Answered step by step

Verified Expert Solution

Question

1 Approved Answer

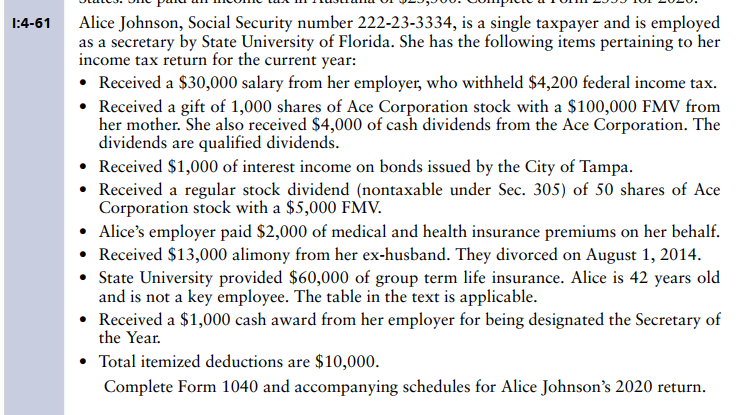

Use 2021 tax forms ONLY Forms required: 1040, schedule 1, and Schedule B A manual capital gain tax calculation worksheet Assume taxpayer received the correct

Use 2021 tax forms ONLY

Forms required: 1040, schedule 1, and Schedule B

A manual capital gain tax calculation worksheet

Assume taxpayer received the correct amount of economic stimulus payments

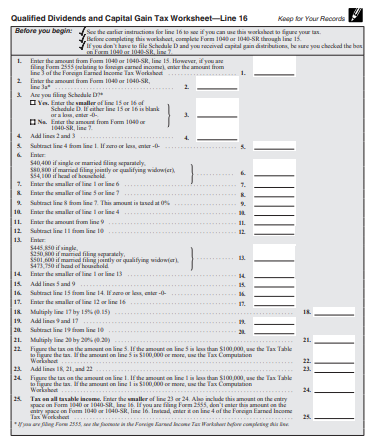

Qualified Dividends and Capital Gain Tax Worksheet-Line 16 Keep for Your Records Before you begin: See the earlier instructions for line 16 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 15. 1. Enter the amount from Form 1040 or 1040-SR, line 15. However, if you are filing Form 2555 (selating to foreign carned income), enter the amount from line 3 of the Foreign Earned Income Tax Worksheet 2. 3. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the ban on Form 1040 or 1040-SR, line 7. 11. 12. 13. Enter the amount from Form 1040 or 1040-SR, line Ja Are you filing Schedule D Yes. Enter the smaller of line 15 or 16 of Na. Enter the amount from Form 1040 1040-SR, line 7 4. Add lines 2 and 3 5. Subtract line 4 from line 1. If no or less, anter-- 23. 24. Schedule D. If either line 15 or 16 is blank or a los esta 7. & 9. 10. Enter the smaller of line 1 or line 4 $40,400 if single ce married fling separately. $80,800 if married filing jointly or qualifying widower), $54,100 if head of household Enter the smaller of line 1 or line 6 Enter the smaller of line 5 or line 7 Subtract line 8 from line 7. This amount is taxed at 0% Enter the amount from line 9 Subtract line 11 from line 10 Enter $445.850 i single, $250.800 if mame filing separately, $501,600 if maid filing jointly or qualifying widow(ar). $473,750 if head of household Enter the smaller of line 1 or line 13 } Add lines 5 and 9 Subtract line 15 from line 14. If zwo or less, enter -- Enter the smaller of line 12 or line 16 9. 11 11. 12. 14. 15. 16. 17. 18 Multiply line 17 by 19% (0.15) 19. Add lines and 17... 20 Subtract line 19 from line 10 21. Multiply line 20 by 20% (0.20) 22. Figure the tax on the amount on line 5. If the amount on line 5 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 5 is $100,000 or more, use the Tax Computation Worksheet 13. 14. 15. 16. 17. 19. 21. Add lines 18, 21, and 22 Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet 25 Tax on all taxable income. Enter the smaller of line 23 or 24. Also include this amount on the entry space on Form 1040 or 1040-Sit, line 16. If you are filing Form 2555, don't enter this amount on the antry space on Form 1040 or 1040-SR, line 16. Instead, enter it on line 4 of the Foreign Earned Income Tax Worksho *If you are filing Form 2555, see the facuate in the Foreign I d'Income Tax Worksheet before completing this line. P 21. 22. 23. 24.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer To complete the tax return for Alice Johnson we will use the 2021 tax forms and follow the in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started