Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use Data for group 31 to answer the question. A company needs a modern material handling system for facilitating access to and from a busy

Use Data for group 31 to answer the question.

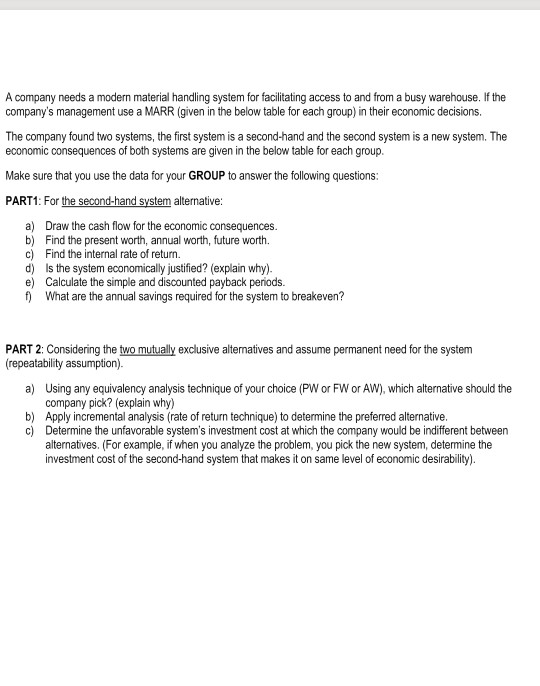

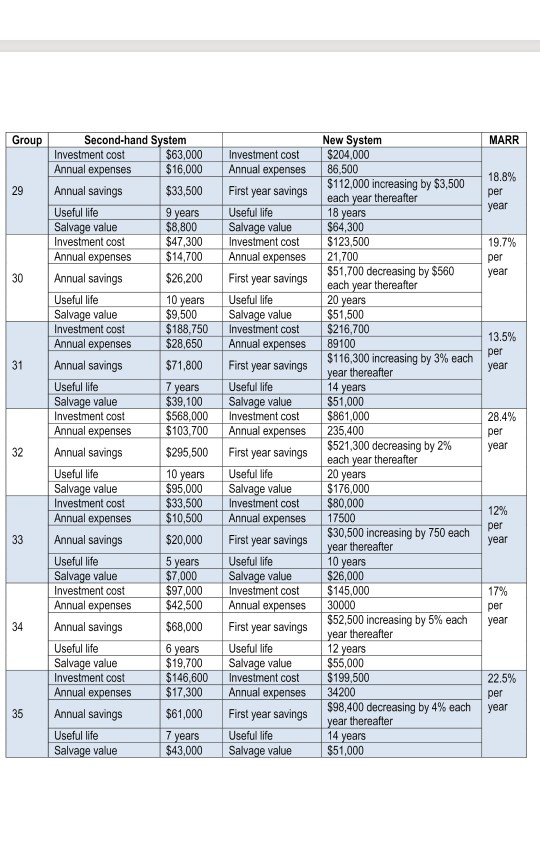

A company needs a modern material handling system for facilitating access to and from a busy warehouse. If the company's management use a MARR (given in the below table for each group) in their economic decisions. The company found two systems, the first system is a second-hand and the second system is a new system. The economic consequences of both systems are given in the below table for each group Make sure that you use the data for your GROUP to answer the following questions: PART1: For the second-hand system alternative: a) Draw the cash flow for the economic consequences. b) Find the present worth, annual worth, future worth. c) Find the internal rate of return. d) Is the system economically justified? (explain why). e) Calculate the simple and discounted payback periods. f) What are the annual savings required for the system to breakeven? PART 2: Considering the two mutually exclusive alternatives and assume permanent need for the system (repeatability assumption). a) Using any equivalency analysis technique of your choice (PW or FW or AW), which alternative should the company pick? (explain why) b) Apply incremental analysis (rate of return technique) to determine the preferred alternative. c) Determine the unfavorable system's investment cost at which the company would be indifferent between alternatives. (For example, if when you analyze the problem, you pick the new system, determine the investment cost of the second-hand system that makes it on same level of economic desirability). Group MARR New System $204,000 86,500 $112,000 increasing by $3,500 each year thereafter 29 18.8% per year 9 years 18 years 19.7% $64,300 $123,500 21,700 $51,700 decreasing by $560 each year thereafter per year 30 10 years 20 years $51,500 $216,700 89100 $116,300 increasing by 3% each year thereafter 13.5% per 31 year 14 years Second-hand System Investment cost $63,000 Annual expenses $16,000 Annual savings $33,500 Useful life Salvage value $8,800 Investment cost $47,300 Annual expenses $14,700 Annual savings $26,200 Useful life Salvage value $9,500 Investment cost $188,750 Annual expenses $28,650 Annual savings $71,800 Useful life 7 years Salvage value $39,100 Investment cost $568,000 Annual expenses $103.700 Annual savings $295,500 Useful life Salvage value $95,000 Investment cost $33,500 Annual expenses $10,500 Annual savings $20,000 Useful life 5 years Salvage value $7,000 Investment cost $97,000 Annual expenses $42,500 Annual savings $68,000 Useful life 6 years Salvage value $19,700 Investment cost $146,600 Annual expenses $17,300 Annual savings $61,000 Useful life 7 years Salvage value $43,000 $51,000 $861,000 235,400 $521,300 decreasing by 2% each year thereafter 28.4% per year Investment cost Annual expenses First year savings Useful life Salvage value Investment cost Annual expenses First year savings Useful life Salvage value Investment cost Annual expenses First year savings Useful life Salvage value Investment cost Annual expenses First year savings Useful life Salvage value Investment cost Annual expenses First year savings Useful life Salvage value Investment cost Annual expenses First year savings Useful life Salvage value Investment cost Annual expenses First year savings Useful life Salvage value 32 10 years 20 years 12% per 33 year $176,000 $80,000 17500 $30,500 increasing by 750 each year thereafter 10 years $26,000 $145,000 30000 $52,500 increasing by 5% each year thereafter 