Answered step by step

Verified Expert Solution

Question

1 Approved Answer

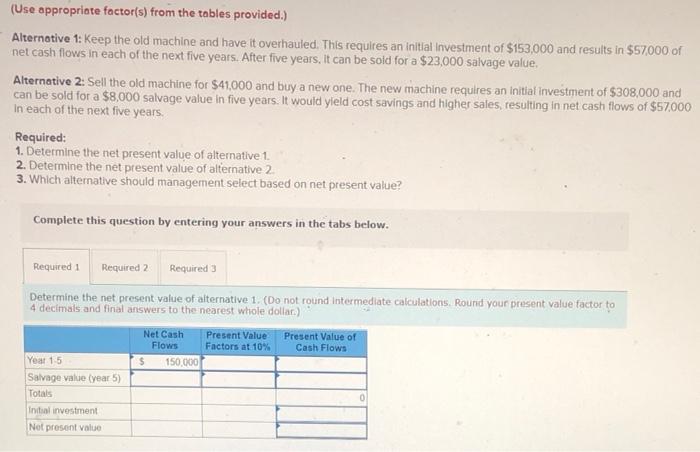

(Use appropriate factor(s) from the tables provided.) Alternative 1: Keep the old machine and have it overhauled. This requires an initial Investment of $153,000

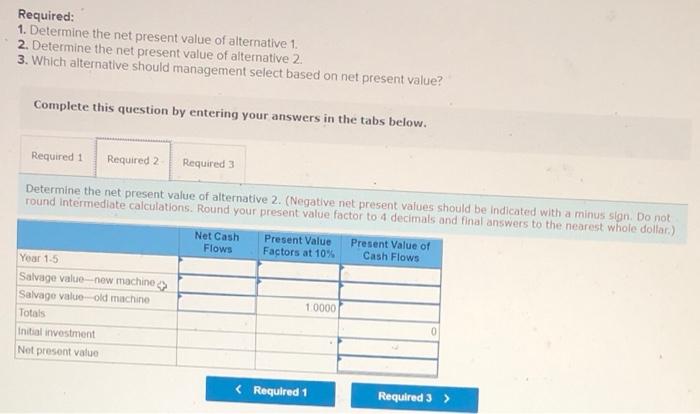

(Use appropriate factor(s) from the tables provided.) Alternative 1: Keep the old machine and have it overhauled. This requires an initial Investment of $153,000 and results in $57,000 of net cash flows in each of the next five years. After five years, It can be sold for a $23,000 salvage value. Alternative 2: Sell the old machine for $41,000 and buy a new one. The new machine requires an initial investment of $308,000 and can be sold for a $8,000 salvage value in five years. It would yield cost savings and higher sales, resulting in net cash flows of $57,000 In each of the next five years. Required: 1. Determine the net present value of alternative 1. 2. Determine the net present value of alternative 2. 3. Which alternative should management select based on net present value? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine the net present value of alternative 1. (Do not round intermediate calculations. Round your present value factor to 4 decimals and final answers to the nearest whole dollar.) Net Cash Flows Present Value Factors at 10% Present Value of Cash Flows Year 1-5 $ 150,000 Salvage value (year 5) Totals Initial investment Net present value 0 Required: 1. Determine the net present value of alternative 1. 2. Determine the net present value of alternative 2. 3. Which alternative should management select based on net present value? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine the net present value of alternative 2. (Negative net present values should be indicated with a minus sign. Do not round intermediate calculations. Round your present value factor to 4 decimals and final answers to the nearest whole dollar.) Year 1-5 Salvage value-new machine Salvage value-old machine Totals Initial investment Net present value Net Cash Flows Present Value Factors at 10% Present Value of Cash Flows 1.0000 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started