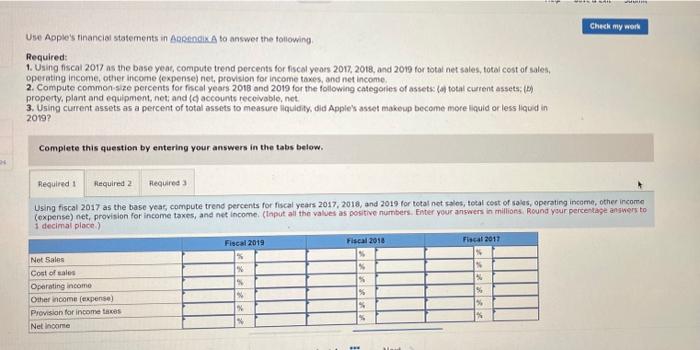

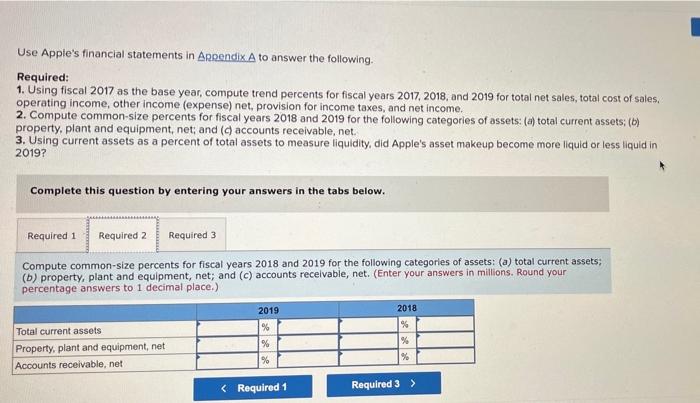

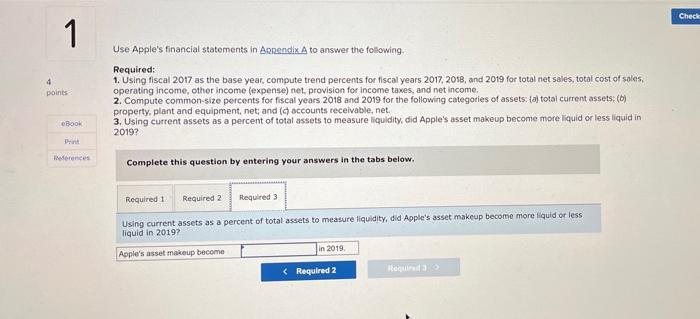

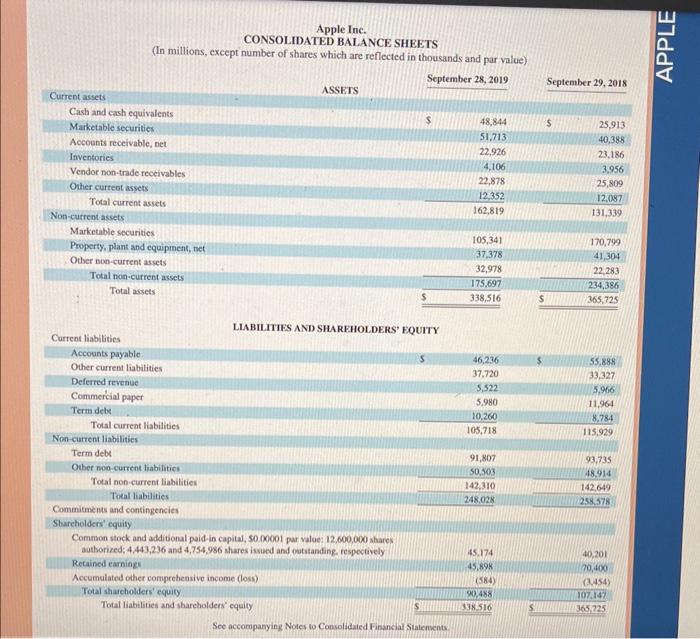

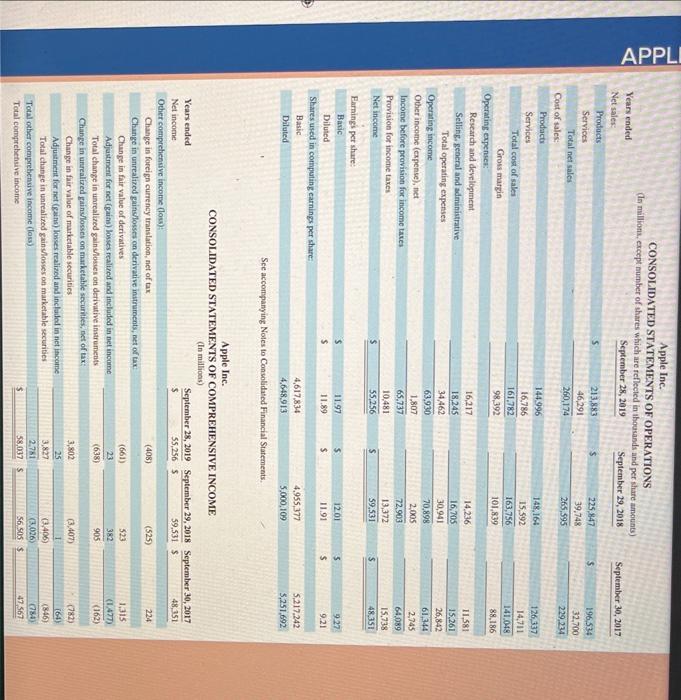

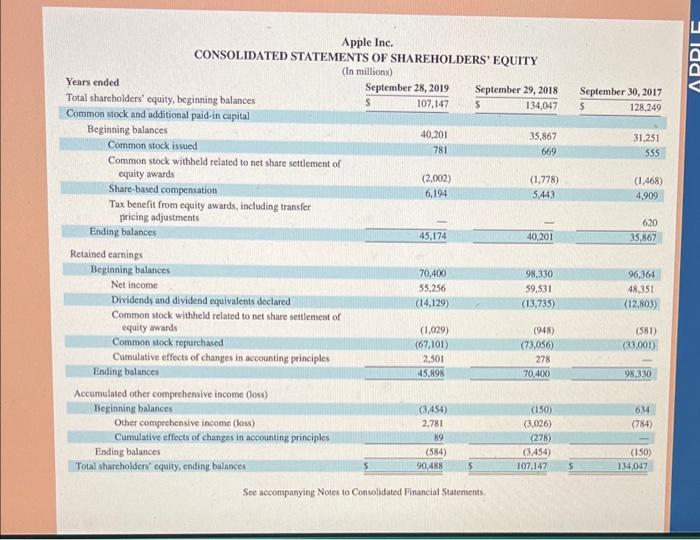

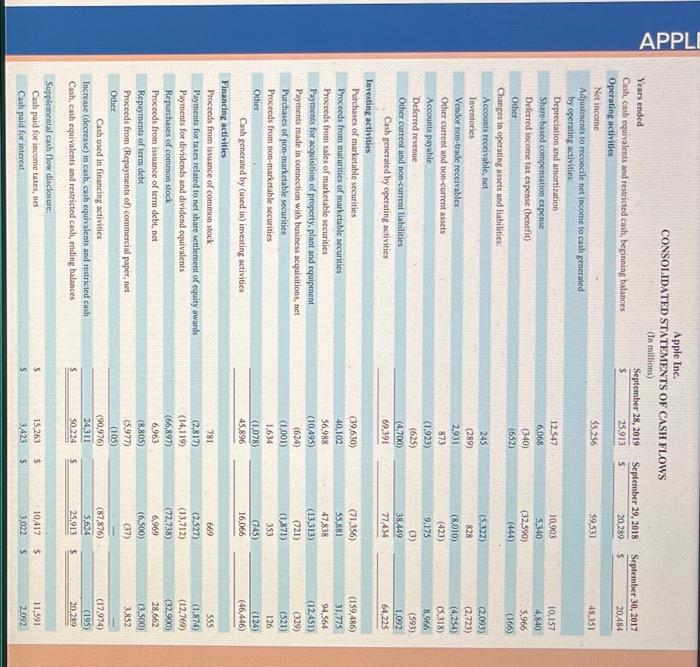

Use Apple's financial statements in ARenencix. A to answer the tollowing. Reguired: 1. Using fiscal 2017 as the base yeat, compute trend percents for fiscal yeors 2017, 20t8, and 2019 for totat net sales, total cost of sales, operating incorne, other income (expense) net, provision for income taxes, and net income. 2. Compute common-size percents for fiscal years 2018 and 2019 for the following categories of assets (a) total current assets: (D) property, plant and equipment, net; and (c) accounts recoivsble, net. 3. Using current assets as a percent of total assets to measure lleuldity, did Apple's astet makeup become more liquid or less liqued in 2019 ? Complete this question by entering your answers in the tabs below. Using fiscal 2017 as the base yeat, compute trend percents for fiscal years 2017,2018 , and 2019 for total net salos, tolal cost of sales, operating inceme, other incoree (expense) net, provision for income taxes, and net income. (thpot all the values as sositive numbers. Fiter your answers in milliors. Round your pertestage angwers to i decimal ploce.) Use Apple's financial statements in Appendix A to answer the following. Required: 1. Using fiscal 2017 as the base year, compute trend percents for fiscal years 2017, 2018, and 2019 for total net sales, total cost of sales, operating income, other income (expense) net, provision for income taxes, and net income. 