Answered step by step

Verified Expert Solution

Question

1 Approved Answer

use 4 instead of X and use 64 instead of XX Q.2 [10+10+5] Part A: Draw the following options strategies by using given data. 1.

use 4 instead of X and use 64 instead of XX

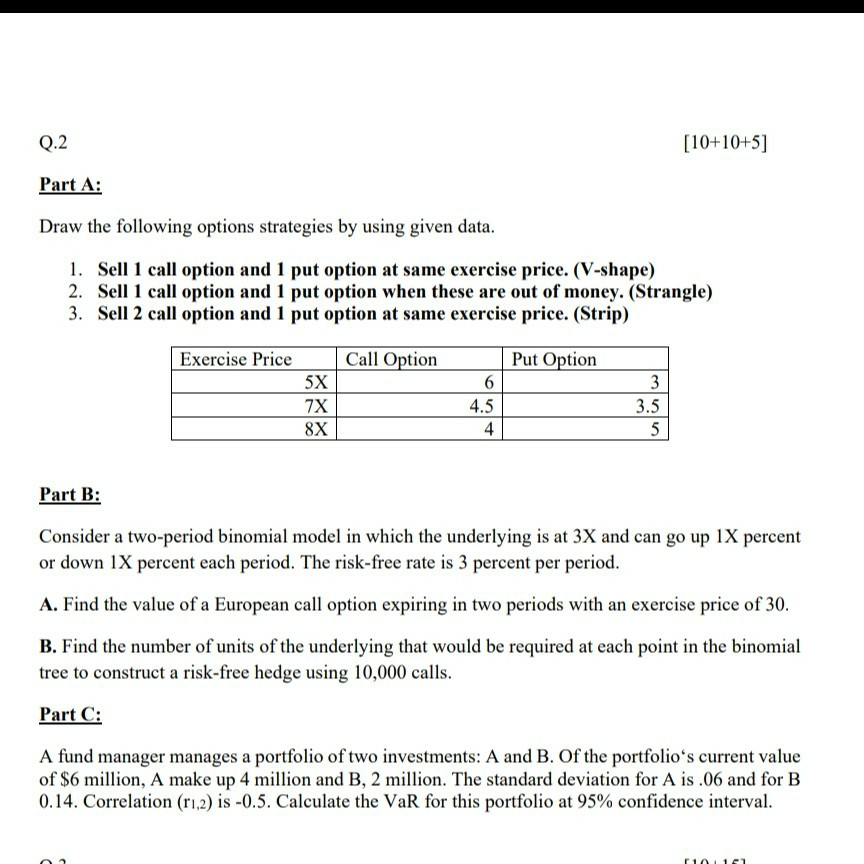

Q.2 [10+10+5] Part A: Draw the following options strategies by using given data. 1. Sell 1 call option and 1 put option at same exercise price. (V-shape) 2. Sell 1 call option and 1 put option when these are out of money. (Strangle) 3. Sell 2 call option and 1 put option at same exercise price. (Strip) Exercise Price Call Option Put Option 5X 7X 8X 6 4.5 4 3 3.5 Part B: Consider a two-period binomial model in which the underlying is at 3X and can go up 1X percent or down 1X percent each period. The risk-free rate is 3 percent per period. A. Find the value of a European call option expiring in two periods with an exercise price of 30. B. Find the number of units of the underlying that would be required at each point in the binomial tree to construct a risk-free hedge using 10,000 calls. Part C: A fund manager manages a portfolio of two investments: A and B. Of the portfolio's current value of $6 million, A make up 4 million and B, 2 million. The standard deviation for A is .06 and for B 0.14. Correlation (r1,2) is -0.5. Calculate the VaR for this portfolio at 95% confidence interval. 110 Q.2 [10+10+5] Part A: Draw the following options strategies by using given data. 1. Sell 1 call option and 1 put option at same exercise price. (V-shape) 2. Sell 1 call option and 1 put option when these are out of money. (Strangle) 3. Sell 2 call option and 1 put option at same exercise price. (Strip) Exercise Price Call Option Put Option 5X 7X 8X 6 4.5 4 3 3.5 Part B: Consider a two-period binomial model in which the underlying is at 3X and can go up 1X percent or down 1X percent each period. The risk-free rate is 3 percent per period. A. Find the value of a European call option expiring in two periods with an exercise price of 30. B. Find the number of units of the underlying that would be required at each point in the binomial tree to construct a risk-free hedge using 10,000 calls. Part C: A fund manager manages a portfolio of two investments: A and B. Of the portfolio's current value of $6 million, A make up 4 million and B, 2 million. The standard deviation for A is .06 and for B 0.14. Correlation (r1,2) is -0.5. Calculate the VaR for this portfolio at 95% confidence interval. 110Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started