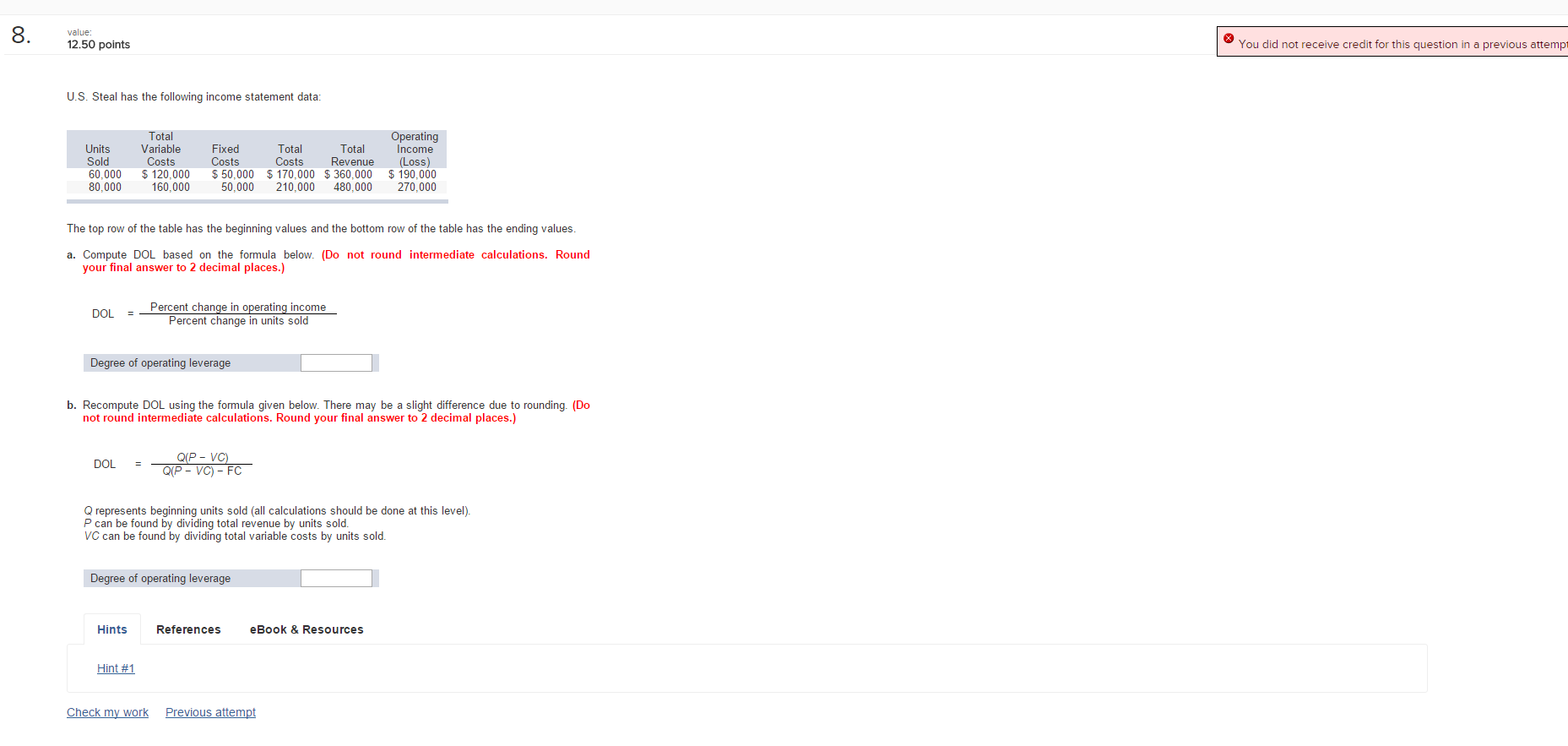

U.S. Steal has the following income statement data: Units Sold Total Variable Costs Fixed Costs Total Costs Total Revenue Operating Income (Loss) 60,000 $ 120,000

| U.S. Steal has the following income statement data: |

| Units Sold | Total Variable Costs | Fixed Costs | Total Costs | Total Revenue | Operating Income (Loss) |

| 60,000 | $ 120,000 | $ 50,000 | $ 170,000 | $ 360,000 | $ 190,000 |

| 80,000 | 160,000 | 50,000 | 210,000 | 480,000 | 270,000 |

| The top row of the table has the beginning values and the bottom row of the table has the ending values. |

| a. | Compute DOL based on the formula below. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) |

| DOL | = | Percent change in operating income |

| Percent change in units sold |

| Degree of operating leverage |

| b. | Recompute DOL using the formula given below. There may be a slight difference due to rounding. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) |

| DOL | = | Q(P ? VC) |

| Q(P ? VC) ? FC |

| Q represents beginning units sold (all calculations should be done at this level). |

| P can be found by dividing total revenue by units sold. |

| VC can be found by dividing total variable costs by units sold. |

| Degree of operating leverage |  |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started