use all three for last page.

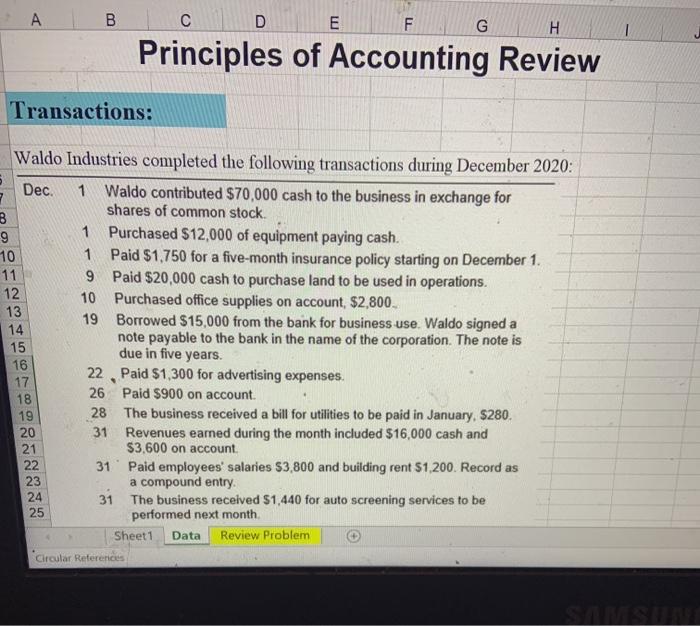

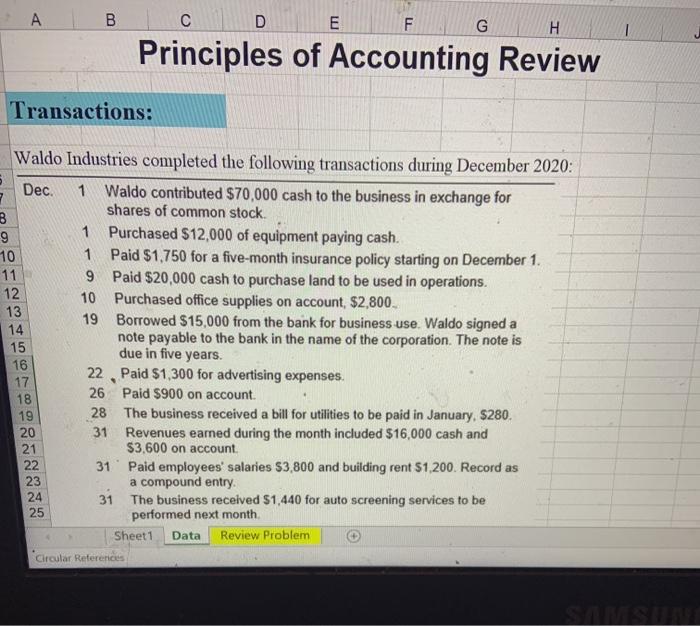

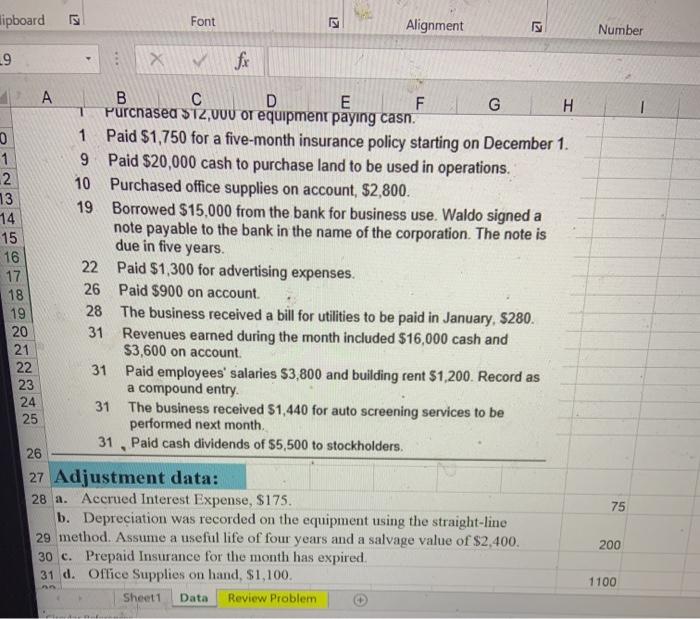

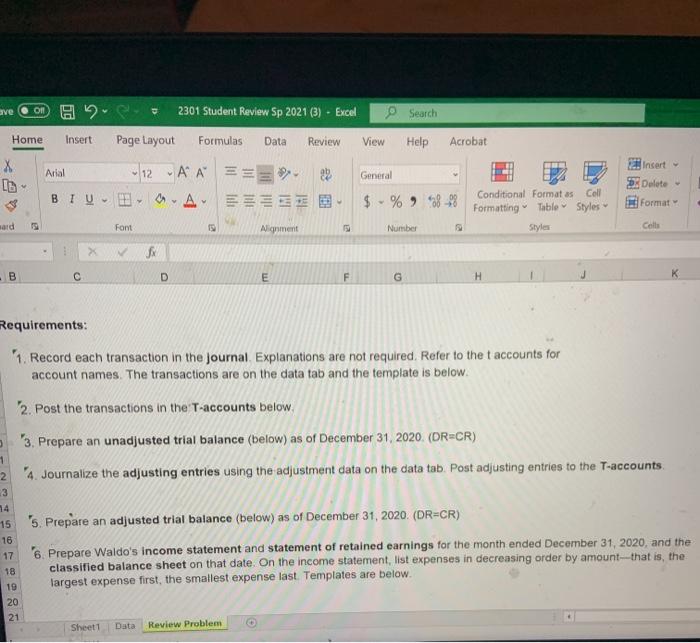

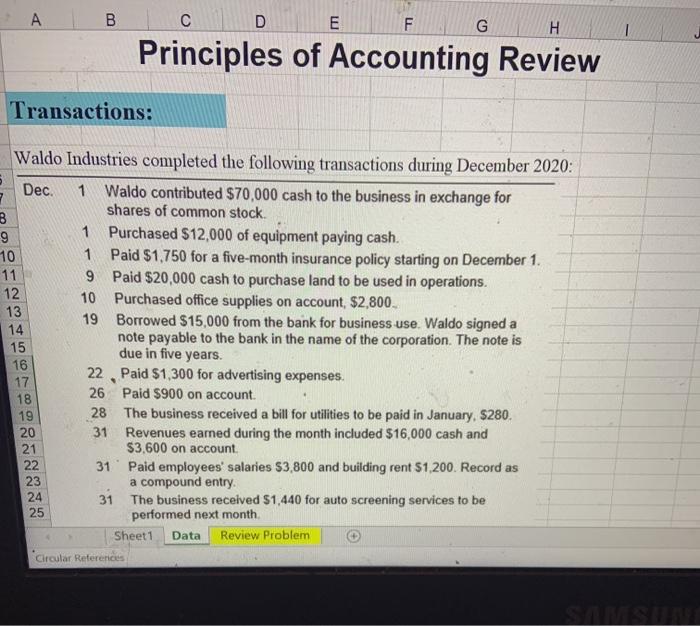

A B C D E F G H 1 Principles of Accounting Review Transactions: Waldo Industries completed the following transactions during December 2020: Dec. 7 1 Waldo contributed $70,000 cash to the business in exchange for shares of common stock B 9 1 Purchased $12,000 of equipment paying cash. 10 1 Paid $1,750 for a five-month insurance policy starting on December 1. 11 9 Paid $20,000 cash to purchase land to be used in operations. 12 10 Purchased office supplies on account, $2,800 13 19 Borrowed $15,000 from the bank for business use. Waldo signed a 14 15 note payable to the bank in the name of the corporation. The note is due in five years. 16 22, Paid $1,300 for advertising expenses. 17 18 26 Paid $900 on account. 28 The business received a bill for utilities to be paid in January, $280. 20 31 Revenues earned during the month included $16,000 cash and $3,600 on account 22 31. Paid employees' salaries $3,800 and building rent $1,200. Record as 23 a compound entry 31 The business received $1,440 for auto screening services to be performed next month Sheet1 Review Problem . NNNN 24 25 Data Circular References lipboard 12 Font Z Alignment L2 Number 9 X fx 1 1 A B C D E F G H Purchased $12,000 or equipment paying casn. 0 1 Paid $1,750 for a five-month insurance policy starting on December 1. 1 9 Paid $20,000 cash to purchase land to be used in operations. 2 10 Purchased office supplies on account, $2,800. 13 19 Borrowed $15,000 from the bank for business use. Waldo signed a 14 note payable to the bank in the name of the corporation. The note is 15 due in five years. 16 22 Paid $1,300 for advertising expenses. 17 26 Paid $900 on account. 