Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use as reference: : *earned income is calculated as income from office/employment, business, property, royalties, spousal or child support (as other source of income the

Use as reference:

:

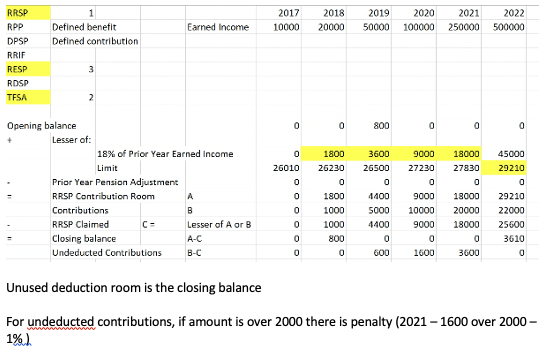

*earned income is calculated as income from office/employment, business, property, royalties, spousal or child support (as other source of income

the *limit for the year is the dollar limit which is 26230 for 2018 and 26500 for 2019

*opening balance is the unused rrsp deduction room at the end of the preceding year

*rrsp deduction limit = rrsp contribution room

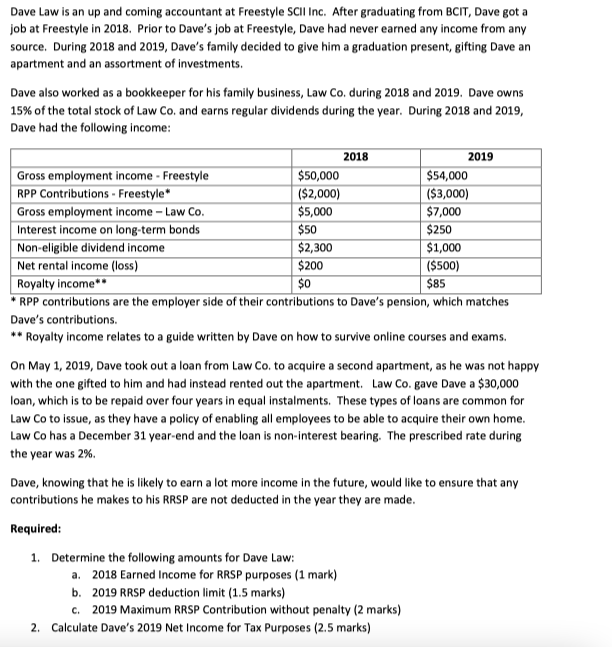

Dave Law is an up and coming accountant at Freestyle SCII Inc. After graduating from BCIT, Dave got a job at Freestyle in 2018. Prior to Dave's job at Freestyle, Dave had never earned any income from any source. During 2018 and 2019, Dave's family decided to give him a graduation present, gifting Dave an apartment and an assortment of investments. Dave also worked as a bookkeeper for his family business, Law Co. during 2018 and 2019. Dave owns 15% of the total stock of Law Co. and earns regular dividends during the year. During 2018 and 2019, Dave had the following income: * RPP contributions are the employer side of their contributions to Dave's pension, which matches Dave's contributions. ** Royalty income relates to a guide written by Dave on how to survive online courses and exams. On May 1, 2019, Dave took out a loan from Law Co. to acquire a second apartment, as he was not happy with the one gifted to him and had instead rented out the apartment. Law Co. gave Dave a \$30,000 loan, which is to be repaid over four years in equal instalments. These types of loans are common for Law Co to issue, as they have a policy of enabling all employees to be able to acquire their own home. Law Co has a December 31 year-end and the loan is non-interest bearing. The prescribed rate during the year was 2%. Dave, knowing that he is likely to earn a lot more income in the future, would like to ensure that any contributions he makes to his RRSP are not deducted in the year they are made. Required: 1. Determine the following amounts for Dave Law: a. 2018 Earned Income for RRSP purposes (1 mark) b. 2019 RRSP deduction limit (1.5 marks) c. 2019 Maximum RRSP Contribution without penalty (2 marks) Unused deduction room is the closing balance For undeducted contributions, if amount is over 2000 there is penalty (2021 - 1600 over 2000 1%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started