Answered step by step

Verified Expert Solution

Question

1 Approved Answer

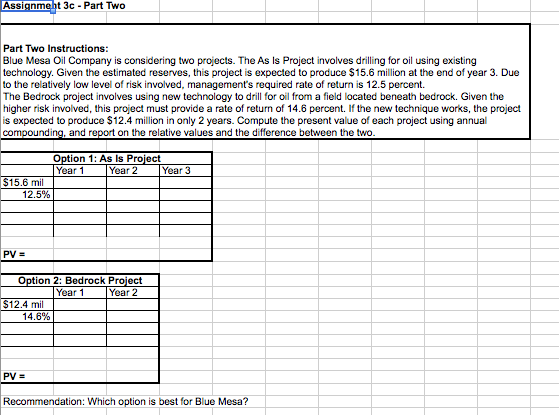

Use annual compounding to make the calculations: Assignment 3c- Part One Note: Be sure to complete Part 2 of this Assignment using the template on

Use annual compounding to make the calculations:

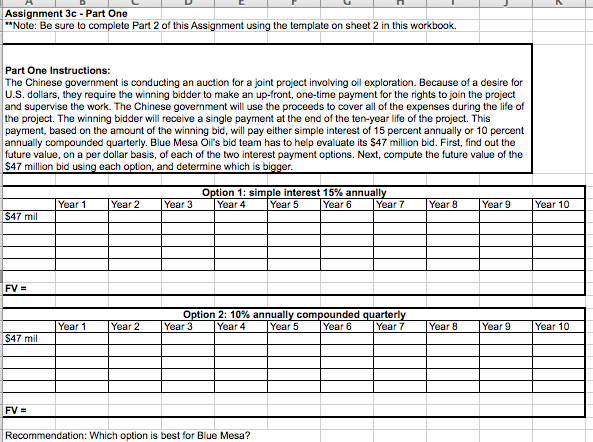

Assignment 3c- Part One Note: Be sure to complete Part 2 of this Assignment using the template on sheet 2 in this workbook. Part One Instructions The Chinese government is conducting an auction for a joint project involving oil exploration. Because of a desire for U.S. dollars, they require the winning bidder to make an up-front, one-time payment for the rights to join the project and supervise the work. The Chinese government will use the proceeds to cover all of the expenses during the life of the project. The winning bidder will receive a single payment at the end of the ten-year life of the project. This payment, based on the amount of the winning bid, will pay either simple interest of 15 percent annually or 10 percent annually compounded quarterly. Blue Mesa Oil's bid team has to help evaluate its $47 million bid. First, find out the future value, on a per dollar basis, of each of the two interest payment options. Next, compute the future value of the $47 million bid using each option, and determine which is bi ion 1: simple interest 15% annual Year 1 Year Year 5 47 mil PV = Option 2: 10% annually compounded quarter Year Year 3 Year 4 Year 5 Year 6 ear 7 Tmi Recommendation: Which option is best for Blue Mesa

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started