Answered step by step

Verified Expert Solution

Question

1 Approved Answer

use 2016 forms Form 1040. William A. Gregg, a high school educator, and Mary W. Gregg, a micro biologist, are married and file a joint

use 2016 forms

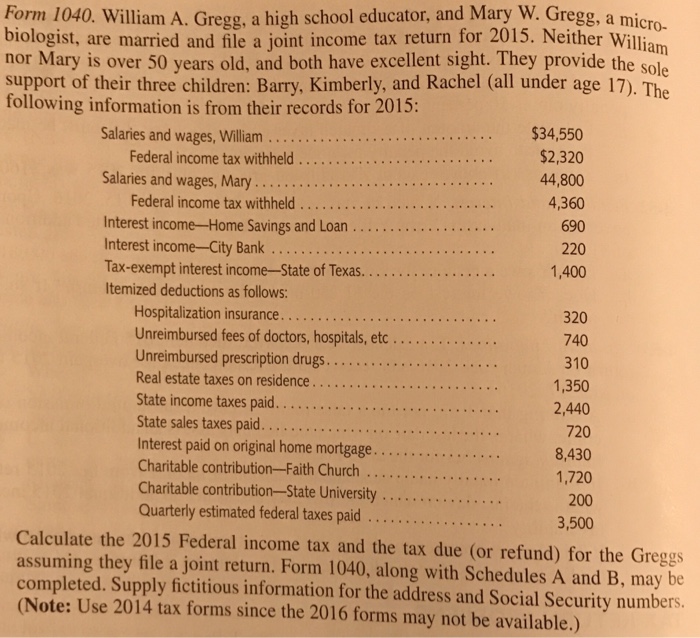

Form 1040. William A. Gregg, a high school educator, and Mary W. Gregg, a micro biologist, are married and file a joint income tax return for 2015. Neither Willia nor Mary is over 50 years old, and both have excellent sight. They provide the sole support of their three children: Barry, Kimberly, and Rachel (all under age 17). The following information is from their records for 2015: $34,550 $2,320 44,800 4,360 690 220 1,400 Salaries and wages, William Federal income tax withheld Salaries and wages, Mary . . . . . . . . . . . . . Federal income tax withheld . Interest income--Home Savings and Loan Interest income-City Bank . . . . temized deductions as follows: Hospitalization insurance Unreimbursed fees of doctors, hospitals, etc... Unreimbursed prescription drugs. Real estate taxes on residence . . . . . .. .. State sales taxes paid. Interest paid on original home mortgage... . Charitable contribution-Faith Church Charitable contribution-State University . Quarterly estimated federal taxes paid 320 740 310 1,350 2,440 720 8,430 1,720 200 3,500 Calculate the 2015 Federal income tax and the tax due (or refund) for the Greggs assuming they file a joint return. Form 1040, along with Schedules A and B, may be completed. Supply fictitious information for the address and Social Security numbers. (Note: Use 2014 tax forms since the 2016 forms may not be available.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started