18 19 28 The business received a bill for utilities to be paid in January, $280. 20 31 Revenues earned during the month included $16,000 cash and 21 $3,600 on account 22 31 Paid employees' salaries $3,800 and building rent $1,200. Record as 23 a compound entry. 24 31 The business received $1,440 for auto screening services to be 25 performed next month. 31, Paid cash dividends of $5,500 to stockholders. 26 27 Adjustment data: 28 a. Accrued Interest Expense, $175. b. Depreciation was recorded on the equipment using the straight-line 29 method. Assume a useful life of four years and a salvage value of $2,400. 30 c. Prepaid Insurance for the month has expired. 31 d. Office Supplies on hand, $1,100. Sheet1 Data Review Problem 75 200 1100 ave on 2- 2301 Student Review Sp 2021 (3) - Excel o Search Home Insert Page Layout Formulas Data Review View Help Acrobat X ID Arial General 12 AM === A Insert Delete Format BIU Coll $ - % 8-98 Conditional Formatas Formatting Table Styles Styles word Font 5 Alignment Number 99 Colli > x - D E F G H K Requirements: 1. Record each transaction in the Journal Explanations are not required. Refer to the accounts for account names. The transactions are on the data tab and the template is below. 2. Post the transactions in the T-accounts below. 3 '3. Prepare an unadjusted trial balance (below) as of December 31, 2020. (DR=CR) 4. Journalize the adjusting entries using the adjustment data on the data tab. Post adjusting entries to the T-accounts 11 2 3 14 15 16 17 18 '5. Prepare an adjusted trial balance (below) as of December 31, 2020. (DR-CR) 6. Prepare Waldo's income statement and statement of retained earnings for the month ended December 31, 2020, and the classified balance sheet on that date. On the income statement, list expenses in decreasing order by amount--that is, the largest expense first, the smallest expense last. Templates are below. 10 20 21 Sheet1 Data Review