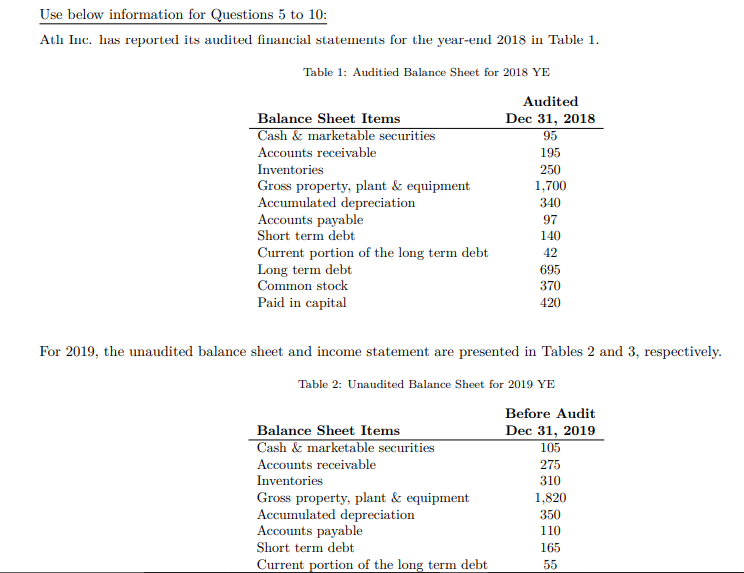

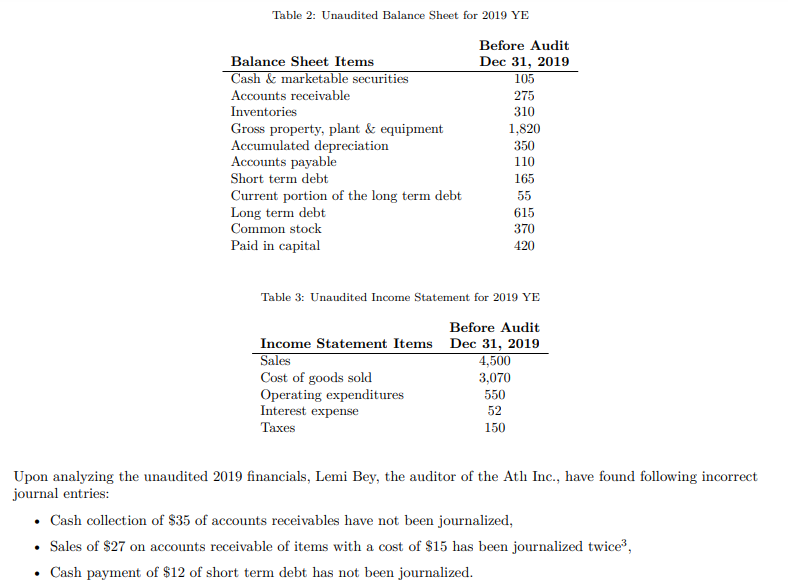

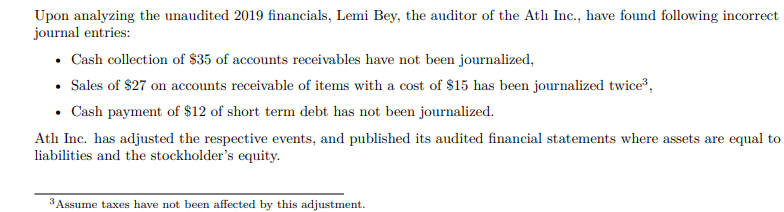

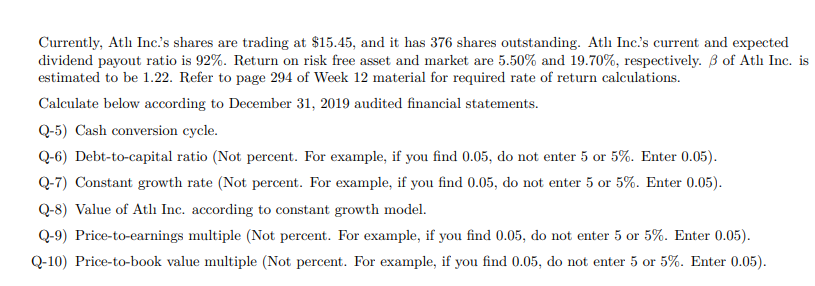

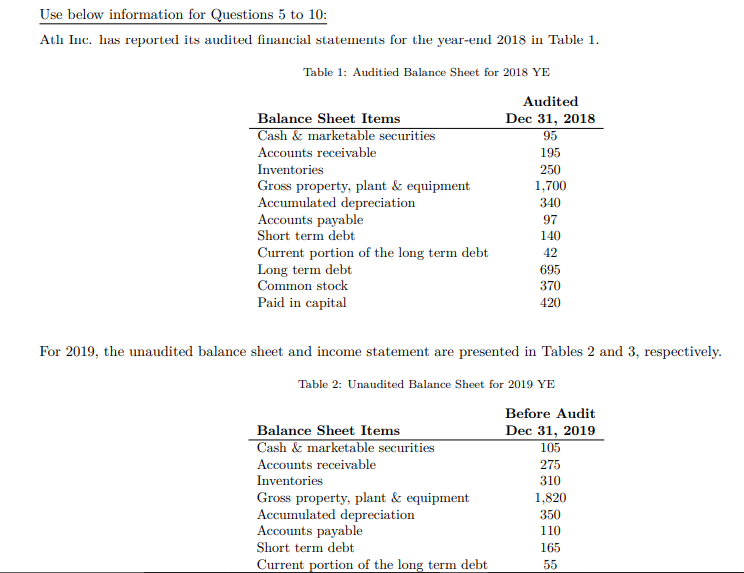

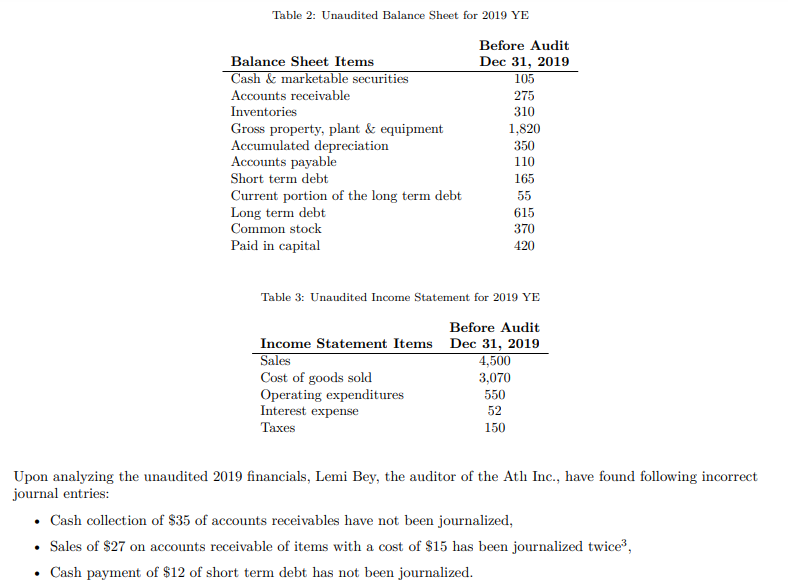

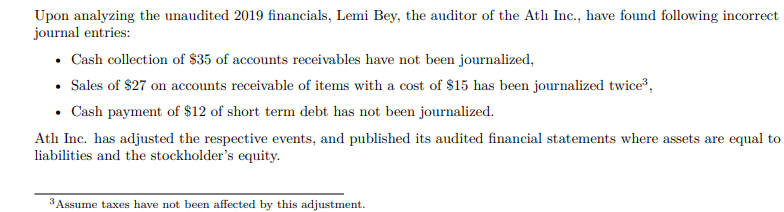

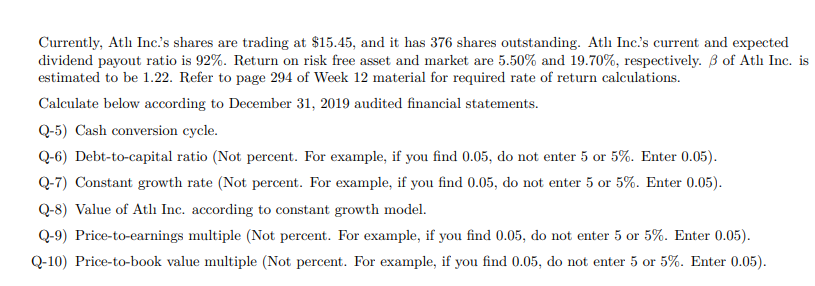

Use below information for Questions 5 to 10: Atl Inc. has reported its audited financial statements for the year-end 2018 in Table 1. Table 1: Auditied Balance Sheet for 2018 YE Audited Dec 31, 2018 95 195 Balance Sheet Items Cash & marketable securities Accounts receivable Inventories Gross property, plant & equipment Accumulated depreciation Accounts payable Short term debt Current portion of the long term debt Long term debt Common stock Paid in capital 250 1,700 340 97 140 42 695 370 420 For 2019, the unaudited balance sheet and income statement are presented in Tables 2 and 3, respectively. Table 2: Unaudited Balance Sheet for 2019 YE Before Audit Dec 31, 2019 105 275 310 Balance Sheet Items Cash & marketable securities Accounts receivable Inventories Gross property, plant & equipment Accumulated depreciation Accounts payable Short term debt Current portion of the long term debt 1,820 350 110 165 55 Table 2: Unaudited Balance Sheet for 2019 YE Balance Sheet Items Cash & marketable securities Accounts receivable Inventories Gross property, plant & equipment Accumulated depreciation Accounts payable Short term debt Current portion of the long term debt Long term debt Common stock Paid in capital Before Audit Dec 31, 2019 105 275 310 1,820 350 110 165 55 615 370 420 Table 3: Unaudited Income Statement for 2019 YE Before Audit Income Statement Items Dec 31, 2019 Sales 4,500 Cost of goods sold 3,070 Operating expenditures 550 Interest expense 52 Taxes 150 Upon analyzing the unaudited 2019 financials, Lemi Bey, the auditor of the Atl Inc., have found following incorrect journal entries: Cash collection of $35 of accounts receivables have not been journalized, Sales of $27 on accounts receivable of items with a cost of $15 has been journalized twice, Cash payment of $12 of short term debt has not been journalized. Upon analyzing the unaudited 2019 financials, Lemi Bey, the auditor of the Atl Inc., have found following incorrect journal entries: Cash collection of $35 of accounts receivables have not been journalized, Sales of $27 on accounts receivable of items with a cost of $15 has been journalized twice3, Cash payment of $12 of short term debt has not been journalized. Atli Inc. has adjusted the respective events, and published its audited financial statements where assets are equal to liabilities and the stockholder's equity. 