Answered step by step

Verified Expert Solution

Question

1 Approved Answer

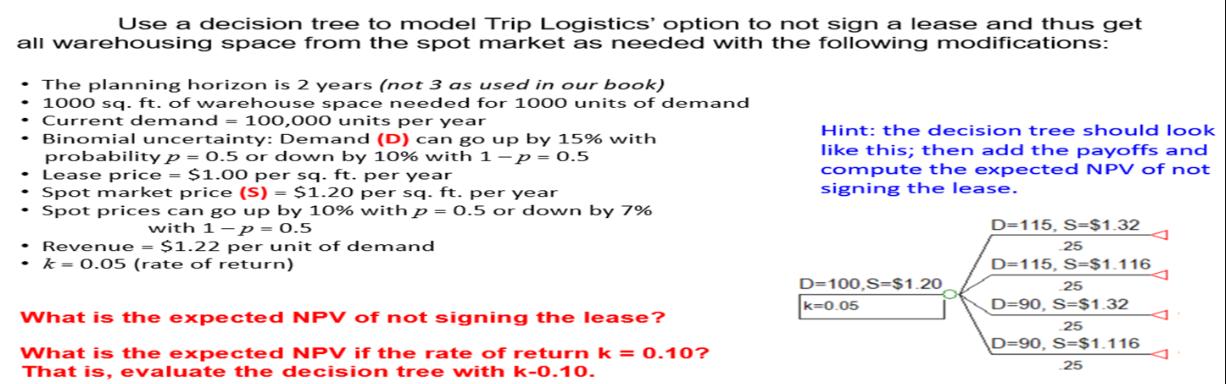

Use a decision tree to model Trip Logistics' option to not sign a lease and thus get all warehousing space from the spot market

Use a decision tree to model Trip Logistics' option to not sign a lease and thus get all warehousing space from the spot market as needed with the following modifications: The planning horizon is 2 years (not 3 as used in our book) 1000 sq. ft. of warehouse space needed for 1000 units of demand Current demand = 100,000 units per year Binomial uncertainty: Demand (D) can go up by 15% with probability p = 0.5 or down by 10% with 1-p = 0.5 Lease price = $1.00 per sq. ft. per year Spot market price (S) = $1.20 per sq. ft. per year Spot prices can go up by 10% with p = 0.5 or down by 7% with 1-p = 0.5 Revenue = $1.22 per unit of demand k= 0.05 (rate of return) What is the expected NPV of not signing the lease? What is the expected NPV if the rate of return k = 0.10? That is, evaluate the decision tree with k-0.10. Hint: the decision tree should look like this; then add the payoffs and compute the expected NPV of not signing the lease. D=100,S=$1.20 k=0.05 D=115, S=$1.32 25 D=115, S-$1.116 25 D-90, S-$1.32 25 D=90, S=$1.116 25

Step by Step Solution

★★★★★

3.46 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

1 The correct calculation for the total cost of materials to be purchased during June is as follows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started