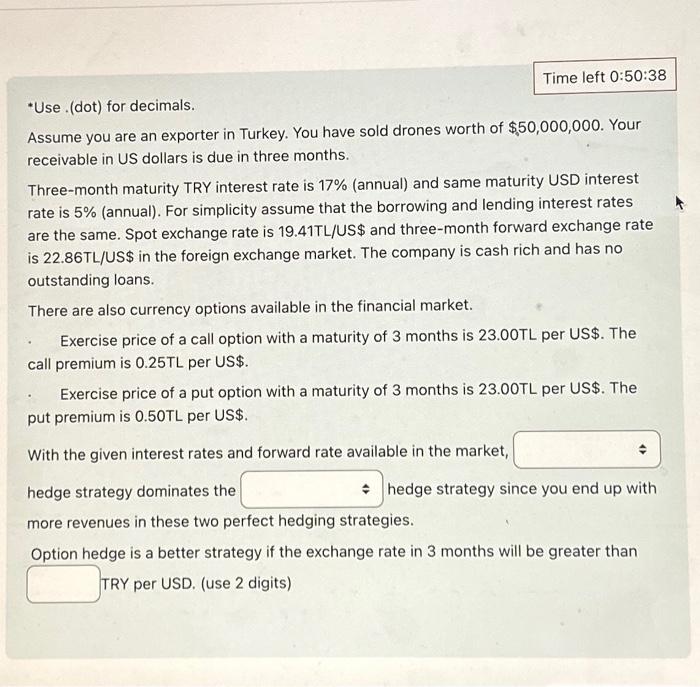

"Use. (dot) for decimals. Assume you are an exporter in Turkey. You have sold drones worth of $50,000,000. Your receivable in US dollars is due in three months. Three-month maturity TRY interest rate is 17% (annual) and same maturity USD interest rate is 5% (annual). For simplicity assume that the borrowing and lending interest rates are the same. Spot exchange rate is 19.41TL/US$ and three-month forward exchange rate is 22.86 TL/US\$ in the foreign exchange market. The company is cash rich and has no outstanding loans. There are also currency options available in the financial market. Exercise price of a call option with a maturity of 3 months is 23.00TL per US $. The call premium is 0.25 TL per US\$. Exercise price of a put option with a maturity of 3 months is 23.00TL per US $. The put premium is 0.50 TL per US $. With the given interest rates and forward rate available in the market, hedge strategy dominates the hedge strategy since you end up with more revenues in these two perfect hedging strategies. Option hedge is a better strategy if the exchange rate in 3 months will be greater than TRY per USD. (use 2 digits) "Use. (dot) for decimals. Assume you are an exporter in Turkey. You have sold drones worth of $50,000,000. Your receivable in US dollars is due in three months. Three-month maturity TRY interest rate is 17% (annual) and same maturity USD interest rate is 5% (annual). For simplicity assume that the borrowing and lending interest rates are the same. Spot exchange rate is 19.41TL/US$ and three-month forward exchange rate is 22.86 TL/US\$ in the foreign exchange market. The company is cash rich and has no outstanding loans. There are also currency options available in the financial market. Exercise price of a call option with a maturity of 3 months is 23.00TL per US $. The call premium is 0.25 TL per US\$. Exercise price of a put option with a maturity of 3 months is 23.00TL per US $. The put premium is 0.50 TL per US $. With the given interest rates and forward rate available in the market, hedge strategy dominates the hedge strategy since you end up with more revenues in these two perfect hedging strategies. Option hedge is a better strategy if the exchange rate in 3 months will be greater than TRY per USD. (use 2 digits)