3 Assume taxes have not been affected by this adjustment. Currently, Atli Inc.'s shares are trading at $15.45, and it has 376 shares outstanding. Atl Inc.'s current and expected dividend payout ratio is 92%. Return on risk free asset and market are 5.50% and 19.70%, respectively. B of Atli Inc. is estimated to be 1.22. Refer to page 294 of Week 12 material for required rate of return calculations. Calculate below according to December 31, 2019 audited financial statements. Q-5) Cash conversion cycle. Q-6) Debt-to-capital ratio (Not percent. For example, if you find 0.05, do not enter 5 or 5%. Enter 0.05). Q-7) Constant growth rate (Not percent. For example, if you find 0.05, do not enter 5 or 5%. Enter 0.05). Q-8) Value of Atl Inc. according to constant growth model. Q-9) Price-to-earnings multiple (Not percent. For example, if you find 0.05, do not enter 5 or 5%. Enter 0.05). Q-10) Price-to-book value multiple (Not percent. For example, if you find 0.05, do not enter 5 or 5%. Enter 0.05). Use below information for Questions 5 to 10: Atl Inc. has reported its audited financial statements for the year-end 2018 in Table 1. Table 1: Auditied Balance Sheet for 2018 YE Audited Dec 31, 2018 95 195 Balance Sheet Items Cash & marketable securities Accounts receivable Inventories Gross property, plant & equipment Accumulated depreciation Accounts payable Short term debt Current portion of the long term debt Long term debt Common stock Paid in capital 250 1,700 340 97 140 42 695 370 420 For 2019, the unaudited balance sheet and income statement are presented in Tables 2 and 3, respectively. Table 2: Unaudited Balance Sheet for 2019 YE Before Audit Dec 31, 2019 105 275 310 Balance Sheet Items Cash & marketable securities Accounts receivable Inventories Gross property, plant & equipment Accumulated depreciation Accounts payable Short term debt Current portion of the long term debt 1,820 350 110 165 55 Table 2: Unaudited Balance Sheet for 2019 YE Balance Sheet Items Cash & marketable securities