Answered step by step

Verified Expert Solution

Question

1 Approved Answer

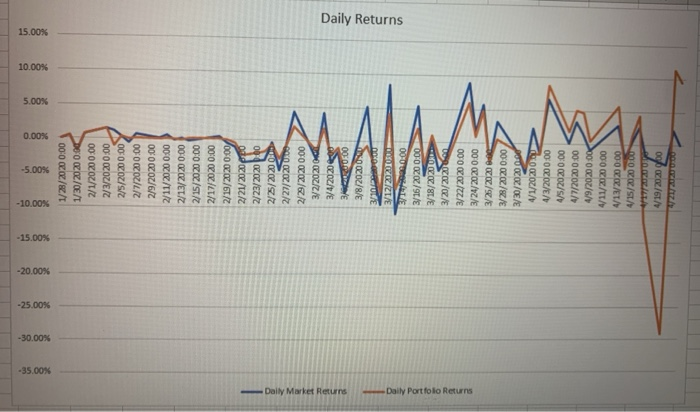

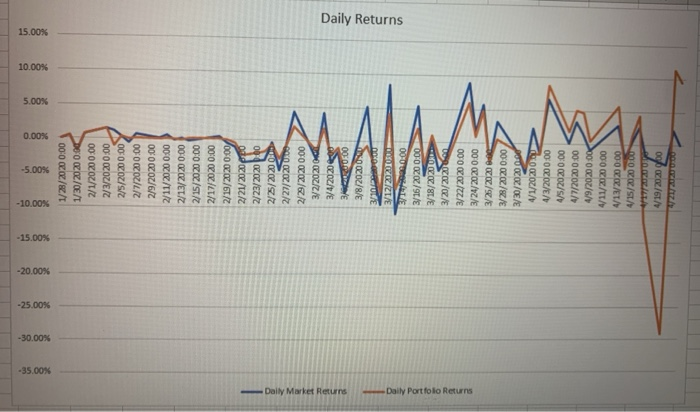

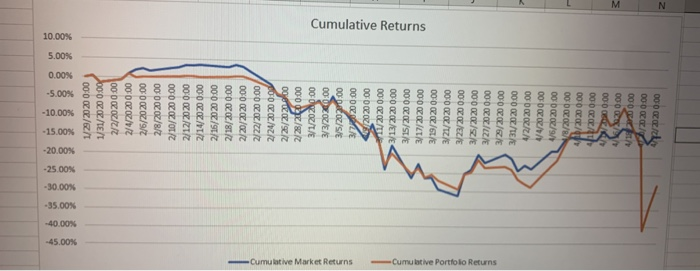

Use daily returns chart to discuss daily returns for your portfolio relative to market returns. Which of the two appears to be more volatile? Why?

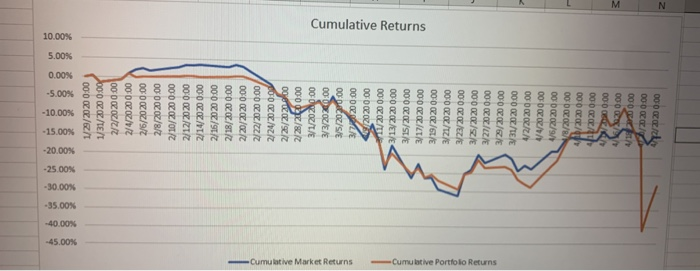

Use daily returns chart to discuss daily returns for your portfolio relative to market returns. Which of the two appears to be more volatile? Why? Similarly, use cumulative returns chart to discuss cumulative returns for your portfolio relative to market returns. How is it different from daily return? What does it tell you about the performance of your portfolio relative to the market?

THUMBS UP FOR CLEAR ANSWER PLEASE. thank you

-35.00% -30.00% -25.00% -20.00% -15.00% -10.00% 5.00% 10.00% 15.00% Daily Market Returns 1/28/2020 0:00 1/30/2020 0.00 2/1/20200.00 2/3/2020 0:00 2/5/2020 0:00 2/7/20200.00 2/9/20200.00 2/11/2020 0:00 2/13/2020 0:00 2/15/2020 0:00 2/17/2020 0:00 2/19/2020 0:00 2/21/2020 PRO 2/23/202060 2/25/2020 2/27/2020 0.00 2/29/2020 0:00 3/2/2020 / 3/4/2020- 30.00 3/8/2020 USD 3/10/PARDO.00 3/12/2020 5/14700.000 3/16/2020 0.00 3/18/2020 RSD 3/20/2020 3/22/20200.00 3/24/2020 0.00 3/26/2020 3/28/2020 0:00 3/30/2020 0:00 4/1/202000W 4/3/20200.00 4/5/20200.00 4/7/20200.00 4/9/20200.000 4/11/2020 0.00 4/13/20200.00 4/15/202000 17/2020 4/19/2020 go 72172000.00 Daily Returns Daily Portfolio Returns -45.00% -40.00% -35.00% 40006 -25.00% SOOOR 800'ST 9000 %600'S NOOO 5.00% 10.00% - Cumulative Market Returns 1/29/2020 0.00 1/31/2020 0:00 2/2/20200.00 2/4/20200.00 2/6/20200.00 2/8/20200.00 2/10/20200.00 2/12/2020 0:00 2/14/2020 0:00 2/15/2020 0.00 2/18/20200.00 2/20/2020 0.00 2/22/2020 0.00 2/20202 000 2/25/2020 000 2/28/2:00:00 3/1/20280.00 3/3/20200.00 3/5/20270.00 3.740 200.00 2020000 11/20.20 0.00 3/13/2020 0:00 3/15/20200.00 3/17/2020 0:00 3/19/2020 0:00 3/21/2020 0:00 3/23/20200.00 3/23/2020 0.00 3/27/2020 0.00 3/29/20200.00 3/31/20200.00 4/2/20200.00 1/4/20200.00 4/6/20200.00 18/20200.00 4 /2020000 11/220 000 000.00 Cumulative Returns - Cumulative Portfolio Returns 2 000 /20200.00 20.00 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started