use column 4 for table 2

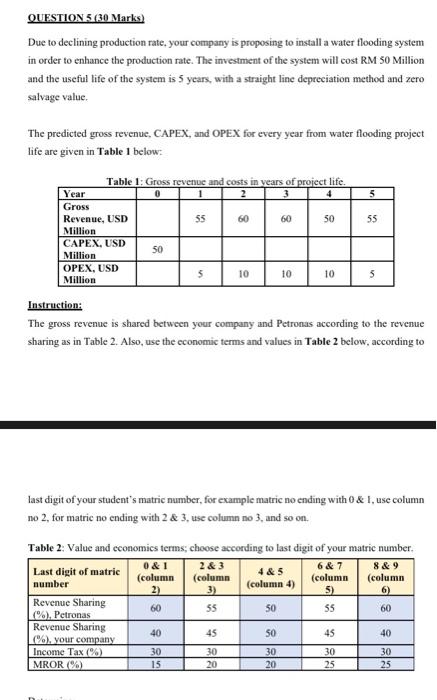

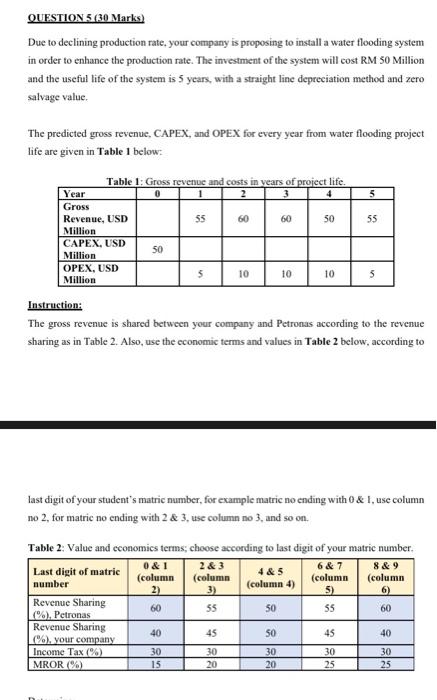

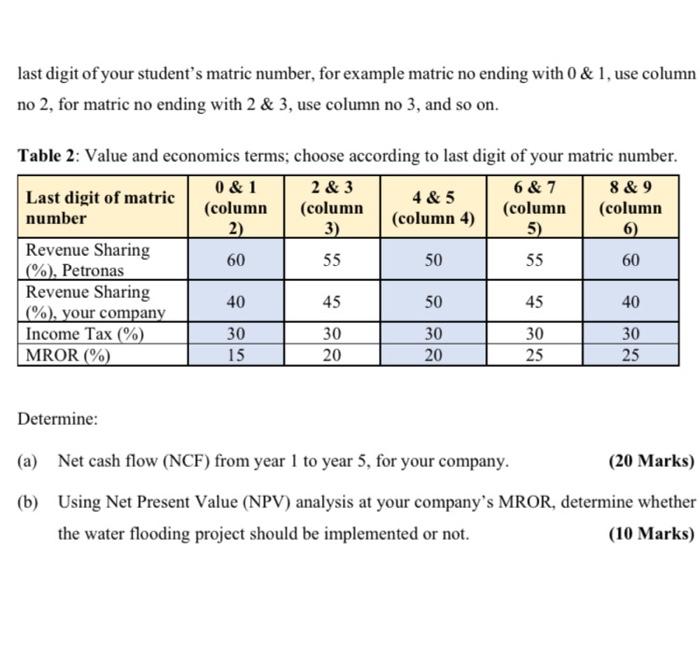

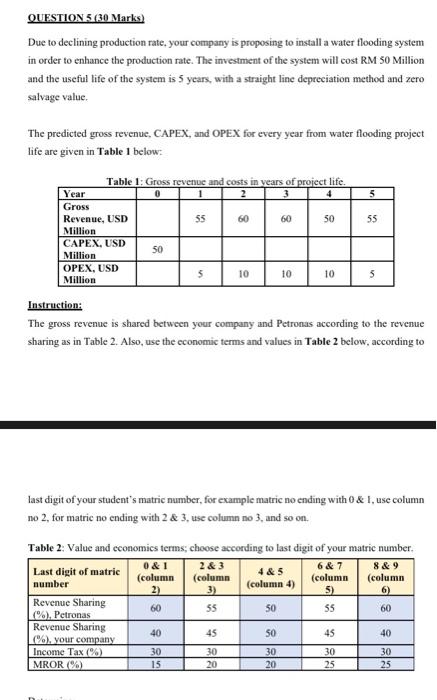

QUESTION 3 (30 Marks) Due to declining production rate your company is proposing to install a water flooding system in order to enhance the production rate. The investment of the system will cost RM 50 Million and the useful life of the system is 5 years, with a straight line depreciation method and zero salvage value The predicted gross revenue, CAPEX, and OPEX for every year from water flooding project life are given in Table I below: 5 55 55 Table 1: Gross revenue and costs in years of project life. Year 0 2 3 Gross Revenue, USD 60 60 SO Million CAPEX, USD 50 Million OPEX, USD 10 10 Million 10 5 Instruction: The gross revenue is shared between your company and Petronas according to the revenue sharing as in Table 2. Also, use the economic terms and values in Table 2 below, according to last digit of your student's matric number, for example matric no ending with 0 & 1, use column no 2, for matric no ending with 2 & 3, use column no 3, and so on. Table 2: Value and economics terms, choose according to last digit of your matric number. Last digit of matric 0&1 2 & 3 6&7 4 & 5 8 & 9 number (column (column (column (column 2) (column 4) 5 6) Revenue Sharing 60 (%), Petronas 55 50 55 60 Revenue Sharing 40 45 50 45 40 C%), your company Income Tax (%) 30 30 30 30 30 MROR (%) 15 20 20 25 25 last digit of your student's matric number, for example matric no ending with 0 & 1, use column no 2, for matric no ending with 2 & 3, use column no 3, and so on. Table 2: Value and economics terms; choose according to last digit of your matric number. 0 & 1 2 & 3 6 & 7 8 & 9 Last digit of matric 4 & 5 (column (column number (column (column (column 4) 2) 3) 5) 6) Revenue Sharing 60 55 50 55 60 (%), Petronas Revenue Sharing 45 50 45 (%), your company Income Tax (%) 30 30 30 30 30 MROR (%) 15 20 40 40 20 25 25 Determine: (a) Net cash flow (NCF) from year 1 to year 5, for your company. (20 Marks) (b) Using Net Present Value (NPV) analysis at your