17% per year 34 12 years $55,000 $199,500 34200 $98,400 decreasing by 4% each year thereafter 22.5% per year 35 14 years $51,000 A company needs a modern material handling system for facilitating access to and from a busy warehouse. If the company's management use a MARR (given in the below table for each group) in their economic decisions. The company found two systems, the first system is a second-hand and the second system is a new system. The economic consequences of both systems are given in the below table for each group Make sure that you use the data for your GROUP to answer the following questions: PART1: For the second-hand system alternative: a) Draw the cash flow for the economic consequences. b) Find the present worth, annual worth, future worth. c) Find the internal rate of return. d) Is the system economically justified? (explain why). e) Calculate the simple and discounted payback periods. f) What are the annual savings required for the system to breakeven? PART 2: Considering the two mutually exclusive alternatives and assume permanent need for the system (repeatability assumption). a) Using any equivalency analysis technique of your choice (PW or FW or AW), which alternative should the company pick? (explain why) b) Apply incremental analysis (rate of return technique) to determine the preferred alternative. c) Determine the unfavorable system's investment cost at which the company would be indifferent between alternatives. (For example, if when you analyze the problem, you pick the new system, determine the investment cost of the second-hand system that makes it on same level of economic desirability). Group MARR New System $204,000 86,500 $112,000 increasing by $3,500 each year thereafter 29 18.8% per year 9 years 18 years 19.7% $64,300 $123,500 21,700 $51,700 decreasing by $560 each year thereafter per year 30 10 years 20 years $51,500 $216,700 89100 $116,300 increasing by 3% each year thereafter 13.5% per 31 year 14 years Second-hand System Investment cost $63,000 Annual expenses $16,000 Annual savings $33,500 Useful life Salvage value $8,800 Investment cost $47,300 Annual expenses $14,700 Annual savings $26,200 Useful life Salvage value $9,500 Investment cost $188,750 Annual expenses $28,650 Annual savings $71,800 Useful life 7 years Salvage value $39,100 Investment cost $568,000 Annual expenses $103.700 Annual savings $295,500 Useful life Salvage value $95,000 Investment cost $33,500 Annual expenses $10,500 Annual savings $20,000 Useful life 5 years Salvage value $7,000 Investment cost $97,000 Annual expenses $42,500 Annual savings $68,000 Useful life 6 years Salvage value $19,700 Investment cost $146,600 Annual expenses $17,300 Annual savings $61,000 Useful life 7 years Salvage value $43,000 $51,000 $861,000 235,400 $521,300 decreasing by 2% each year thereafter 28.4% per year Investment cost Annual expenses First year savings Useful life Salvage value Investment cost Annual expenses First year savings Useful life Salvage value Investment cost Annual expenses First year savings Useful life Salvage value Investment cost Annual expenses First year savings Useful life Salvage value Investment cost Annual expenses First year savings Useful life Salvage value Investment cost Annual expenses First year savings Useful life Salvage value Investment cost Annual expenses First year savings Useful life Salvage value 32 10 years 20 years 12% per 33 year $176,000 $80,000 17500 $30,500 increasing by 750 each year thereafter 10 years $26,000 $145,000 30000 $52,500 increasing by 5% each year thereafter 17% per year 34 12 years $55,000 $199,500 34200 $98,400 decreasing by 4% each year thereafter 22.5% per year 35 14 years $51,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started