Accounts receivable Inventories Gross property, plant & equipment Accumulated depreciation Accounts payable Short term debt Current portion of the long term debt Long term debt Common stock Paid in capital Before Audit Dec 31, 2019 105 275 310 1,820 350 110 165 55 615 370 420 Table 3: Unaudited Income Statement for 2019 YE Before Audit Income Statement Items Dec 31, 2019 Sales 4,500 Cost of goods sold 3,070 Operating expenditures 550 Interest expense 52 Taxes 150 Upon analyzing the unaudited 2019 financials, Lemi Bey, the auditor of the Atl Inc., have found following incorrect journal entries: Cash collection of $35 of accounts receivables have not been journalized, Sales of $27 on accounts receivable of items with a cost of $15 has been journalized twice, Cash payment of $12 of short term debt has not been journalized. Upon analyzing the unaudited 2019 financials, Lemi Bey, the auditor of the Atl Inc., have found following incorrect journal entries: Cash collection of $35 of accounts receivables have not been journalized, Sales of $27 on accounts receivable of items with a cost of $15 has been journalized twice3, Cash payment of $12 of short term debt has not been journalized. Atli Inc. has adjusted the respective events, and published its audited financial statements where assets are equal to liabilities and the stockholder's equity. 3 Assume taxes have not been affected by this adjustment. Currently, Atli Inc.'s shares are trading at $15.45, and it has 376 shares outstanding. Atl Inc.'s current and expected dividend payout ratio is 92%. Return on risk free asset and market are 5.50% and 19.70%, respectively. B of Atli Inc. is estimated to be 1.22. Refer to page 294 of Week 12 material for required rate of return calculations. Calculate below according to December 31, 2019 audited financial statements. Q-5) Cash conversion cycle. Q-6) Debt-to-capital ratio (Not percent. For example, if you find 0.05, do not enter 5 or 5%. Enter 0.05). Q-7) Constant growth rate (Not percent. For example, if you find 0.05, do not enter 5 or 5%. Enter 0.05). Q-8) Value of Atl Inc. according to constant growth model. Q-9) Price-to-earnings multiple (Not percent. For example, if you find 0.05, do not enter 5 or 5%. Enter 0.05). Q-10) Price-to-book value multiple (Not percent. For example, if you find 0.05, do not enter 5 or 5%. Enter 0.05)