company's MROR, determine whether the water flooding project should be implemented or not. (10 Marks) QUESTION 3 (30 Marks) Due to declining production rate your company is proposing to install a water flooding system in order to enhance the production rate. The investment of the system will cost RM 50 Million and the useful life of the system is 5 years, with a straight line depreciation method and zero salvage value The predicted gross revenue, CAPEX, and OPEX for every year from water flooding project life are given in Table I below: 5 55 55 Table 1: Gross revenue and costs in years of project life. Year 0 2 3 Gross Revenue, USD 60 60 SO Million CAPEX, USD 50 Million OPEX, USD 10 10 Million 10 5 Instruction: The gross revenue is shared between your company and Petronas according to the revenue sharing as in Table 2. Also, use the economic terms and values in Table 2 below, according to last digit of your student's matric number, for example matric no ending with 0 & 1, use column no 2, for matric no ending with 2 & 3, use column no 3, and so on. Table 2: Value and economics terms, choose according to last digit of your matric number. Last digit of matric 0&1 2 & 3 6&7 4 & 5 8 & 9 number (column (column (column (column 2) (column 4) 5 6) Revenue Sharing 60 (%), Petronas 55 50 55 60 Revenue Sharing 40 45 50 45 40 C%), your company Income Tax (%) 30 30 30 30 30 MROR (%) 15 20 20 25 25 last digit of your student's matric number, for example matric no ending with 0 & 1, use column no 2, for matric no ending with 2 & 3, use column no 3, and so on. Table 2: Value and economics terms; choose according to last digit of your matric number. 0 & 1 2 & 3 6 & 7 8 & 9 Last digit of matric 4 & 5 (column (column number (column (column (column 4) 2) 3) 5) 6) Revenue Sharing 60 55 50 55 60 (%), Petronas Revenue Sharing 45 50 45 (%), your company Income Tax (%) 30 30 30 30 30 MROR (%) 15 20 40 40 20 25 25 Determine: (a) Net cash flow (NCF) from year 1 to year 5, for your company. (20 Marks) (b) Using Net Present Value (NPV) analysis at your company's MROR, determine whether the water flooding project should be implemented or not. (10 Marks)