2. Compute common-size percents for fiscal years 2018 and 2019 for the following categories of assets: (a) total current assets; (b) property, plant and equipment, net; and (c) accounts receivable, net. 3. Using current assets as a percent of total assets to measure liquidity, did Apple's asset makeup become more liquid or less liquid in 2019? Complete this question by entering your answers in the tabs below. Compute common-size percents for fiscal years 2018 and 2019 for the following categories of assets: (a) total current assets; (b) property, plant and equipment, net; and (c) accounts receivable, net. (Enter your answers in millions. Round your percentage answers to 1 decimal place.) Use Apple's financial staternents in. Angendix A to answer the following. Required: 1. Using fiscal 2017 as the base year, compute trend percents for fiscal years 2017, 2018, and 2019 for total net sales, total cost of sales, operating income, other income (expense) net, provision for income taxes, and net income. 2. Compute common-size percents for fiscal years 2018 and 2019 for the following categories of assets: (a) total current assets; (b) property, plant and equipment, net; and (c) occounts receivable, net. 3. Using current assets as a percent of total assets to measure liquidity, did Apple's asset makeup become more liquid or less liquid in 2019? Complete this question by entering your answers in the tabs below. Using current assets as a percent of total assets to measure liqulity, did Apple's asset makeup become more liquid or less liguid in 2019? Apple Inc. CONSOLIDATED BAL ANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) Abble Inc. Apple Inc. Apple Inc